Policy Response to the Crisis in South Asian Countries Surajit Das Muttukadu 25/01/2015

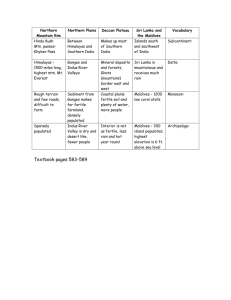

advertisement

Policy Response to the Crisis in South Asian Countries Surajit Das Muttukadu 25/01/2015 South Asia: Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka Graph: Growth Rates of GDP at Constant Prices in terms of respective national currencies. Source: World Economic Outlook Database updated in October 2014, IMF. Notes: Growth rates of Maldives are measured along the secondary axis. 2014 figures are provisional. Observation: There was a reduction of growth rate during 2008-2009 following the crisis, then there was a recovery during 2010-2011 and then again there was another fall in growth rates during 2012-2013. Chart 1: Growth Rates (In %) 15 20 13 15 11 10 9 7 5 5 0 3 -5 1 -1 2000 2001 Bangladesh -3 2002 2003 Bhutan 2004 India 2005 Nepal 2006 2007 Pakistan 2008 2009 Sri Lanka 2010 2011 Simple Average 2012 2013 Average 2014 -10 Maldives -15 Graph: Growth Rates of GDP at Constant Prices in terms of respective national currencies. Source: World Economic Outlook Database updated in October 2014, IMF. Notes: Growth rates of Maldives are measured along the secondary axis. 2014 figures are provisional. The broken line with black dots represents the average excluding Bhutan and Maldives. Observation: There was a reduction of growth rate during 2008-2009 following the crisis, then there was a recovery during 2010-2011 and then again there was another fall in growth rates during 2012-2013. Chart 1: Growth Rates (In %) 15 13 11 9 7 5 3 1 -1 2000 2001 2002 2003 2004 2005 India -3 2006 2007 2008 2009 2010 Average 2011 2012 2013 2014 Graph: Inflation based on GDP Deflator. Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Observation: There was an upward trend in inflation rate 2003 onwards (mainly due to rise in international oil prices), which has soften in the recent past during 2012-2013. Chart 2: Inflation Based on GDP Deflator (In %) 25 20 15 10 5 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 -5 Bangladesh -10 Bhutan India Maldives Nepal Pakistan Sri Lanka Simple Average Graph: Inflation based on GDP Deflator. Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Observation: There was an upward trend in inflation rate 2003 onwards (mainly due to rise in international oil prices), which has soften in the recent past during 2012-2013. Chart 2: Inflation Based on GDP Deflator (In %) 25 20 15 10 5 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -5 India -10 Simple Average 2011 2012 2013 2014 Graph: Lending Rate less the inflation based on GDP deflator. Source: http://data.worldbank.org/, The World Bank. Notes: The dashed average line with black dots represents the average excluding Bhutan and Maldives. Observation: There was a downward trend in the real interest rates till 2010-2011, which has gone up during 2012-2013. Chart 2A: Real Interest Rates (In %) 15 10 5 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -5 -10 Bangladesh Bhutan India Sri Lanka Maldives Nepal Pakistan Simple Average Average Graph: Lending Rate less the inflation based on GDP deflator. Source: http://data.worldbank.org/, The World Bank. Notes: The dashed average line with black dots represents the average excluding Bhutan and Maldives. Observation: There was a downward trend in the real interest rates till 2010-2011, which has gone up during 2012-2013. Chart 2A: Real Interest Rates (In %) 15 10 5 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 -5 India -10 Average 2010 2011 2012 2013 Graph: Investment GDP Ratio (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Investment rates of Bhutan are plotted along the secondary axis. The broken line depicts the average excluding Bhutan and Maldives. Observation: Investment Rate remained more or less the same on an average. India and Pakistan have registered a decline in investment ratio in the recent past following the financial crisis. Chart 3: Investment Rate (In %) 50 70 45 60 40 50 35 30 40 25 30 20 15 20 10 10 5 Bangladesh India Maldives Nepal Pakistan Sri Lanka Simple Average Average Bhutan 0 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Graph: Investment GDP Ratio (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Investment rates of Bhutan are plotted along the secondary axis. The broken line depicts the average excluding Bhutan and Maldives. Observation: Investment Rate remained more or less the same on an average. India and Pakistan have registered a decline in investment ratio in the recent past following the financial crisis. Chart 3: Investment Rate (In %) 50 45 40 35 30 25 20 15 10 India 5 Average 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Graph: Domestic Saving to GDP Ratio (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken line represents the average excluding Bhutan & Maldives. Observation: Saving Rate has in fact gone up on an average. For India, relative to 2008, there was slight increase during 2009-2010 then again the saving rate has declined during last three years or so. Chart 4: Saving Rate (In %) 50 40 30 20 10 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 -10 Bangladesh Bhutan India Maldives Nepal Pakistan Sri Lanka Simple Average Average Graph: Domestic Saving to GDP Ratio (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken line represents the average excluding Bhutan & Maldives. Observation: Saving Rate has in fact gone up on an average. For India, relative to 2008, there was slight increase during 2009-2010 then again the saving rate has declined during last three years or so. Chart 4: Saving Rate (In %) 50 40 30 20 10 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -10 India Average 2011 2012 2013 2014 Graph: Investment-Saving Gap as % of GDP. Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. I-S gaps for Bhutan and Maldives are plotted along the secondary axis. The dashed average line with black dots represents the average excluding Bhutan and Maldives. Observation: I-S gap has gone up since 2003 till 2011 excepting in 2009. Big economies like India, Pakistan and Sri Lanka have registered a decline in I-S gap in 2013. Chart 5: Investment-Saving Gap as % of GDP 12 35 10 30 8 25 6 20 4 2 15 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 10 -2 5 -4 0 -6 -8 Bangladesh India Nepal Pakistan Sri Lanka Simple Average Average Bhutan Maldives -5 Graph: Investment-Saving Gap as % of GDP. Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. I-S gaps for Bhutan and Maldives are plotted along the secondary axis. The dashed average line with black dots represents the average excluding Bhutan and Maldives. Observation: I-S gap has gone up since 2003 till 2011 excepting in 2009. Big economies like India, Pakistan and Sri Lanka have registered a decline in I-S gap in 2013. Chart 5: Investment-Saving Gap as % of GDP 12 10 8 6 4 2 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -2 -4 -6 India -8 Average 2011 2012 2013 2014 Graph: Annual growth rate of index numbers of volume of exports of goods and services (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Bhutan, Maldives and Sri Lanka are on the secondary axis. Data for Nepal is unavailable. The broken line depicts the average excluding Nepal, Bhutan and Maldives. Observation: The average export growth rate has come down from more than 20% in 2007 to less than 0 in 2009; then it recovered during 2010-2011 and has come down again to near zero in 2012. Chart 6: Export (Volume) Growth Rate 35 80 30 60 25 20 40 15 20 10 5 0 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 -20 -5 -10 Bangladesh India Average Pakistan Simple Average Bhutan Sri Lanka Maldives -40 Graph: Annual growth rate of index numbers of volume of exports of goods and services (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Bhutan, Maldives and Sri Lanka are on the secondary axis. Data for Nepal is unavailable. The broken line depicts the average excluding Nepal, Bhutan and Maldives. Observation: The average export growth rate has come down from more than 20% in 2007 to less than 0 in 2009; then it recovered during 2010-2011 and has come down again to near zero in 2012. Chart 6: Export (Volume) Growth Rate 35 30 25 20 15 10 5 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -5 -10 India Average 2011 2012 2013 2014 Graph: Value of Exports of goods and services as proportion of GDP in national currencies (in %). Source: http://data.worldbank.org/, World Bank. Bhutan, Maldives and Sri Lanka are on secondary axis. Note: Bhutan, Maldives & Sri Lanka are on secondary axis. Broken average excludes Bhutan & Maldives. Observation: The export-GDP ratio, on an average, came down following the crisis during 2008-2009 and recovered during 2011-2012-2013 despite fall in growth rate of volume of exports. The value of export didn not fall that much as compared to the fall in volumes either because of increase in the price of exportables or because of the depreciation of the exchange rate or some combination of both. Chart 6A: Export-GDP Ratio (In %) 40 120 35 100 30 80 25 20 60 15 40 10 20 5 Bangladesh India Nepal Pakistan Average Bhutan Sri Lanka Maldives Simple Average 0 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Graph: Value of Exports of goods and services as proportion of GDP in national currencies (in %). Source: http://data.worldbank.org/, World Bank. Note: Bhutan, Maldives and Sri Lanka are on secondary axis. Broken average excludes Bhutan & Maldives. Observation: The export-GDP ratio, on an average, came down following the crisis during 2008-2009 and recovered during 2011-2012-2013 despite fall in growth rate of volume of exports. The value of export didn not fall that much as compared to the fall in volumes either because of increase in the price of exportables or because of the depreciation of the exchange rate or some combination of both. Chart 6A: Export-GDP Ratio (In %) 40 35 30 25 20 15 10 5 India Average 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Graph: Annual growth rate of index numbers of volume of imports of goods and services (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Bhutan, Maldives and Sri Lanka are