The Impact Of Corporate Entrepreneurship On Company Growth In A Hostile Business Environment

advertisement

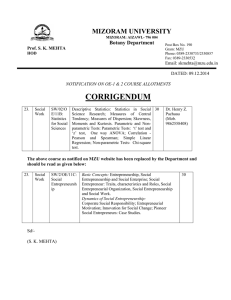

7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 The Impact of Corporate Entrepreneurship on Company Growth in a Hostile Business Environment Mohamed Zain College of Business and Economics Qatar University, Doha, QATAR Tel: (974) 485 1823 Abdelaziz Elbashir Hassan BACH, Abu Dhabi, UAE ABSTRACT A relationship between corporate entrepreneurship (CE) and company performance in a hostile business environment of a developing country is examined in this research using suyvey data obtained from 55 Malaysian construction firms. Among others, this study found that: (1) CE strongly influenced company growth in a hostile business environment, and (2) CE exists at more than one level within a business organization. Given the growing importance of CE in today's businesses it is important for firms to be able to identify entrepreneurial practices carried out by their employees so that they can distinguish their entrepreneurially inclined employess from those who are not within their organizations. INTRODUCTION Considerable ancedotal evidence suggests that an entrepreneurial management style is common to successful companies. According to Drucker (1985) and Stevensen and Gumbert (1985), large firms like IBM, Sony, Hewlett-Packard and 3M have been able to sustain high levels of performance by behaving entrepreneurially. Also, in order for firms to achieve sustained innovation and long-term excellence in the product-market field organizations they should maintain a culture that supports and encourages performance improvement. This sort of culture can also be described as a culture that October 13-14, 2007 Rome, Italy 1 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 promotes corporate entrepreneurship (CE), i.e., a culture that encourages its employees to be creative and innovative that will enable them to realize and take advantage of opportunities when ever they arise. Nevertheless, the relationship of CE and its influences on company growth in a developing countery environment has not been investigated before. CE is known universally as intrapreneurship (Chang, 1998). According to Pinchot (1985), the term refers to the development of internal markets and relatively small and independent units designed to create internal ventures and expand innovative staff services, technologies and methods within a large organization. Selecting an appropriate basis for defining CE and understanding its process is a real challenge for researchers due to the absence of a universally accepted definition of corporate entrepreneurship. Based on the literature, the main elements of CE definitions are innovation, proactivity and risk taking at organization and individual levels (Table 1). [Insert Table 1 here] Therefore, after reviewing the various definitions of CE given in Table 1, for the purpose of this study CE is defined operationally as a process whereby corporate entrepreneurs of established business organizations undertake product and service innovations, act proactively and are willing to take risk through internal and external October 13-14, 2007 Rome, Italy 2 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 business ventures in order to enhance their company's performance (Miller and Friesen, 1982; Covin and Slevin, 1989; Brazeal, 1993; Morris, Avila and Allen, 1993; Zahra, 1993b; Zahra and Covin, 1995; Pearce and Carland, 1995). The literature, however, shows no consensus about the locus of corporate entrepreneurs within a business organization (Zahra, 1993b), i.e., whether it should be at all levels of the firm or at one autonomous business unit led by entrepreneurial worker, manager, or group of employees (Gibb, 1987; Kao, 1989, Zahra, 1993b). In this connection, intrapreneurship school focuses on entrepreneurial executives within a complex organization. The emergence of CE according to this school depends on two main variables: the existence of entrepreneurial climate inside a business organization and the presence of entrepreneurial abilities in its participants. One of the first models of CE is the domain model of CE developed by Guth and Ginsberg (1990) which was targetted at fitting CE into strategic management of firms. Another model developed by Covin and Slevin (1991), is a conceptual model of entrepreneurship where a firm's entrepreneurial behavior is built on three-level variables: organizational, entrepreneurial employees’ and environmental levels (Covin and Slevin, 1991). The model is a general theoretical framework that depicts the causes and consequences of organizational-level entrepreneurial behavior. In 1993, Brazeal developed an organizational model of internally developed ventures which is built on two levels of variables and focuses on two categories of factors related to long term building and maintenance of CE: (1) motivating factors, i.e., the reward system and structural arrangements, and (2) broad-base individual characteristics that describe a corporate entrepreneur including attributes, values and behavioral orientations. Being the only model that has been tested empirically, its October 13-14, 2007 Rome, Italy 3 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 empirical findings are somewhat mixed. His findings suggest that separate reward and structural arrangement are not necessary or even desirable for both entrepreneurial and non-entrepreneurial managers. In another study, Hornsby, Naffzigar, Kuratko, and Montagno (1993) developed an interactive model of CE (Brazeal,1993; Covin and Slevin, 1991) which utilizes theories of the causes of behavior and focuses on the interactions between an individual’s personality and his environment due to certain precipitating events. Further, Zahra (1986) and Zahra and Covin (1995) conducted two studies that addressed this issue where they found a correlation between CE and performance for firms that emphasize CE as risk taking, product innovation and proactivity. Covin and Slevin (1986) conducted another study on entrepreneurial posture and firm performance relationship where they found found zero-order