''Neo-Liberal Economic Policy and Peasant Classes: The question of farm profitability and indebtedness in Indian agriculture''

advertisement

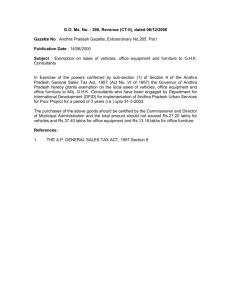

NEO-LIBERAL ECONOMIC POLICY AND PEASANT CLASSES: The Question of Farm Profitability and Indebtedness in Indian Agriculture ARINDAM BANERJEE Centre for Economic Studies and Planning Jawaharlal Nehru University, New Delhi Draft presentation for IDEAS Workshop, Beijing,June,2007. Not to be quoted. (I am thankful to Prof. Utsa Patnaik for her insightful comments.) Indian Agriculture under a Deflationary Regime: New situation for the farmers Volatility of the world and domestic prices. Steep increase in input prices under the neo-liberal regime. Continuous decline in the access to institutional credit in rural areas over this period. value in Rs Trends in fertilizer prices 10000 9000 8000 7000 6000 5000 4000 3000 2000 1000 0 1981 1991 2003 year Urea DAP 17:17:17 NPK 10:26:26 NPK Comparison of Fertilizer Prices under controlled and decontrolled regimes 17:17:17 10:26:26 Year Urea DAP NPK NPK Percentage increase during controlled regime 1981-91 17.5* 30 30 30.2 Percentage increase during decontrolled regime 1991-2003 75* 99.8 139.6 117.7 *: decontrolled regime started in 1992 Source: Calculation based on data from Fertilizer Association of India (FAI). Trends in percentage share of rural credits and deposits of SCBs in India Year 1981 1991 2000 2001 2002 2003 2004 2005 Credit 11.9 14.7 10.6 10.1 10.2 10.2 9.7 9.5 Deposit Credit-deposit ratio 13.4 60.6 15.1 59.4 14.7 40.0 14.7 39.0 14.2 41.8 13.8 43.7 12.9 43.6 12.2 51.6 Sources: Ramachandran and Swaminathan (2002) for the figures pertaining to 1981, 1991 and 2000 and Banking Statistics: Basic Statistical Returns, RBI for 2001-2005. Objectives of the study The study has two objectives Trace the economic behaviour of peasant classes in the labour and land-lease markets under the current policy regime. An assessment of the debt situation of the peasantry and identify the classes affected by debt-driven vulnerability. Methodology The study is based on a primary survey of 248 rural households in West Bengal and Andhra Pradesh. A two-tier selection process was adopted to identify an economically advanced region (AR) and backward region (BR) in each of the states. A stratified random sample survey has been conducted in four villages in Bardhaman district, West Bengal and five villages in Anantapur and Karimnagar districts, Andhra Pradesh. Peasant Classification Classification of households into economic classes has been done on the basis of Patnaik’s Labour Exploitation Index (E) E = X/F = [(Hi – Ho) + (Lo – Li)]/F where Hi, Ho are labour days hired in and out respectively, Lo, Li are the total labour days on land leased out and land leased in respectively and F is the family labour in self-employment. The size-class classification of households using operated area has also been employed in the framework of analysis. Details of Economic Classification Economic Class Value of E Comments Rural labour E=-∞ X < 0 and |X| is very large, F = 0. Poor Peasant E≤-1 X < 0, F > 0, |X| is large and |X| ≥ F. Small Peasant 0≥E>-1 X ≤ 0, F > 0 and |X| < F. Middle Peasant 1>E>0 X > 0, F > 0 and X < F. Rich Peasant E≥1 X > 0, F > 0, X is large and X ≥ F. Landlord E=∞ X > 0 and X is very large, F = 0. Source: Adopted from Patnaik (1976) Peasant class interaction in the labour and landlease markets in the four regions of study West Bengal: Advanced Region In the AR, West Bengal, a significant feature is the small size of land holdings. The marginal and small farmers constitute a high 77.9 % of the households. The poor peasants are hiring out slightly more labour-days than the rural labour. This class, however has access to small plots of land due to the land reforms that this region in West Bengal experienced. The rich peasant class forms the largest economic class at around 39 % and is spread across all the size-classes. This implies that a demand for hired labour in cultivation is generated from all size-classes in this region. Andhra Pradesh: Advanced region The middle and small peasant class together comprise more than 60 % of the households. The leasing in of land from others for cultivation is significant in this region. Only the highest two size-classes are hiring in labour in the net. This is due to the concentration of rich peasants and landlords in the two highest size-classes. West Bengal: Backward Region The agriculture here is of a subsistence nature and hence interactions in input, output and credit markets are significantly lower compared to the other regions. This is a predominantly labour hiring out region due to the low absorption of labour in its near subsistence level agricultural activities. The hiring out of labour in non-agricultural activities is equally important as the selling of labour in the agricultural labour market. Andhra Pradesh: Backward Region The poor peasant and small peasant classes together comprise close to 60% of the households i.e. a majority of the households are net-sellers of labour power. The poor peasants resort to large hiring out of labour in a typical rural proletarian fashion but are spread across all size-classes. This phenomenon where cultivators are exploited indirectly through rent payments in the land-lease market is present in this region also. Indebtedness among Peasant Classes and the underlying factors The BR, West Bengal is not included in this analysis as the credit market interaction of the peasantry is negligible. The outstanding debt per household is much higher in both the regions in Andhra Pradesh compared to the AR, West Bengal. The outstanding debt per household is Rs. 60699 and Rs. 67546 in the AR and BR respectively in Andhra Pradesh while the same is Rs. 30873 in the AR, West Bengal. Inter-regional comparison of household indebtedness An inter-regional comparison of the Debt-Assets ratio and the InterestGVO ratio gives a stronger illustration