on the secondary axis. Data for Nepal is not available. Bhutan and Maldives are excluded in the broken average. Observation: The average import growth rate also came down during 2008-2009; then it increased during 2010-2011 and it has come down again to near zero in 2012-2013, when manufacturing remained stagnant. Chart 7: Import (Volume) Growth Rate 40 60 50 30 40 30 20 20 10 10 0 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 -10 -20 -10 -30 Bangladesh -20 India Average Pakistan Simple Average Bhutan Maldives Sri Lanka -40 Graph: Annual growth rate of index numbers of volume of imports of goods and services (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. Bhutan, Maldives and Sri Lanka are on the secondary axis. Data for Nepal is not available. Bhutan and Maldives are excluded in the broken average. Observation: The average import growth rate also came down during 2008-2009; then it increased during 2010-2011 and it has come down again to near zero in 2012-2013, when manufacturing remained stagnant. Chart 7: Import (Volume) Growth Rate 40 30 20 10 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -10 India -20 Average 2011 2012 2013 2014 Graph: Value of imports of goods and services as proportion of GDP in national currencies (in %). Source: http://data.worldbank.org/, World Bank. Bhutan, Maldives & Sri Lanka are on the secondary axis. Observation: The import-GDP ratio, which was continuously increasing since 2003, came down in 2009 immediately after the crisis and then (in spite of fall in growth rate of import volume) increased again during 2010 onwards in the recent years. Therefore, the value of import must have increased either because of increase in (oil) prices or depreciation of the exchange rate or some combination of both. Chart 7A: Import-GDP Ratio (In %) 50 120 110 40 100 90 30 80 70 20 60 50 10 40 30 Bangladesh India Nepal Pakistan Simple Average Average Bhutan Sri Lanka Maldives 0 20 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Graph: Value of imports of goods and services as proportion of GDP in national currencies (in %). Source: http://data.worldbank.org/, World Bank. Bhutan and Maldives are excluded in the broken average. Observation: The import-GDP ratio, which was continuously increasing since 2003, came down in 2009 immediately after the crisis and then (in spite of fall in growth rate of import volume) increased again during 2010 onwards in the recent years. Therefore, the value of import must have increased either because of increase in (oil) prices or depreciation of the exchange rate or some combination of both. Chart 7A: Import-GDP Ratio (In %) 50 40 30 20 10 India Average 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Graph: International Oil Price (2005=100): Growth Rates of annual averages of monthly index numbers. Source: Primary Commodity Prices, IMF. Observation: Very similar pattern with the Import-GDP Ratio. Crude Oil (petroleum), Price index, 2005 = 100, simple average of three spot prices; Dated Brent, West Texas Intermediate, and the Dubai Fateh Source: Primary Commodity Prices, IMF 200 180 160 140 120 100 80 60 40 20 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Graph: Current Account Deficit (in US$Billion). Positive means deficit and negative means surplus. Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The black line depicts the total figure of South Asia as a whole. Figures for India, Pakistan and total are plotted along the secondary axis. Observation: In absolute terms, the current account deficit of India as well as that of South Asia continuously increased since 2003 till 2012, which has come down substantially in 2013 due to negative growth in import volume and positive growth rate in volume of exports of goods and services. Chart 8: Current Account Deficit in US$ Billion 5 100 4 85 3 70 2 55 1 40 0 25 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 -1 10 -2 -5 -3 -20 Bangladesh Bhutan Maldives Nepal Sri Lanka India Pakistan Total Graph: Current Account Balance in US$ as proportion of GDP in current US$ (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The dashed average line with black dots represents the average excluding Nepal, Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: On an average, the CAD-GDP ratio deteriorated sharply in 2008, then recovered during 20092010, then again the deficit increased during 2011-2012, finally it has shown some sign of recovery in 2013 Chart 8A: Current Account Balance as % of GDP 10 16 8 11 6 6 4 1 2 -4 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 -9 -2 -14 -4 -19 -6 -24 -8 -10 -12 -29 Bangladesh India Nepal Pakistan Sri Lanka Simple Average Average Bhutan Maldives -34 Graph: Current Account Balance in US$ as proportion of GDP in current US$ (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The dashed average line with black dots represents the average excluding Nepal, Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: On an average, the CAD-GDP ratio deteriorated sharply in 2008, then recovered during 20092010, then again the deficit increased during 