correlation of r = 0.39 (p < 0.001) between entrepreneurial posture and firm performance. In relation to CE in the Asian business culture, Kim and McIntoch, (1997) found that Korean entrepreneurs possess high need for achievement, are group oriented, and are motivated by a recognition that brings honor, prestige and respect to their family, unlike the individualistic entrepreneurs of the Western culture. Also, autonomy, freedom and innovation are also practiced under management vigilance and control while benefits and rewards are lower compared to Western and Japanese firms. Furthermore, Hussin’s (1995, 1997) empirical study about Malay and Chinese entrepreneurs' personal values, found that Malay and Chinese entrepreneurs are characterized by high need for achievement, their abilities to create and utilize opportunities, risk taking, hard working, and being innovative. Additionally, in another empirical study on Asian entrepreneurs, Ray, Rainer, Arnulfo and Soke October 13-14, 2007 Rome, Italy 4 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 (1996) found that the entrepreneurs are individuals with opportunity knowing abilities, willing to take risk, hard working, dedicated and have good business skills. Attahir (1995) found that the critical factors of success for South Pacific entrepreneurs are government support, access to resources and possession of managerial skills in addition to autonomy and smallness of the company size. In addition to these, management support for CE and their commitment to it are found to be the main features distinguishing Malaysian entrepreneurial firms from others (Attahir, 1995). The findings of Siti Maimon’s (1991) study about Peters and Waterman’s (1982) eight attributes of entrepreneurial firms confirmed the existence of these attributes in Malaysian firms. Autonomy and freedom, in addition to productivity through people, were found to be most prevalent among these companies. The empirical findings from Zain’s (1993, 1995, 1996) study of eight Malaysian manufacturing firms also show the existence of internal entrepreneurial climate in the firms that support innovation and creativity. The common trend in the published research on CE is the predominance of data from manufacturing companies conducted in particularly in the US market (Zahra, Jennings and Kuratko, 1999) while companies from other business sectors received only a modest attention. Thus, the main purpose of this study is to examine corporate entrepreneurship (CE) and company growth relationship which is moderated by competitive and hostile business environment. This study departs from the previously mentioned approach by examining data from a different economic sector, that is, the construction sector of a developing country of Malaysia. The rivalry among October 13-14, 2007 Rome, Italy 5 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 the firms within the industry has been intense and therefore the industry's environment could be considered as hostile. THEORETICAL FRAMEWORK AND HYPOTHESES There are many theoretical and empirical studies which examine CE-performance relationships among firms. In contrast to most of the previous studies found in the literature which examined the relationships at the organization level (where CE is represented by only one variable), this study examined theses relationships in a different way. Specifically, this study enriched the knowledge by examining CEcompany growth relationships at two organizational levels: company and employee levels. Moreover, this study adopted company growth as a dependent variable, which is broader and more comprehensive indictor of corporate performance (Zahra and Covin, 1995; Delmar, 1997). Corporate growth reflects a company’s response to entrepreneurial change over short, medium and long terms. Improvement in performance initially will be reflected in the company sales in the short run. In the medium-term the company will respond to the increase in demand by acquiring more assets to meet increasing demand for its products and services. The main CE elements or the independent variables of the theoretical framework of this study are: (1) innovation, which refers to company’s and individual’s ability inside a business organization to create new products and services, introducte new markets, processes, supply of new resources, and new industry organization (Schollhammmer, 1982; Miller and Friesen, 1982; (2) proactivity, which refers to an ability to act earlier than others in capturing new markets or introducing new products or tapping new resources; (3) autonomy, which refers to a perception of self-determination with respect to work procedures, goals and priorities (Ross 1986; 1987); (4) management October 13-14, 2007 Rome, Italy 6 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 support, i.e., the extent to which the management encourages and supports CE through policy orientation and provision of resources (Kuratko et al. 1990); (5) structure, which is identified as the workflow arrangement, communication across different managerial layers and authority relationship in an organization (Ross 1986; 1987); and (6) reward, which means the allocation of specific incentives to motivate individuals to engage in entrepreneurial and innovative behavior (Miller and Friesen, 1982). Thus, the proposed model of this research is as shown in Figure 1. (Insert Figure 1 here) Company growth represents the growth in the company’s assets, sales, and number of employees (Delmar, 1997). In theory, the increase in sales over time may reflect the ability of the company to capture an increase in the market demands, or it can be due to improvement in quality of products, processes or methods of production (Delmar, 1997). In the literature there is little conclusive evidence available to support the belief that there is strong relationship between CE and firm growth (Delmar, 1997). This may be attributed to the fact that most of CE studies examined CE at the company level alone, where as this study examined CE at company level as well as the individual level. Thus, our first hypothesis is formulated as follows: H1: There is a relationship between CE and company growth. The