LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

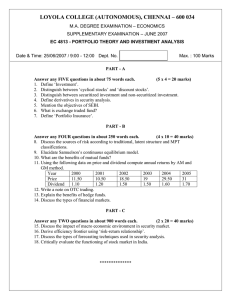

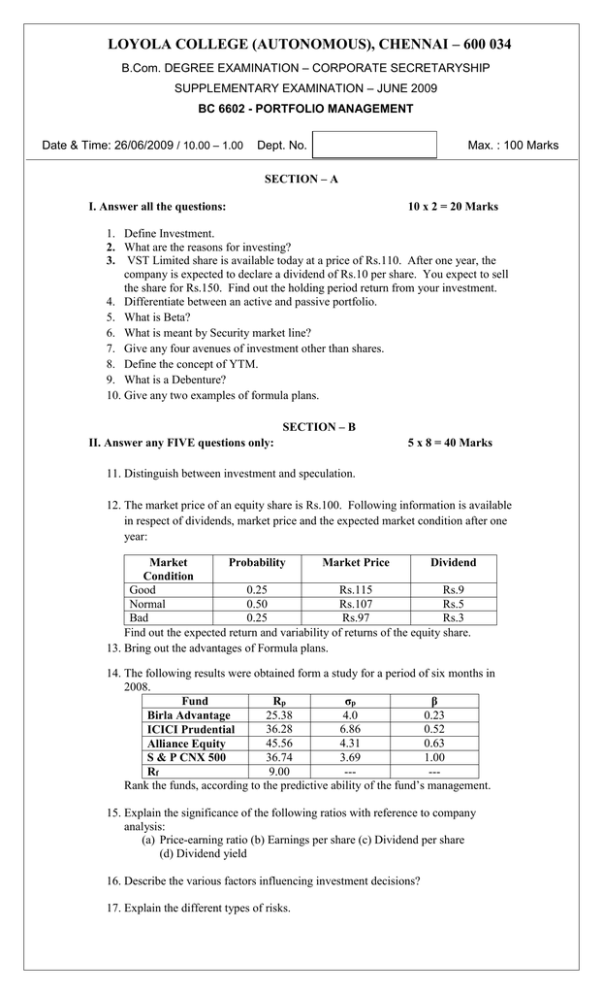

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – CORPORATE SECRETARYSHIP SUPPLEMENTARY EXAMINATION – JUNE 2009 BC 6602 - PORTFOLIO MANAGEMENT Date & Time: 26/06/2009 / 10.00 – 1.00 Dept. No. Max. : 100 Marks SECTION – A I. Answer all the questions: 10 x 2 = 20 Marks 1. Define Investment. 2. What are the reasons for investing? 3. VST Limited share is available today at a price of Rs.110. After one year, the company is expected to declare a dividend of Rs.10 per share. You expect to sell the share for Rs.150. Find out the holding period return from your investment. 4. Differentiate between an active and passive portfolio. 5. What is Beta? 6. What is meant by Security market line? 7. Give any four avenues of investment other than shares. 8. Define the concept of YTM. 9. What is a Debenture? 10. Give any two examples of formula plans. SECTION – B II. Answer any FIVE questions only: 5 x 8 = 40 Marks 11. Distinguish between investment and speculation. 12. The market price of an equity share is Rs.100. Following information is available in respect of dividends, market price and the expected market condition after one year: Market Probability Market Price Dividend Condition Good 0.25 Rs.115 Rs.9 Normal 0.50 Rs.107 Rs.5 Bad 0.25 Rs.97 Rs.3 Find out the expected return and variability of returns of the equity share. 13. Bring out the advantages of Formula plans. 14. The following results were obtained form a study for a period of six months in 2008. Fund Rp σp β 25.38 4.0 0.23 Birla Advantage 36.28 6.86 0.52 ICICI Prudential 45.56 4.31 0.63 Alliance Equity 36.74 3.69 1.00 S & P CNX 500 9.00 ----Rf Rank the funds, according to the predictive ability of the fund’s management. 15. Explain the significance of the following ratios with reference to company analysis: (a) Price-earning ratio (b) Earnings per share (c) Dividend per share (d) Dividend yield 16. Describe the various factors influencing investment decisions? 17. Explain the different types of risks. 18. Following are data for Anand Products: Particulars Assets Short term liabilities 8% Debentures 10% Bonds Common stock (Rs.10) Surplus Revenues Operating Expenses EBIT Interest EBT Taxes Dividend Rs. in Lakhs 6,000 450 1,250 500 3,500 300 6,600 5,950 650 150 500 200 50 Find out the following ratios: i. Effective interest rate ii. Effective tax rate iii. Debt/equity ratio iv. Dividend pay-out ratio SECTION – C III. Answer any TWO questions only: 2 x 20 = 40 Marks 19. From the given details, evaluate the performances of the different funds using Sharpe, Treynor and Jensen performance evaluation techniques. Fund A B C MARKET Return 2 12 8 9 σ 20 18 22 24 β 0.98 0.97 1.17 1.00 Risk free rate is 4. 20. Explain in detail the various phases of Fundamental analysis. 21. Explain the Capital Asset Pricing Model along with its assumptions. *************