LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

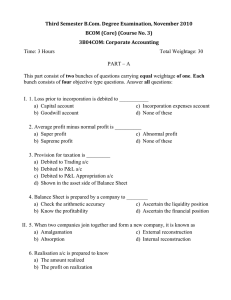

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.B.A. DEGREE EXAMINATION –BUSINESS ADMINISTRATION SUPPLEMENTARY EXAMINATION – JUNE 2007 BU 4500 - CORPORATE ACCOUNTING Date & Time: 27/06/2007 / 9:00 - 12:00 Dept. No. Max. : 100 Marks PART A Answer ALL questions Explain the following: 10 x 2 = 20 marks 1. 2. 3. 4. 5. 6. 7. Calls in advance and calls in arrears Two purposes for which securities premium can be used Average Capital employed Amalgamation adjustment reserve Intrinsic value of a share Preferential creditor with two examples P Ltd redeems 2,000 8% preference shares of Rs.100 each at a premium of 10% out of divisible profits. Journalize. 8. A Ltd issued 1,000 8% debentures of Rs.100 each at par, redeemable at 5% premium. Pass entries at the time of issue and redemption of the debenture. 9. R Ltd was formed on 1st May 2006 to purchase the business of X with effect from 1st January 2006. While preparing final accounts on 31.12.2006, it was found that the total sales for the year was Rs.10,00,000 and the sales from 1st July 2006 was double that of those up to that date on a monthly average basis. Calculate sales ratio. 10. A Ltd., issued 6% debentures of Rs.100 each. The issue was underwritten to the extent of 50% by X and 30% by Y. applications were received for 900 debentures. Calculate the liability of the underwriters. PART B Answer ANY FIVE questions 5 x 8 = 40 marks 11. Ellora Ltd., issued 1,50,000 equity shares of Rs.10 each at par. The issue was underwritten by Anand, Vijay and Ashok equally. Applications totaled 1,29,700 shares. This included marked forms as follows: Anand - 40,000 shares Vijay - 52,500 shares Ashok – 30,000 shares The underwriting commission was fixed at 5%. Calculate the liability of each underwriter and pass journal entries in the books of the company. 12. State the conditions to be followed while (a) Redeeming Preference shares (b) Issuing share @ a discount 13. Aruna Ltd., had Rs.9,00,000 10% debentures outstanding on 1.1.1993. On that date, the sinking fund stood in the company’s books at Rs.7,50,000. The fund was invested in Rs.7,95,000 6% Govt. bonds. The annual appropriation to the sinking fund was Rs.1,23,450. On 31.12.1993, the interest on the investments was received. The bank balance before receiving interest was Rs.2,40,000. On that date, the investments were realized at 90% of their face value and the debentures were redeemed. Show the important ledger accounts for the year 1993. 14. On 1st July 1989 ABC Co. Ltd., purchased the business of Mr. Ram Keshav, a sole trader, taking over all the assets with the exception of book debts amounting to Rs.1,25,000 and creditors amounting to Rs.75,000. The company undertook to collect all the book debts and pay off the creditors and for this service, it has to be paid a commission of 3% on the amounts collected and 1% on amounts paid. The debtors realized Rs.1,12,000 out of which Rs.68,000 was paid to creditors in full settlement. The company was able to collect Rs.5,000 debt which was previously written off as bad by the sole trader. The company was also forced to meet a contingent liability of Rs.3,000 on account of a claim against the vendor for damages. The vendor received Rs.30,000, 10% debentures of Rs.100 each at 95 and the balance in cash in settlement of his account with the company. Journalize the above transactions in the book of the company. 15. Prabhu Private Ltd., was incorporated on 1st July 1994 to take over the running concern of Mr. Rowther with effect from 1st April 1994. The following profit and loss account for the year ended 31st March 1995 was drawn up. Rs. Rs. To Commission 2,625 By Gross profit 98,000 To Advertisement 5,250 By Bad debts realized 500 To Managing Director’s Remuneration 9,000 To Depreciation 2,800 To Salaries 18,000 To Insurance 600 To Preliminary expenses 700 To Rent and taxes 3,000 To Discount 350 To Bad debts 1,250 To Net Profit 54,925 ---------------98,500 98,500 The following details are available: (a) The average monthly turnover from July 1994 onwards was double than that of previous months. (b) The rent for the first 3 months was paid @ Rs.200 p.m. and thereafter at a rate increased by Rs.50 p.m. (c) Bad debts Rs.350 related to sales effected after the 1st September 1994 and the realisation of bad debts was in respect of debts written off during 1992. You are required to find out profit prior to incorporation and to state the treatment thereof in the books of the company. 