external environment is identified as the set of forces surrounding an organization that have potentials to affect the way it operates and access the scarce resources (Jones, 1998). This study adopts a construct that encompasses general and October 13-14, 2007 Rome, Italy 7 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 specific environmental factors, i.e., environmental hostility. Environmental hostility implies the environmental pressure caused by changes in the market place, the industry, the competition in product quality, price and consumer taste. The importance of the environment to an entrepreneurial firm’s performance has been documented extensively in the literature (Zahra, 1993b; Zahra and Covin, 1995; Covin and Slevin, 1989). What is missing in the literature is the moderating effect of environmental hostility on CE-firm growth and CE-job satisfaction relationships (Tsai, MacMillan and Low, 1991; Zahra, 1993b; Zahra and Covin, 1995; Covin and Slevin, 1989). This relationship is examined in our second hypotheses: H2: There is a relationship between CE and company growth in a hostile business environment. METHODOLOGY The population of the study is the construction industry in Malaysia. In the past, only a few studies have been published using data from non-US companies (Zahra, Jennings and Kuratko, 1999). Moreover, the trend in the published research on CE is the predominance of data collected from the manufacturing sector 85% (Zahra, Jennings and Kuratko, 1999). The selection of the construction firms was based on the growing competition among construction companies in Malaysia where 86% (see Table 2) of the respondents of this research agreed that there is stiff competition in this business sector where their existence, survival and growth depend on their competitiveness, industriousness, and entrepreneurial orientation (Brazeal, 1993; Zahra, and Covin, 1995) in addition to the fact that the construction sector is one of October 13-14, 2007 Rome, Italy 8 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 the leading economic sectors of the Malaysian economy. Thus, the environment of the Malaysian construction section could be considered as hostile. [Insert Table 2 here] Primary data on CE elements as well as on environmental hostility were collected using questionnaires addressed to top or senior management of the firms. The selection of the respondents with position titles such as chief executive officer (CEO), general manager, senior executive and manager is attributed to the assumptions that (1) leaders have a prominent role in company growth in Asian companies (Petzall and Kim, 1996) and these executives may have some unique opportunities for innovation in their firm (Brazeal, 1993; 1996; Zahra and Covin, 1995); (2) they are the best to tell about the entrepreneurial orientation of their firm and its inter-workings; (3) top or senior level executives are more likely to complete the questionnaire (Brazeal, 1993; 1996). On the other hand, a one-level selection of subjects, i.e. the top or senior executive level is followed because it has a better control of personal variations arising from work exposure, experience, and education (Brazeal, 1993; 1996). Data on company growth were collected from the Kuala Lumpur Stock Exchange (KLSE) Market Handbooks. The SPSS software package was used to analyze CE and firm performance relationships. To test the identified hypotheses moderated multivariate regression analysis (MMRA) was utilized. October 13-14, 2007 Rome, Italy 9 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 A total of 150 questionnaires were mailed to the KLSE companies in Malaysia where we asked them to reply within 15 days. The first response was very low, i.e., only five companies responded, after which a second set of questionnaires were mailed and were followed by phone calls and a letter to those who did not respond to the first mailing. In total, 55 companies replied out of which only 45 of them were useful, thus giving us a 30% response rate. This rate is statistically sufficient to give a reliable estimation of the population parameters (Hair, Anderson, Tatham, and Black, 1998; Cooper and Emory, 1995). This rate is similar to those reported in this field of research (Miller and Friesen, 1982; Zahara and Covin, 1995). The respondents came from most of the Malaysian States, of which 70% were from around the Federal Capital (Selangor and Kuala Lumpur) while the rest came from Sabah, Sarawak, Johor, Penang, Kedah, Perak, Melaka, and Terengganu. The CE measure in the questionnaire is represented by eleven variables which explain different aspects of CE at two levels: seven variables at company level and four variables at employee level. The questionnaire also covers environmental hostility. Data pertaining to the dependent variable (company growth) were collected from financial reports of the selected companies listed in KLSE Market reports. A pilot study was first conducted to refine the measurement instrument after which the questionnaires were mailed to the subjects together with an explanation for conducting the research in order to enhance, clarify and facilitate the data collection process. This study used parametric measurement scale because the samples were selected from a normally distributed population and the primary findings showed a linear relationship between the independent and dependent variables (Cooper and October 13-14, 2007 Rome, Italy 10 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Emory, 1995). The dependent variable (company growth) was regressed with the independent variables (the CE index) within a hostile business environment. This is a cross-sectional study which attempts to explain the impact of CE on company growth at specific point in time. If the regression equations of the CE on company growth and CE relationship in a hostile business environment were found to be significant, this would support the relationship between CE and company growth. That is to say, this relationship was examined under the moderating factor of environmental hostility, implying that the CE-company growth relationship could explain the outcome of this relationship