2011-2012, finally it has shown some sign of recovery in 2013 Chart 8A: Current Account Balance as % of GDP 10 8 6 4 2 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -2 -4 -6 -8 -10 -12 India Average 2011 2012 2013 2014 Graph: Foreign direct and institutional investment (in US$ Billion). Source: http://data.worldbank.org/, The World Bank. Notes: Figures for India, Pakistan and total are plotted along the secondary axis. Observation: The foreign investment in absolute terms came down in 2008 but increased again during 2009-2010, then declined again in 2011 and increased again during 2012-2013 both for India and for South Asia as a whole. Chart 9: FDI Plus FII (In Billion US$) 2.0 70 60 1.5 50 1.0 40 0.5 30 0.0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 -0.5 2013 20 10 -1.0 0 Bangladesh Bhutan Sri Lanka Maldives Nepal India Pakistan Total Graph: Foreign direct and institutional investment as proportion of GDP in current US$ (in %). Source: Source: http://data.worldbank.org/, The World Bank and WEO Database, IMF. Note: Foreign investment as proportion of GDP for Sri Lanka have been plotted along the secondary axis. The broken average line represents South Asian average excluding Sri Lanka. Observation: Foreign investment as proportion of GDP was increasing steadily till 2007, then it declined sharply in 2008, then increased again in 2009, then declined again during 2010-2011, then increasing again in the recent past during 2012-2013. Chart 9A: FDI+FII As % of GDP 7 70 6 50 5 4 30 3 10 2 1 -10 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 -1 2013 -30 Bangladesh India Maldives Nepal Weighted Average Simple Average Bhutan Sri Lanka Pakistan Graph: Foreign direct and institutional investment as proportion of GDP in current US$ (in %). Source: Source: http://data.worldbank.org/, The World Bank and WEO Database, IMF. Note: Foreign investment as proportion of GDP for Sri Lanka have been plotted along the secondary axis. The broken average line represents South Asian average excluding Sri Lanka. Observation: Foreign investment as proportion of GDP was increasing steadily till 2007, then it declined sharply in 2008, then increased again in 2009, then declined again during 2010-2011, then increasing again in the recent past during 2012-2013. Chart 9A: FDI+FII As % of GDP 7 6 5 4 3 2 1 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 -1 India Simple Average 2010 2011 2012 2013 Graph: Official Exchange Rate (Domestic currency per US$). Source: Source: http://data.worldbank.org/, The World Bank. Note: 2014 numbers are taken from various country specific sources. Data was not available for Bhutan and that was not available for Nepal and Maldives for the last year. Observation: There has been a secular depreciation of exchange rates of South Asian countries after crisis Chart 10: Exchange Rate per US$ 140 120 100 80 60 40 20 0 2000 2001 2002 Bangladesh 2003 Bhutan 2004 India 2005 2006 Maldives 2007 Nepal 2008 2009 Pakistan 2010 2011 Sri Lanka 2012 2013 Simple Average 2014 Graph: Foreign Exchange Reserves (in US$ Billion). Source: Source: http://data.worldbank.org/, The World Bank. Note: 2014 numbers are not available for Bhutan, Nepal, Maldives and Sri Lanka for the last year. Figures for India and South Asian total are plotted along the secondary axis. Observation: Excepting Pakistan, there has been a secular increase in foreign exchange reserves of all South Asian countries. Reserves are being piled-up and exchange rates are being allowed to depreciate continuously for maintaining international competitiveness. Exchange rate policy for boosting demand! Chart 11: Foreign Exchange Reserves in Billion US$ 25 400 350 20 300 250 15 200 10 150 100 5 50 0 0 2000 2001 2002 2003 Bangladesh 2004 Bhutan 2005 2006 Sri Lanka 2007 Maldives 2008 2009 Nepal 2010 Pakistan 2011 2012 India 2013 Total 2014 Graph: Combined government revenue as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken average line with black dots represents the average excluding Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: Following crisis, the revenue-GDP ratio came down during 2008-2009 both for India as well as for the Asian countries on an average and it remained low till 2011, then it has shown some recovery during last one or two years. However, excluding Bhutan and Maldives, the average ratio remained flat. Chart 12: Government Revenue to GDP Ratio (In %) 23 50 21 45 19 40 17 15 35 13 30 11 25 9 Bangladesh India Nepal Pakistan Sri Lanka Simple Average Average Bhutan Maldives 7 20 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Graph: Combined government revenue as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken average line with black dots represents the average excluding Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: Following crisis, the revenue-GDP ratio came down during 2008-2009 both for India as well as for the Asian countries on an average and it remained low till 2011, then it has shown some recovery during last one or two years. However, excluding Bhutan and Maldives, the average ratio remained