ADVANCED FINANCIAL ACCOUNTING & ANALYSIS / ADVANCED

advertisement

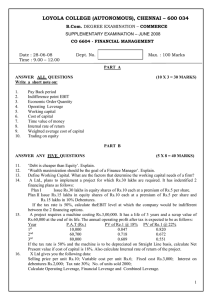

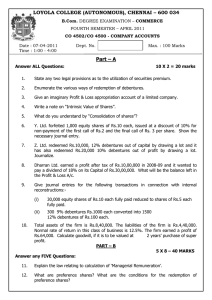

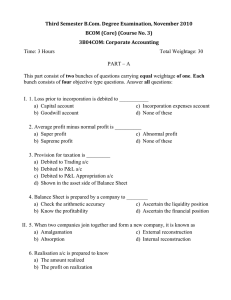

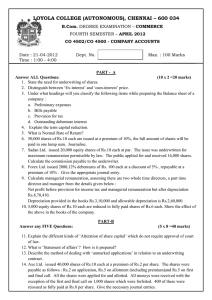

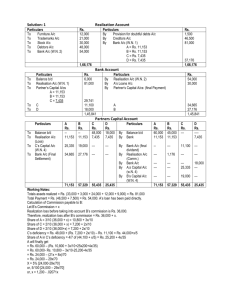

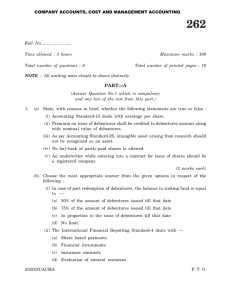

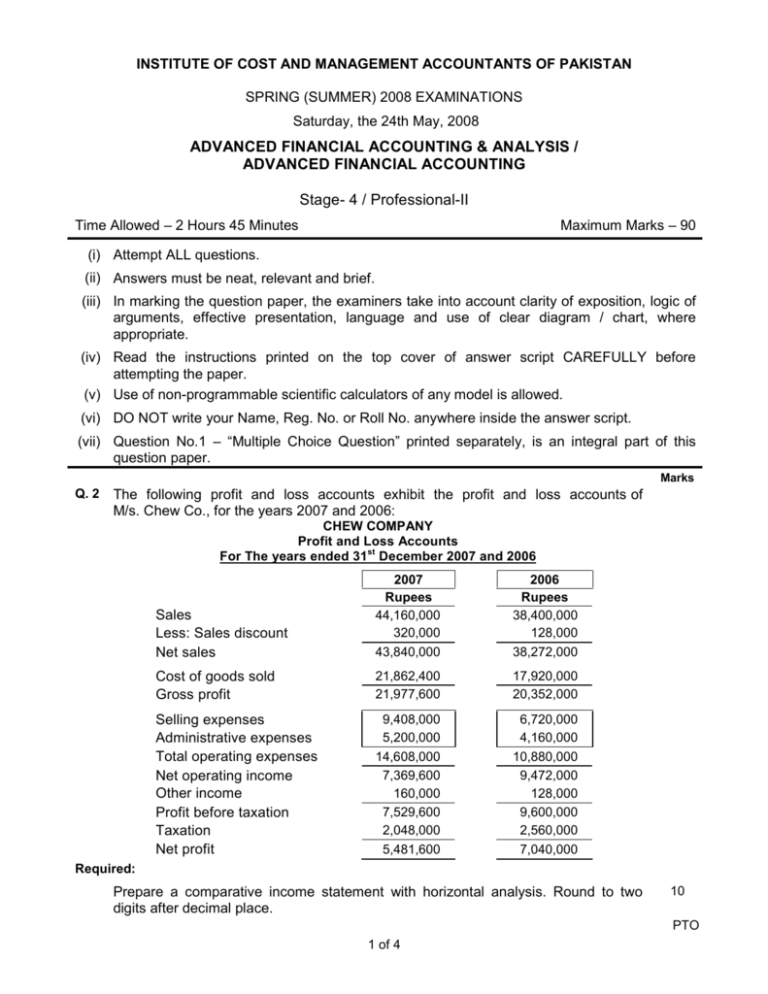

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN SPRING (SUMMER) 2008 EXAMINATIONS Saturday, the 24th May, 2008 ADVANCED FINANCIAL ACCOUNTING & ANALYSIS / ADVANCED FINANCIAL ACCOUNTING Stage- 4 / Professional-II Time Allowed – 2 Hours 45 Minutes Maximum Marks – 90 (i) Attempt ALL questions. (ii) Answers must be neat, relevant and brief. (iii) In marking the question paper, the examiners take into account clarity of exposition, logic of arguments, effective presentation, language and use of clear diagram / chart, where appropriate. (iv) Read the instructions printed on the top cover of answer script CAREFULLY before attempting the paper. (v) Use of non-programmable scientific calculators of any model is allowed. (vi) DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script. (vii) Question No.1 – “Multiple Choice Question” printed separately, is an integral part of this question paper. Marks Q. 2 The following profit and loss accounts exhibit the profit and loss accounts of M/s. Chew Co., for the years 2007 and 2006: CHEW COMPANY Profit and Loss Accounts For The years ended 31st December 2007 and 2006 Sales Less: Sales discount Net sales 2007 Rupees 44,160,000 320,000 43,840,000 2006 Rupees 38,400,000 128,000 38,272,000 Cost of goods sold Gross profit 21,862,400 21,977,600 17,920,000 20,352,000 Selling expenses Administrative expenses Total operating expenses Net operating income Other income Profit before taxation Taxation Net profit 9,408,000 5,200,000 14,608,000 7,369,600 160,000 7,529,600 2,048,000 5,481,600 6,720,000 4,160,000 10,880,000 9,472,000 128,000 9,600,000 2,560,000 7,040,000 Required: Prepare a comparative income statement with horizontal analysis. Round to two digits after decimal place. 10 PTO 1 of 4 Marks Q. 3 st Z Ltd., was placed in voluntary liquidation on 31 December 2007 when its balance sheet was as follows: Z Ltd. Rupees Freehold factory Plant and machinery Motor vehicles 214,600,000 106,930,000 21,275,000 Stocks Debtors Profit and loss account 68,820,000 27,380,000 79,180,000 518,185,000 Ordinary share capital: 17,575,000 ordinary shares of Rs.10/- each Preference share capital: 2,220,000 5% cumulative preference shares of Rs.100/- each fully paid up Share premium account 5% Debentures 175,750,000 222,000,000 18,500,000 37,000,000 Interest on debentures Bank overdraft Creditors 925,000 21,460,000 42,550,000 518,185,000 The preference dividends are in arrears from 2004 onwards. The company’s Articles provide that on liquidation, out of surplus assets remaining after payment of liquidation costs and outside liabilities, firstly all arrears of preference dividends shall be paid, secondly the amount paid up on preference share together with a premium thereon of Rs.10 per share, and thirdly the balance shall be paid to the ordinary shareholders. The bank overdraft was guaranteed by the directors who were called upon by the bank to discharge their liability under the guarantee. The directors paid the amount to the Bank. The liquidator realized the assets as follows:Freehold factory Rupees 259,000,000 Plant and machinery 88,800,000 Motor vehicles 21,830,000 Stocks 55,500,000 Debtors 22,200,000 Creditors were paid less discount of 5 paisa in a Rupee. The debenture and accrued interest were repaid on 31st March 2008. Liquidation costs were Rs.1,413,400/- and the liquidators remuneration was 2 percent on the amount realized. Required: Prepare the liquidator’s statement of account. 