within a hostile business environment. Measurement Instrument We developed the CE measurement instrument based on previous scales developed by Khandwala (1977), Miller and Friesen's (1982) CE index, Ross’s (1987) Intrapreneurial Performance Quotient (IPQ) and Pinchot’s freedom factors. The CE measurement was modified to measure the CE at two levels (business and individual) inside a business organization by utilizing 52 items grouped into eleven variables. As for the dependent variable, Delmar’s (1997) instrument was adopted to measure company growth, which covers average annual growth rates of sales, assets and number of employees. The company growth measure is calculated as follows: Assets growth = (This year’s assets - last year’s assets)/ Last years assets Sales growth = (This year’s sale - last year’s sales)/ Last years sales Employees' growth = (This yr's no. of employees – Last yr's no. of employees)/Last yr's no. of employees October 13-14, 2007 Rome, Italy 11 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 The CE measure has been widely used in past research (Khandwala 1977; Miller and Friesen, 1982; Zahra, 1991; Md-Noor, 1991; Zahra and Covin, 1995) because of its reliability and validity. This measure follows six point Likert-type scale ranging from 1= highly disagree to 6= highly agree. Scores on the items were averaged to produce the overall CE index. A low score on the index shows low involvement in CE activities and vice versa. The respondents were asked to give their perception about the presence of CE in their companies and their contribition to it. They were also assured confidentiality of the data gathered. The CE index of this study, surpassed minimum internal consistency requirements as measured by alpha coefficient of 0.885. Scale Reliability Cronbach’s alpha scores were computed for each construct (CE, environmental hostility and company growth) to measure the internal consistency and to indicate how different items can realibly measure the construct. The values of the Cronbach’s alpha range from zero (no internal consistency) to one (perfect internal consistency). The scale is sufficiently reliable if Cronbach’s alpha is greater than 0.80 and is most likely reliable for values greater than 0.70 (Cronbach, 1951). In this research, the Cronbach’s alpha obtained was 0.96 for overall CE scale and the estimates for company growth and environmental hostility scales were 0.87 and 0.75, respectively. Research conducted by Zahra and Covin (1995) found the internal consistency level of CE to be 0.75. Thus, the scales used in this research could be considered as reliable. October 13-14, 2007 Rome, Italy 12 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 ANALYSIS AND RESULTS To test the hypotheses the analysis was conducted in two steps: (1) Testing the effect of CE on company growth and the CE relationship with company growth which is moderated by environmental hostility. The regression model used for the analysis is as follows: Comp. Growth = a+b1 conovate + b2 cotonomy +b3 coproact + b4 mgtsupport+ b5 corisk+b6 orgstruct + b7 reward+ b8 mynovate+ b9 myfreedom+ b10 myrisk + b11 myproact The independent variable, CE, is on the right hand side of the equation and is represented by eleven independent variables. The intercept “a” is the level of company growth that is attributed to activities other than CE and bi is the coefficient or the slope of the independent variables. (2) To test the effect of the moderating variable (the environmental hostility) on CEperformance relationship we added the interaction factor as follows: Comp. Growth = a+b1 conovate + b2 cotonomy +b3 coproact + b4 mgtsupport+ b5 corisk+b6 orgstruct + b7 reward+ b8 mynovate+ b9 myfreedom+ b10 myrisk + b11 myproact + b12 EH+ b13 EH X CE To test the hypotheses of this study we utilized sequential search approach and backward elimination. The adoption of the sequential regression analysis is due to the October 13-14, 2007 Rome, Italy 13 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 fact that most of the previous researches on CE test the relationship at the aggregate CE level, i.e., by taking the average of the three CE variables at organizational level (innovation, risk taking and proactive attitude). As mentioned earlier, this study examined CE-company growth relationship at the organizational and individual levels. Therefore, since CE is present at a relatively early stage of a firm's growth, there is a need to identify the factors that support the presence of CE which then influence performance. For each hypothesis, this approach allows us to first regress CE against company growth (H1), and then to regress it against company growth in a hostile business environment (H2). Table 3 shows the results of the regression analysis that examined the relationship between CE and company growth. The finding indicates that the independent variables explain 72.4% of the variances in company growth. This indicates that the influence of CE on company growth is highly significant (p<0.001). Thus, the data provides strong support for the first H1, i.e., CE is significantly associated with company growth. Thus, the results of this study support the theoretical and empirical research findings on CE by Brazeal (1993), Zahra (1993a,b), Zahra and Gravis (2000), and Zahra and Covin (1995). The point of difference is that the CE variables in this study show higher explanatory power (72.4%) compared to theirs which showed R2 to be below 30% (Brazeal, 1993; Zahra, 1993a, 1993b; Zahra and Gravis, 2000; and Zahra and Covin, 1995). Furthermore, the regression coefficients for two independent variables of CE at the company level, i.e., being proactive (p<0.003) and being willing to take risk (p<0.001) are positively associated with company growth. The results indicate that the increase in management efforts at being proactive via the introduction of new products, new services, and new methods of October 13-14, 2007 Rome, Italy 14 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 production even if the outcome is uncertain, i.e., being willingness to take risk, might improve company growth. These findings are in line with previous studies