Document 15504133

advertisement

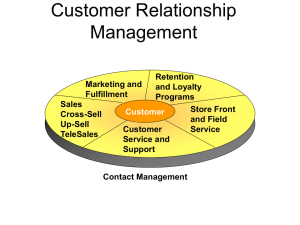

6. The criteria for design of customer loyalty rewards a. Timing of rewards b. Relationship to the product c. Both a & b d. None of these 7. What is NOT a feature of CRM software a. Work flow management b. Role based dashboards c. Customer analytics d. Financial accounts 8. CRM blue print helps in a. Assists in comprehend integrated view of process outlines and systems b. Cross selling c. Up selling d. Outsourcing 9. Which is NOT a criterion for shortlisting CRM outsourcing partner? a. Financial stability b. Domain expertise c. Ability to scale d. None of the above CII Institute of Logistics PGDSCM/DSCM/ADSCM & CERTIFICATE PROGRAMS Semester-end Examinations- December 2011 CUSTOMER RELATIONSHIP MANAGEMENT Time: 3 hours Marks: 100 Part A Answer all questions (10 x 1 = 10 Marks) 1. What is NOT a generic objective of Customer relationship management? a. Acquisition b. Retention c. Enhancement d. Engagement 2. What is NOT a layer in the CRM practice framework? a. People b. Place c. Process d. Technology 3. Which activity is necessary before CRM process automation? a. Training b. Process mapping c. Marketing program d. Advertisement 4. What is NOT related to customer segmentation? a. Micro segmentation b. Data mining c. Pareto rule d. Process mapping 5. Which is one of the stages of customer life cycle? a. Sales budget b. Leverage customer equity c. Deliver products d. Product development 10. Following is an example of customer loyalty program a. Tanishq’s Anuttara b. IOC’s Extra miles c. Both (a) and (b) d. None of the above Part B Answer any four 1. 2. 3. 4. 5. 6. (4x15= 60 marks) Define customer relationship management. How CRM improves profits of a business. Discuss with an example. Discuss various stages in customer life cycle? Give an example Discuss five layered CRM practice development framework How are timing of rewards and relationship to product are related in the context of customer loyalty rewards design. Discuss with an example Discuss any five CRM measures Why should any enterprise outsource CRM program? On what factors a prospective outsourcing partner shall be evaluated. Part C Case study (3*10=30 marks) NEWBANK has among the largest retail and corporate banking operations in India. Long revered as the most technology friendly bank, NEWBANK India continues to be at the forefront in launching new products and services—be it automatic teller machines (ATM) or Internet banking. NEWBANK credit cards are among the most popular in the Indian market. NEWBANK India counts close to 2.5 million customers for their retail banking division alone. This number of customers fosters a similarly large volume of inquiries covering the gamut of offered products. Until October 2000, NEWBANK handled all customer inquiries through traditional mail and telephone. Given the burgeoning growth rates of their own retail banking business and the increasingly competitive market, they no longer viewed paper mail as a viable channel for rapid response to customer inquiries. NEWBANK India processed millions of pieces of paper mail every month for years. Then, in October of 2000—long before other financial institutions—the technology savvy banks decided to offer customer support through electronic channels. The first frontier they approached was e-mail and it proved to be great differentiator in a highly competitive market. Adding this channel served a two-fold purpose. First, it provided a channel of communication for the large number of their customers, who had extensive access to the Internet. Second, it diverted more and more customers, who typically contacted the bank via telephone and letter, to using email, a support media far less expensive and more efficient than any other. Once committed to supporting e-mail inquiries, the bank faced this key decision. NEWBANK India had rarely, if ever, purchased enterprise scale software from external vendors. While small point solutions were purchased often enough for use by specific departments, the bank had never purchased software that was deployed across the entire organization. Whenever a need arose for large-scale software deployment, NEWBANK utilized the services of their associate companies specializing in building software solutions. However, they realized quickly enough that it would take an extremely long time for their in-house company to develop this CRM tool. And, they urgently needed to have the solution in place. So they evaluated CRM technology vendors and selected CRMTEK for the following reasons: 1. 2. 3. exposed APIs to speed integration, and an extremely intuitive user interface (UI), enabling on-the-fly configuration by each user—a concept CRMTEK calls “use-based evolution.” Features key to NEWBANK’s CRM success included: Product deployment, Ease of use, Scalability, Good support. The key features were Response templates, Auto and manual categorization and personalized workspaces. CRMTEK was a full-service provider with a worldwide presence and a complete line of products, which would enable NEWBANK to offer new value-added customer services over time. CRMTEK developed its own software and employed an experienced research and development team, as well as a top-notch professional services staff. CRMTEK product design underscored ease and power at every opportunity, featuring open architecture for greater extensibility, NEWBANK estimates that in less than a year, it has recovered nearly all of its investment in CRMTEK E-Mail. Furthermore, they are delighted that more and more customers are choosing e-mail communication with gusto, thus minimizing costs of their traditional mail and phone support channels. NEWBANK has found that the CRMTEK customer support teams consistently deliver on the CRMTEK tagline “Relationships Made Easy” irrespective of the time of the day they are contacted. Response times have been excellent and the quality of problem resolution exceptional. NEWBANK has also been pleased with CRMTEK commitment to proactive communication with customers. Given the substantial benefits of working with a vendor committed to quality customer relationships, NEWBANK acknowledged that the return on investment has been particularly high with CRMTEK. Answer all questions 1. 2. 3. What is reason for NEWBANK to implement a CRM? Is it a right decision to select an external vendor to implement CRM? Provide rationale? How CRMTEK did enabled NEWBANK to achieve its objectives and ROI? ******************************