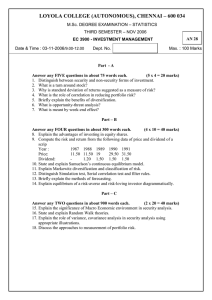

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

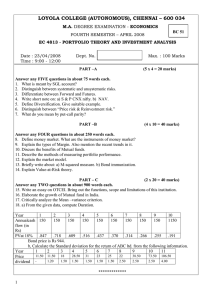

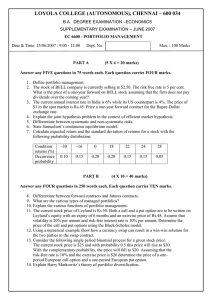

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 M.A. DEGREE EXAMINATION – ECONOMICS SUPPLEMENTARY EXAMINATION – JUNE 2007 EC 4813 - PORTFOLIO THEORY AND INVESTMENT ANALYSIS Date & Time: 25/06/2007 / 9:00 - 12:00 Dept. No. Max. : 100 Marks PART - A Answer any FIVE questions in about 75 words each. (5 x 4 = 20 marks) 1. Define ‘Investment’. 2. Distinguish between ‘cyclical stocks’ and ‘discount stocks’. 3. Distinguish between securitized investment and non-securitized investment. 4. Define derivatives in security analysis. 5. Mention the objectives of SEBI. 6. What is exchange traded fund? 7. Define ‘Portfolio Insurance’. PART - B Answer any FOUR questions in about 250 words each. (4 x 10 = 40 marks) 8. Discuss the sources of risk according to traditional, latent structure and MPT classifications. 9. Elucidate Samuelson’s continuous equilibrium model. 10. What are the benefits of mutual funds? 11. Using the following data on price and dividend compute annual returns by AM and GM method. Year 2000 2001 2002 2003 2004 2005 Price 11.50 10.50 18.50 19 29.50 31 Dividend 1.10 1.20 1.50 1.50 1.60 1.70 12. Write a note on OTC trading. 13. Explain the benefits of hedge funds. 14. Discuss the types of financial markets. PART - C Answer any TWO questions in about 900 words each. (2 x 20 = 40 marks) 15. Discuss the impact of macro economic environment in security market. 16. Derive efficiency frontier using ‘risk-return relationship’. 17. Discuss the types of forecasting techniques used in security analysis. 18. Critically evaluate the functioning of stock market in India. **************