that examine the relationship between CE and performance, where Zahra and Gravis (2000), Zahra (1993a, 1993b), and Zahra (1991) in their cross-sectional studies found positive relationships between the influence of CE on firm’s gross profit growth and sales growth. Also, in a longitudinal study, Zahra and Covin (1995) found positive relationship between CE and company profitability and sales growth. [Insert Table 3 here] Nevertheless, the regression coefficients for company's desire for autonomy (p<0.001), company structure (p<0.002) and employees’ desire for freedom (p<0.012) were negatively associated with company growth. Perhaps, this negative association could be due to the fact that, among the entrepreneurial firms, resources were depleted by too much expenditures on new designs and new products in the short run (crosssectional) in order to meet the increasing desire for autonomy, freedom and entrepreneurial practices (Miller and Friesen, 1982). Furthermore, the coefficient of entrepreneurial employee’s desire for autonomy and flexibility displays a negative sign which indicates that those who are entrepreneurially inclined have greater desire for freedom which is consistent with previous findings (e.g., Koh, 1996). The result of this study extended the literature further by showing that companies in a developing country environment could benefit from growth when pursuing CE. This finding is consistent with the studies conducted by Khandwalla (1984; 1985), Knight (1997) and Kuratko, Montagno, and Hornsby et. al (1990), and October 13-14, 2007 Rome, Italy 15 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Hornsby et al. (1993) who found that the emergence of entrepreneurship inside business organizations requires a risk taking attitude and proactive managerial support. Khandwalla (1984; 1985) found that top management’s commitment to CE is associated with innovation and industriousness of the companies. Kuratko et al.’s (1990) factors analysis found that management support for entrepreneurial attitude, autonomy, reward and organization boundaries are the factors that contribute to CE. Also, Schollhammer (1982) suggests that CE is important for gaining financial advantage and rewards. In addition, Covin and Slevin’s (1993) argue that the adoption of CE would improve financial performance while Zahra and Covin’s (1995) longitudinal non-linear empirical study found that CE improves companies’ profitability over time. Table 4 presents the results of the regression analysis which shows that the independent variables explain 80.3% of the variances in company growth within a hostile business environment. In other words, the influence of CE on company growth within a hostile business environment is significant at p< 0.001. As can be seen from Table 4, after the environmental hostility variable was added to the equation there is a significant change in the explanatory power or the F value and as such, the introduction of the interaction variable into the equation has produced a meaningful result. In other words, the introduction of this interaction effect changed the form of the relationship between the independent variables. As a result, the independent variables accounted for 80.3% of the variances in company growth within a hostile business environment compared to 72.4% before the moderating variable was introduced. Moreover, the level of significance of the relationship (the F value) improved from 8.9 to 10.62. Thus, the interaction variable is a true moderator since it October 13-14, 2007 Rome, Italy 16 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 changed the form of the relationship and the influence of the independent variables resulting in an improvement in the power of the multiple regression analysis (Aguinis, 2002; Sharma et. al., 1981). This means the data provided support for H2; i.e., CE is significantly associated with company growth in a hostile business environment. [Insert Table 4 here] From the regression coefficients for CE at the company level shown in Table 4, we can see that the variables proactive and risk-taking attitudes of the firms display significant positive relationships with company growth in a hostile business environment (at p<0.003 and p< 0.01, respectively). Interestingly, certain individual and organizational factors including a company's desire for autonomy (significant at p<0.001), an individual's desire for freedom (significant at p<0.007) and organizational structure (significant at p<0.001) turned out to be negatively related to company growth in a hostile business environment. Thus, in the short run, increasing the desire for organizational autonomy and individual freedom and changing the organization structure of the firms might have a negative impact on their performance (Abraham, 2000). The results indicate that the association between CE and company growth is contingent upon perceived competition, market change and environmental hostility, which is consistent with previous findings (Covin and Slevin, 1989; Zahra and Covin, 1995). October 13-14, 2007 Rome, Italy 17 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 The main finding from H2 is the presence of strong, positive and significant relationship between CE [represented by company's proactive ability (p<0.003) and its tendency to take risk (p<0.01) in a hostile business environment] and corporate growth. This implies that an ability of a firm to be proactive and to be a risk-taker may improve its financial performance under competitive pressure and changing market environment. THEORETICAL AND PRACTICAL IMPLICATIONS A few theoretical implications could be drawn this this research. Firstly, the findings support the belief that companies that engage in CE activities can realize important financial benefits from their entrepreneurial practices. The negative association between CE variables and performance measure could perhaps be due to the fact that, among the entrepreneurial firms, their resources were depleted by too much expenditures on new designs and new product introductions in the short run, which is consistent with Miller and Friesen’s (1982) findings. On the other hand, Jaworski and Kohli (1993) found