flat. Chart 12: Government Revenue to GDP Ratio (In %) 23 21 19 17 15 13 11 9 India Average 7 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Graph: Combined government expenditure as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken average line with black dots represents the average excluding Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: The government expenditure went up for India only in 2008 before crisis due to pay commission and farmers’ debt relief and it has continuously come down as proportion of GDP thereafter. It is the same story for Asian average excluding Bhutan and Maldives. Chart 13: Government Expenditure to GDP Ratio (In %) 30 60 28 55 26 50 24 45 22 20 40 18 35 16 30 14 25 12 Bangladesh 10 2000 2001 India 2002 Nepal 2003 2004 Pakistan 2005 Sri Lanka 2006 2007 Simple Average 2008 2009 Average 2010 2011 Bhutan 2012 2013 Maldives 2014 20 Graph: Combined government expenditure as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken average line with black dots represents the average excluding Nepal, Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: The government expenditure went up for India only in 2008 before crisis due to pay commission and farmers’ debt relief and it has continuously come down as proportion of GDP thereafter. It is the same story for Asian average excluding Bhutan and Maldives. Chart 13: Government Expenditure to GDP Ratio (In %) 30 28 26 24 22 20 18 16 14 12 India Average 10 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Graph: Combined fiscal deficit as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The dashed average line with black dots represents the average excluding Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: The fiscal deficit as proportion of GDP increased during 2008-2009 both for India as well as for South Asia, but this has been brought down continuously 2010 onwards. Chart 14: Fiscal Deficit to GDP Ratio (In %) 11 22 9 17 7 12 5 3 7 1 -1 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 -3 2 -3 Bangladesh India Nepal Pakistan Sri Lanka Simple Average Average Bhutan Maldives Graph: Combined fiscal deficit as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The dashed average line with black dots represents the average excluding Bhutan and Maldives. Bhutan and Maldives are plotted along the secondary axis. Observation: The fiscal deficit as proportion of GDP increased during 2008-2009 both for India as well as for South Asia, but this has been brought down continuously 2010 onwards. Chart 14: Fiscal Deficit to GDP Ratio (In %) 11 9 7 5 3 1 -1 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -3 India Average 2011 2012 2013 2014 Graph: Accumulated liability of government as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken average line with black dots represents the average excluding Bhutan and Maldives. Observation: The debt-GDP ratio has been brought down continuously since 2002-2003 excepting just one year of 2008 both for India and, on an average, for South Asian countries for ‘debt-sustainability’. Chart 15: Accumulated Combined Public Debt to GDP Ratio (In %) 120 100 80 60 40 20 Bangladesh Bhutan India Maldives Nepal Pakistan Sri Lanka Simple Average Average 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Graph: Accumulated liability of government as proportion of GDP in national currency (in %). Source: World Economic Outlook Database updated in October 2014, IMF. Notes: 2014 figures are provisional. The broken average line with black dots represents the average excluding Bhutan and Maldives. Observation: The debt-GDP ratio has been brought down continuously since 2002-2003 excepting just one year of 2008 both for India and, on an average, for South Asian countries for ‘debt-sustainability’. Chart 15: Accumulated Combined Public Debt to GDP Ratio (In %) 120 100 80 60 40 20 India Average 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Summary Findings: • Growth rates have come down • Inflation has become moderate • Real interest rate is increasing • Aggregate demand in a depression • Investment rate is reducing • I-S gap is coming down • CAD-GDP ratio increased but, reduced now • Foreign investment reduced in between but, increasing now as % of GDP • Exchange rate is depreciating • Forex reserve is being piled up • Revenue-GDP ratio is improving very slowly • Government expenditure is coming down as proportion of GDP • Fiscal deficit to GDP ratio is being brought down • Public Debt-GDP ratio is being brought down Conclusion: • Contractionary fiscal and monetary policies have led to reduction in the growth rate of aggregate demand both in India as well as in South Asian countries on an average. • Exchange rate policy is somewhat helping in demand management through improvement in net exports and it seems, there is some degree of coordination in this regard. Policy Implication: • We should come out of ongoing fiscal conservatism and undertake expansionary fiscal policy. And also, it is high time to do away with the obsession of ‘inflation targeting’ by pushing up the interest rate. Thank you