2 of 4 20 Marks Q. 4 Sultana carried out the following transactions in connection with his investments during the year ended 31st March 2008: 2007 15-April Purchased Rs.400,000 12% convertible debentures in Somani Ltd., at Rs.125.50. Interest is payable on 15th September and 15th March. The debentures are convertible into equity shares of Rs.10 each at the rate of Rs.20 per equity share. 1-June Purchased Rs.1,000,000 12% debentures in Sim Sim Ltd., for Rs.1,100,000. Interest is due for payment on 1st October and 1st April. 15-June Converted the debentures in Somani Ltd., into equity shares. On this date, the market price of the shares was Rs.20. The accrued interest to date was paid. 25-August Received 20% dividend on the equity shares in Somani Ltd. 15-December Somani Ltd., made a rights issue of one equity share for every 20 shares held at Rs.16 per share. The market value of a share was Rs.20. 2008 10-January Sultana sold the right for Rs.3 per share. 15-March Sold 4,000 equity shares in Somani Ltd., at Rs.25 per share. Required: Record the above transactions in the Ledger of Sultana. Maintain separate account for each category of investment. Ignore tax and brokerage charges. Sultana’ accounting year ends on 31st March. Q. 5 20 You are the financial analyst of a Multinational Bank Limited and your bank manager has provided you with the following information along with the industry average of Alpha and Beta Limited who have requested for a long term secured loan: Industry Average 38% 22% 22% 50% Alpha Beta Gross profit margin Net profit margin (before tax) Return on capital employed Debt equity ratio 35% 17% 24% 40% 39% 20% 26% 45% Inventory turnover (times) Receivables’ turnover (days) Payables’ turnover (days) 8 30 16 7 19 28 10 28 19 0.95 0.5 1.25 0.85 1.1 0.9 Current ratio Acid test ratio Required: Write a memo to your bank manager comparing the financial position of the two companies and specifically highlighting any area that requires further investigation. You are also requested to list down what additional information will be necessary in order to take a meaningful decision. 20 PTO 3 of 4 Marks Q. 6 The balance sheets of M/s. Big and its subsidiary entity M/s. Little at 31st December 2007 were as follows: Big Rs.000 Little Rs.000 Property, plant and equipment Investment in Little Inventory Receivables Bank 228 150 35 22 8 443 177 0 15 25 5 222 Ordinary share capital (Rs.10 each) Reserves 200 163 363 80 443 75 120 195 27 222 Current liabilities Additional Information: 1. Big purchased 6,000 shares in Little on 1st January 2004, when the reserves of Little showed a balance of Rs.40,000. 2. Big sold goods to Little during the year for Rs.20,000, half of which were sold by the year end. Big made a gross margin of 20% on selling price. 3. On the date of acquisition, the carrying values and fair values of net assets of Little were the same except for some machinery whose fair value was estimated to be higher than carrying value by Rs.50,000. The subject machinery had a remaining useful economic life of five years from 1st January 2004. The machinery is still in use of Little. 4. Since acquisition, there has been no impairment of goodwill on consolidation. Required: Prepare the consolidated balance sheet for the group as at 31st December 2007. THE END 4 of 4 20