no moderating effect from higher market turbulence, higher competitive intensity, or higher technological turbulence while Slater and Narver (1994) found little support for the degree of competitor hostility as a moderator of the marketing orientation-performance relationship. Greenley (1995), on the other hand, reported that marketing orientation had a positive effect on performance. The presence of different results necessitates the need for more research to improve the theoretical development of the area. Secondly, the results show that even when the market environment is considered hostile, entrepreneurial efforts can enhance the growth and profitability of a firm. These findings should be tempered with caution because there is a risk that the financial payoff from excessive CE activities in this environment may October 13-14, 2007 Rome, Italy 18 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 decline. Finally, this study broadens the factors that influence organizational performance in an attempt to contribute and to organize the large body of academic literature on CE. The principal challenge to management researchers is to identify the entrepreneurial processes that lead to various forms of CE, and then to theoretically predict and empirically verify the forms of this phenomenon that produce the best results for firms in various business and industry contexts. Admittedly, this is a tough challenge. A number of practical or managerial implications could also be derived from this study. Firstly, it appeared that CE is an important element for corporate growth. Therefore, managers of companies should seriously consider adopting CE as an effective tool for enhancing creation of a long-term favorable work environment which could improve their firms' performance. Secondly, given the growing importance of CE in today's businessess there is a practical value for managers in being able to identify entrepreneurial practices of their employees so that they can distinguish those who are entrepreneurially inclined from those who are not. Lastly, the management of business organizations who adopts entrepreneurial programs should provide an environment that facilitates and supports their employees to be innovative and creative. Otherwise, it will be very difficult for CE to occur. CONCLUSION Most of the studies addressing CE issues focussed on theory building rather than testing theories empirically. The limited studies that were carried out to examine the CE-company growth relationships provide inconclusive empirical evidences. Given the absence of empirical and systematic scholarly work from which to draw October 13-14, 2007 Rome, Italy 19 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 conclusions, little is known about the CE factors that can influence company performance. Therefore, this study is an attempt to fill the void in the literature, by examining more entrepreneurial factors within business organizations at more than just one level, and also by examining environmental hostility as a moderating variable. The results show that CE is strongly associated with company growth which corroborate prior theoretical and empirical CE studies that have documented the presence of a relationship between CE-company growth (Zahra and Covin, 1995; Brazeal 1993; Zahra, 1993a and 1993b; Zahra and Gravis, 2000; Zahra and Covin, 1995; Richard and John, 1997; Khandwalla, 1984; 1985, Knight, 1997; and Kuratko, Montagno, and Hornsby, 1990). However, this research extends prior knowledge by empirically demonstrating that CE exists at more than just one level within business organizations and that CE influences the performance of business organizations significantly. Also, the environment in which entrepreneurial activities are practiced have strong impact on company performance. Finally, changes in the market in terms of prices, rules, regulations and emergence of new competitors have a strong and significant influence on firms' financial performance. There are a few limitations to this research which need to be mentioned. Firstly, it should be noted that having small number of respondents (45 subjects out of 150 construction companies) besides our inability to include all the CE factors at different levels of business organizations might be the reason for the lower coefficient of determination we obtained. Additionally, this study focused on two levels of CE in business organizations (corporate and employee levels). Therefore, future researches need to develop comprehensive predictors of the influence of CE inside business October 13-14, 2007 Rome, Italy 20 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 organizations, including at multiple levels and dimensions, using not just quantitative analysis but qualitative as well. REFERENCES Aguinis, H. "Estimating moderating effects using multiple regression." Invited address sponsored by the Research Methods Division and delivered at the meeting of the Academy of Management, Denver, CO. August 2002. http://carbon.cudenver.edu/~haguinis/conf.html. Abraham, R.R. "Organizational cynicism; bases and consequences." Genetics, Social & General Psychology Monographs, August 2000, Vol.126, Issue 3, 2000. Attahir, Y. "International notes; critical success factors for small business: perception of South Pacific entrepreneurs." Journal of Small Business and Management, April 1995, vol. 33, no. 2, pp. 68-73, 1995. Brazeal, D.V. "Organizing for internally developed corporate ventures." Journal of Business venturing, vol. 8, no. 4, pp. 75-90, 1993. _____________. "Managing an entrepreneurial organizational environment." Journal of Business Research, vol. 35, pp. 55-67, 1996. Burgelman, R.A. "A model of the interaction of strategic behavior, corporate context, and the concept of strategy." Academy of Management Review, 8(1), 61-70, 1983a. _____________. "Corporate entrepreneurship and strategic management: Insights from a process study." Management Science, vol. 29, no, 12, pp. 1349-1363, 1983b. _____________. "A process model of internal corporate venturing in the diversified major firm." Administrative Science Quarterly, vol. 28, no. 2, pp. 223-244, 1983c. Cooper, D.R. and