16. Determine the maximum remuneration available to the part time Directors and Manager of Blueprint Co. Ltd. (a manufacturing company) under section 309 and 387 of the Companies Ac, 1956, from the following particulars: Before charging any such remuneration the Profit and Loss A/c showed a credit balance of Rs.6,60,000 for the year ended March 31, 1983 after taking into account the following matters: Rs. Capital expenditure 1,50,000 Subsidy received from Govt. 1,20,000 Special depreciation 20,000 Multiple shift allowance 30,000 Bonus to foreign technicians 90,000 Provision for taxation 8,00,000 Compensation paid to injured workman 20,000 2 Ex-gratia to an employee Loss on sale of fixed asset Profit on sale of investment 10,000 20,000 60,000 17. Bright Ltd., invited applications for 10,000 shares of Rs.100 each at a discount of 6% payable as follows: On application Rs.30 On allotment Rs.24 On first and final call Rs.40 Applications were received for 9,500 shares and all these were accepted. All moneys due were received except the final call on 250 shares which were forfeited. 150 of the forfeited shares were reissued at Rs.80 per share as fully paid. Pass journal entries in the books of the company. 18. The following are the Balance Sheets of Sindhu Ltd., and Bindhu Ltd., as on 31.3.2000 Liabilities Sindhu Ltd Bindhu Ltd Assets Sindhu Ltd Bindhu Ltd (Rs.) (Rs.) (Rs.) (Rs.) Eq. Sh.Capital 5,00,000 3,00,000 Fixed Assets 8,00,000 3,50,000 (Rs.10 each) 8% Pref. sh. Capital (Rs.100 each) 2,00,000 1,00,000 Current Assets 4,00,000 2,50,000 General Reserve 1,00,000 50,000 P&L a/c 50,000 30,000 Creditors 3,50,000 1,20,000 ------------ ----------------------- -----------12,00,000 6,00,000 12,00,000 6,00,000 Sindhu Ltd., agreed to acquire Bindhu Ltd., on the following terms: (a) 8% preference shares will be issued to discharge the preference shares in Bindhu Ltd., at 5% premium. (b) One equity share in Sindhu Ltd., will be issued at agreed value of Rs.12 per share for every equity share in Bindhu Ltd. Give journal entries in the books of Sindhu Ltd., and prepare its Balance sheet, if amalgamation is in the nature of merger. PART C Answer ANY TWO questions marks 2 x 20 = 40 19. The following is the balance sheet of R Ltd., on 31.3.2006 Liabilities Rs. Assets Rs. Share capital Fixed assets 20,00,000 20,000 equity shares of Rs.100 Current assets 6,50,000 each 20,00,000 P &L balance 9,70,000 6% debentures of Rs.100 each 10,00,000 Debenture interest due 1,20,000 Creditors 5,00,000 36,20,000 36,20,000 Fixed assets are re-valued at Rs.9,60,000 and current assets at Rs.4,80,000. A capital reduction scheme was approved by the court as follows: i) Shares were sub divided into shares of Rs.5 each and 90% of the shares were surrendered. ii) Claims of debenture holders were reduced to Rs.4,90,000 for which 2,50,000 equity shares were allotted from out of the shares surrendered. iii) Creditors agreed to reduce their claims to Rs.3,00,000, 1/3rd of this amount was to be satisfied by the issue of equity shares out of the shares surrendered. 3 Pass necessary journal entries and prepare the Balance sheet of the company after the reconstruction. 20. Balance sheet of M Ltd., on 31.3.2006 stood as follows: Liabilities Rs. Assets Share capital: Land and building 5,000 equity shares of Rs.100 Machinery each Rs.60 paid up. 3,00,000 Stock 5,000 equity shares of Rs.100 Debtors each Rs.50 paid up. 2,50,000 P&L 12% preference shares of Rs.100 each fully paid. 10,00,000 15% debentures 4,00,000 Preferential creditors 1,05,000 Unsecured creditors 10,45,000 31,00,000 Rs. 3,86,000 8,21,000 1,84,000 13,37,000 3,72,000 31,00,000 Preference dividend is in arrears for 2 years and are payable on liquidation. Assets realized as follows Land and building Rs.9,84,000; Stock Rs.1,63,000 Machinery Rs.7,12,000 and Debtors Rs.11,91,000 Liquidation expenses was Rs.65,500 Liquidator is entitled to a commission of 3% on assets realized and 2% on payments to unsecured creditors. All payments are made on 30.9.2006. Prepare Liquidator’s final statement of account. 21. a) Explain the various methods used to value the goodwill of a firm. b) The balance sheet of A Ltd., is as follows: Liabilities Rs. Assets Rs. Share capital: Land & building 1,10,000 20,000 equity shares of Rs.10 Machinery 1,30,000 each. 2,00,000 Stock 68,000 General reserve 40,000 Debtors 88,000 P & L account 32,000 Cash 52,000 Tax liability 60,000 Preliminary expenses 12,000 Workman’s saving A/c 30,000 Creditors 98,000 4,60,000 4,60,000 Land and building has been valued at Rs.2,40,000 and Machinery at Rs.1,20,000. Goodwill should be valued at two years’ purchase of the average profit of the past three years, which were Rs.80,000, Rs.90,000 and Rs.1,06,000 respectively. It is the company’s practice to transfer 25% of the profits to reserve. The normal rate of return is 10%. Calculate the value of the share under (1) intrinsic value method (2) yield method @@@@@ 4