of the disparity in the debt situation between the regions. Debt-assets ratio: AP – AR: 0.66 AP – BR: 0.38 The Interest-GVO ratio: AP – AR: 0.240 AP – BR: 0.227 WB – AR: 0.22. WB – AR: 0.074. Inter-class analysis of household indebtedness for the three regions In the AR, West Bengal, The small peasant class has a high interest-GVO ratio of 0.297. The marginal farmers (0.01 to 1.0 acres), the majority group in the region, have a high interest-GVO ratio of 0.213. In the AR, Andhra Pradesh, The interest-GVO ratio is high for the poor, middle and rich peasants. The debts as a percentage of assets exceeded 60 percent for these three classes. The marginal and small cultivators are also in an extreme debt situation with incredibly high interest-GVO ratios of 0.853 and 0.460 respectively. Continued, In the BR, Andhra Pradesh, The poor peasant class, which is the largest class in this region, has remarkably high debt-assets ratio and interest-GVO ratio at 0.87 and 0.575 respectively. The rich peasants and the middle peasants also have moderately high indicators of indebtedness. The interest-GVO ratio is high for not only the marginal an small cultivators but also for those with large operated area (more than 10 acres). Marginal: 48.45 Small: 0.90 Large: 0.242 Number of loans and average interest rate region wise West Bengal AR Andhra Pradesh AR Andhra Pradesh BR No. of loans, of which 92 71 104 Institutional 75 27 78 Non-institutional 17 44 26 Average interest rate 14.64 19.73 13.82 A calculation of the average interest rate points out the disparity between the credit market structure and the cost of credit between the three regions. Comparison of the Interest component in Outstanding Debt with the average Interest rate A comparison of the share of interests in the outstanding debt with the average interest rate reveals the rates of failure on part of the households to clear their interest commitments yearly. This share exceeds the average interest rate by 7.75 percentage points and 8.47 percentage points for the AR and BR respectively in Andhra Pradesh indicating a drastic build up of household interest costs over a time-period (Table 9). In the AR, West Bengal, this share is 16.18 percent and marginally higher than the average interest rate. Intra-class Comparison of the Interest component in Outstanding Debt with the average Interest rate AR,West Bengal: The poor peasant class has an interest share of 23 % which is higher than the average interest rate. AR, Andhra Pradesh: The interest share in outstanding debt for the poor peasants and rich peasants is at around 25% and 41% respectively BR, Andhra Pradesh: The interest component of debt exceeds the average interest rate for all classes except the small peasants. Comparison of the annual outstanding interest payments and yearly Farm Labour Income A comparison of the outstanding interest per household and the Farm Labour Income (FLI) per household for the reference year of the survey identifies the vulnerability of the peasant classes in the credit market (Table 10). The debt situation In BR, Andhra Pradesh, the yearly interest commitment exceeds the FLI by around 63 percent. In AR, Andhra Pradesh, the annual interest obligations of the households are 74 percent of their FLI. In the AR, West Bengal, this figure is lower at around 35 percent. Intra-class Comparison of the annual outstanding interest payments and yearly FLI The small peasants in the AR, West Bengal as well as the marginal and small cultivators in the AR, Andhra Pradesh are making losses and have a negative FLI for the reference year. In WB – AR, The annual interest cost is greater than the annual income for the poor peasants and marginal cultivators. In AP – AR, The interest costs for small and middle peasants are higher than their annual farm incomes. For the poor and rich peasants also, the yearly interest costs add up to around 75 percent of the annual FLI. In AP – BR, The interest obligations for the poor and middle peasants are 4 to 5 times their FLI. The landlords have their FLI exceeded by their interest costs.The interest liability of rich peasants amount to more than 85 percent of the FLI. The processes and causes behind the three different situations: AR – AP The share of total debt owed to institutional sources in the AR, Andhra Pradesh is only 23.63 percent (Table 11). An early crisis post-liberalization in this cotton-growing region has led to this situation where the banks stopped giving credit to farmers from 1998. A lower interest rate structure due to more access to formal credit can reduce the yearly liability of interest costs on the annual income of the households. BR – AP The vulnerability of peasant classes is fundamentally due to plummeting farm incomes and is spread across classes irrespective of whether they have access to institutional credit or not. The deflationary economic regime led to a consequent dwindling of the domestic demand for groundnut, which pushed down the prices of groundnuts. The simultaneous crop failures, high cost structures and paltry returns to private investments in irrigation are factors which together has piled up debts for the households. AR - WB This is a primarily rice and potato cultivating region. The vulnerability of the poorer classes is due to the moderate volatility in potato prices and the rising input costs including that of irrigation. A well-functioning Primary Agricultural Cooperative Society (PACS) shields the households from debt-driven vulnerability. Also ensures high access to formal credit even for the vulnerable classes and makes them less susceptible to the predatory nature of private credit. Policy Measures to tackle the problem of Indebtedness Immediate debt-relief measures. Enhancing access to institutional credit in the rural areas. Arrest the upward spiral of input prices, especially for the essential farm inputs. Provision of proper extension services and training to the farmers, especially for commercial cultivation. Thank You