Emory, C.W. Business research methods, 5th edition, Chicago: IRWIN, 1995. Covin, J.G. and Slevin, D.P. "The development and testing of organizational-level entrepreneurship", in R., Ronstadt, R Peterson and K. H., Vesper, eds., Frontiers of Entrepreneurship Research, Wellesly, MA; Babson College, 1986. ____________________________. "Corporate entrepreneurship and performance." Strategic Management Journal,10, 75-87, 1989. October 13-14, 2007 Rome, Italy 21 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 ____________________________. "A response to Zahra's critique and extension of Covin-Slevin entrepreneurship model." Entrepreneurship Theory and Practice, (ET & P) vol. 17, no. 4, pp. 23-28, 1993. ____________________________. "A conceptual model of entrepreneurship as a firm behavior." Entrepreneurship Theory and Practice, vol. 16, no. 1, pp. 25-36, 1991. Chung, H.L. and Gibbons, T.P. "Corporate entrepreneurship: The roles of ideology and social capital." Group & Organization Management, vol. 22, no. 1, pp. 1030, 1997. Chang, J. "Model of corporate entrepreneurship: Intrapreneurship and exopreneurship." Allied academies international internet conference proceedings, vol. 1, pp. 7-37, 1998. http://www. alliedacademies.org/pdf/internet/paai-1.pdf, 6/12/1998. Cronbach, L.J. "Coefficient Alpha and the Internal Structure of Tests." Psychometrika, pp. 297-334, 1951. Delmar, F. "Measuring growth: methodological considerations and empirical results," in Donckels Rik and Mietinen Asko, eds., Entrepreneurship and SME Search: on its Way to the next Millenium. USA, Sydney and Singapore: Ashgate Publishing Ltd., pp. 199-216, 1997. Drucker, P. Entrepreneurship and innovation; practice and principles. London: William Heinemann, 1985. Gibb, A.A. "Enterprise culture its meaning and implication for education and training." Journal of European Industrial Training, vol.11, no. 2, pp.20-29, 1987. Greenley, G.E. 1995. Market Orientation and Company Performance: Empirical Evidence from UK Companies. British Journal of Management, vol. 6, no. 1, pp. 1-13, 1995. Guth, W. and Ginsberg, A. "Guest editor's introduction: corporate entrepreneurship." Strategic Management Journa,. Vol. 11, no. 13, pp. 5-13, 1990. Hair, J.R., Jr., R.E. Anderson, Tatham, R.L. and Black, W.C. Multivariate data analysis 5th ed. New Jersey: Prentice Hall, 1998. Hornsby, R.D., Montagno, R.V. and Kuratko, F. "A study of factors in corporate entrepreneurship." Proceedings of the United States Association of Small Business and Entrepreneurship, pp. 239-244, 1990. ____________, Naffziger, D.W., Kuratko, D.F., and Montagno, R.V. 1993. An integrative model of corporate entrepreneurship process. Entrepreneurship Theory and Practice, Winter, pp. 29-37, 1993. October 13-14, 2007 Rome, Italy 22 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Hussin, H. "Personal values and identity structures of entrepreneurs of Malay and Chinese entrepreneurs in Malaysia." UK: Cranfield University, School of Management; Unpublished Ph.D. Thesis, 1995. ________. "Personal values and identity structures of entrepreneurs: a comparative study of Malay and Chinese entrepreneurs in Malaysia." In Donckels Rik and Mietinen Asko, eds., Entrepreneurship and SME research: on its way to the next Millenium. USA and Singapore: Ashgate Publishing Ltd. pp. 33-46, 1997. Jaworski, B.J. and Kohli, A.K. "Market Orientation: Antecedents and Consequence." Journal of Marketing, vol. 57, July, pp. 53-70, 1993. Jennings, D.F. and Lumpkin, J.R. "Functioning modeling corporate entrepreneurship: An empirical integrative analysis." Journal of Management, vol. 15, no. 3, pp. 485-502, 1989. Jones, R.G. Organizational theory: text and cases. Massachusetts: Addison-Wesley Publishing Company, 1998. Kuala Lumpur Stock Exchange Market, Kuala Lumpur Stock Exchange Market Handbook, vol. 22, no. 2, October-December, Malaysia: KLSE, 1996. ________________________________, Kuala Lumpur Stock Exchange Market Handbook, vol. 22, no. 3, Malaysia: KLSE, 1997. ________________________________, Kuala Lumpur Stock Exchange Market Handbook, vol. 22, no. 2, January-April, Malaysia: KLSE, 1997. ________________________________, Kuala Lumpur Stock Exchange Market Handbook, vol. 22, no. 4, May-June, Malaysia: KLSE, 1997. Kao, J.J. Entrepreneurship, Creativity & Organization Text; Cases and Readings. New Jersey: Prentice Hall, pp. 45-55, 1989. Khandwalla, P.N. "The Techno-economic ecology of corporate strategy." Journal of Management Studies, vol. 13, n. 1, pp. 62-75, 1977. ______________. "PI management." International Studies of Management and Organization, Vol. XIV, no. 2-3, pp. 99-132, 1984. ______________. "Pioneering innovative management." Organization Studies, vol. 6, no. 2, pp. 161- 183, 1985. Knight, G.A. "Cross-cultural reliability and validity of a scale to measure firm entrepreneurial orientation." Journal of Business Venturing, vol. 12, no. 3, pp. 213-225, 1977. October 13-14, 2007 Rome, Italy 23 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Koh, K.C. "Testing hypothesis of entrepreneurial characteristics; A study of Hong Kong MBA students." Journal of Managerial Psychology, vol. 11, no. 3. pp. 1225, 1996. Kuratko, D.F., Montango, R.V. and Hornsby, J.S. "Developing intrapreneurial assessment instrument for an effective corporate entrepreneurial environment." Strategic Management Journal, vol. 11, pp. 49-58, 1990. ____________ and Welsch, H.P. Entrepreneurial Strategy: Texts and cases. New York, The Dryden Press, pp.368-390, 1994. Md-Nor, M. "A study on American and Malaysian intrapreneurs: their differences in intrapreneurial personality, style and climate." Nova University: unpublished Dissertation of Doctorate in Business Administration, 1991. Miller, D. and Friesen, P.H. "Innovation in conservative and entrepreneurial firms: two models of strategic momentum." Strategic Management Journal, vol. 3, no. 1, pp. 1-25, 1982 Morris, M.H., Avila, R.A. and Allen, J.W. "Individualism and the modem corporation: Implications for innovation and entrepreneurship." Journal of Management, vol. 19, no. 3, pp. 595-613, 1993. ____________, Davis, D.L. and Allen, J.W. "Fostering corporate entrepreneurship: cultural comparisons of the importance of individualism versus collectivism." Strategic Management Journal, vol. 25, no. 1, 1st Quarter, pp. 65-89, 1994. Kim, O.T.E. and McIntoch, J.C. "The relevance of American motivation theories to managing in an Asian context: An examination of the cross-cultural transferability of American management to Korea." Journal of International Business & Entrepreneurship, vol. 5, no. 1, pp. 43-60, July, 1997. Pearce, W.J. and Carland, J.W. "Intrapreneurship and innovation in manufacturing firms: an empirical study of performance implications." Academy of Entrepreneurship Journal, vol. 1, no. 2, pp. 1-9, 1995. http://www.alliedacademies.org/archive/aej/aej1-2/paper8.html, December, 1998. Petzall, S. and Kim, T. "Entrepreneurs, Entrepreneurship and Enterprising Culture", Leadership Styles of Singapore Small Business Owner, pp. 15-29, AddisonWesley, Singapore, 1996. Peters, T.J. and Waterman, R.H., Jr., In search of excellence: lesson from America’s best-run companies. New York: Harper and Row, 1982. Pinchot, I.G., Intrapreneuring. New York: Harper and Row, 1985. October 13-14, 2007 Rome, Italy 24 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Ray, D., Kolshorn, R., Itao, A. and Yin, W.S. "Evaluation of CEFE entrepreneurship programs in Asia." Journal of International Business and Entrepreneurship, vol. 4, no. 1, pp. 29-73, July, 1996. Richard, C.B. and John, G.M. "The moderating effect of environmental variables on entrepreneurial and marketing orientation of entrepreneurs-led firms." Entrepreneurship Theory and Practice, .vol. 22, no. 1, pp. 35-47, 1997. Ross, J. "Who is intrapreneur?" Personnel, pp. 45-49, December, 1986. ______, "Intrapreneurship and corporate culture." Industrial Management, vol. 29, pp. 22-26, 1987. ______, "Corporation and entrepreneurs: paradox and opportunity. Business Horizons, July August, vol. 30, pp. 76-81, 1987b. Schendel, D. "Introduction to the special issue on corporate entrepreneurship." Strategic Management Journal, vol. 11, Summer, pp. 1-3, 1990. Schollhammer, H. "Internal corporate entrepreneurship," in C.A. Kent, D.L. Sexton, & K.H. Vesper (Eds.), Encyclopedia of entrepreneurship, pp. 209-229. Englewood Cliffs, NJ: Prentice, 1982. Spann, M.S., Adams, M. and Wortman, M.S. "Entrepreneurship: Definitions, dimensions and dilemmas." Proceedings of the US Association for Small Business and Entrepreneurship, pp. 147-153, 1988. Sharma, P. Toward a reconciliation of the definitional issues in the field of corporate entrepreneurship. Entrepreneurship: Theory & Practice, Spring, vol. 23, no. 3, p.11, 1999. Sharma, S., Durand, R.M. and Gur-Arie, O. "Identification and analysis of moderator variables." Journal of Marketing Research, vol. 18, pp. 291-300, 1981. Siti Maimon, K.W.R. "Characteristics of excellence in companies awarded the excellence award for exports and imports products: An exploratory study," Malaysian Management Review, pp. 11-20, 1991. Slater, S.F. and Narver, J.C. "Does Competitive Environment Moderate the Market Orientation-Performance Relationship?" Journal of Marketing, vol. 58, January, pp. 46-55, 1994. Stevenson, H.H. and Gumbert, D. 1985. The heart of entrepreneurship. Harvard Business Review, 85(2), 85-95. Tsai, W.M.H., MacMillan, I.C. and Low, C. "Effects of strategy and environment on corporate venture success in industrial markets." Journal of Business Venturing, vol. 6, pp. 9-28, 1991 October 13-14, 2007 Rome, Italy 25 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Vesper, K.H. "Three faces of corporate entrepreneurship: a pilot study," in J. Hornaday, F.A. Tarpley, J. Timmons, and K.H. Vesper, eds., Frontiers of Entrepreneurship Research, Wellesley, Mass.: Babson Centre for Entrepreneurship Studies, pp. 294-320, 1984. Zahra, S.A. "A canonical analysis of corporate entrepreneurship: antecedents and impact on performance. Proceedings of National Academy of Management, vol. 46, pp. 71-75, 1986. __________. "Predictions and financial outcomes of corporate entrepreneurship: an explanatory study." Journal of Business Venturing, vol. 6, no. 4, pp. 259-285, 1991. __________."A conceptual model of entrepreneurship as firm behavior: a critique and extension." Entrepreneurship Theory and Practice, vol. 17, no. 4, pp. 5-21, 1993a. __________. "Environment, corporate entrepreneurship, and financial performance: a taxonomic approach." Journal of Business Venturing,. Vol. 8, no. 4, pp. 319340, 1993b. __________."Corporate entrepreneurship and financial performance: the management of leverage buyouts." Journal of Business Venturing, vol. 10, no. 3, pp. 225-247, 1995. __________ and Covin, J.G. "Contextual influences on the corporate entrepreneurship-performance relationship: a longitudinal analysis". Journal of Business Venturing, vol. 10, no. 1, pp. 43-58, 1995. __________, Jennings, D.F. and Kuratko, D.F. "The Antecedents and consequences of firm-level entrepreneurship: The State of the Field," Entrepreneurship Theory and Practice, Winter, vol. 24, no. 2, 1999. __________. and Garvis, G.M. "International corporate entrepreneurship and firm performance and the moderating effect of international environmental hostility." Journal of Business Venturing, vol. 15, no. 5-6, pp. 469-492, 2000. Zain, M.M. "A Field Study of Adoption and Implementations of Innovations by Manufacturing Firms in Malaysia." Unpublished Ph.D. thesis at University of Manchester, Faculty of Business Administration, 1993. _____________. "Competitiveness of Malaysian firms; an investigation into their implementations of continuous improvement." Entrepreneurship, Innovation, and Change, vol. 4, no. 3, pp. 191-207, 1995. _____________ and Rickards, T. "Assessing and comparing the innovativeness and creative climate firms." Scandinavian Journal of Management, vol. 12, no. 2, pp. 109-121, 1996. October 13-14, 2007 Rome, Italy 26 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Figure 1: Proposed model of corporate entrepreneurship Corporate Entrepreneurial Factors: A. ORGANIZATIONAL FACTORS 1. Management support (Kuratko et al., 1990) 2. Structure 3. Autonomy & freedom (Ross 1986; 1987) 4. Innovation 5. Reward System 6. Proactiveness (Miller and Friesen, 1982) 7. Risk taking (Ross, 1987) 1. Company Growth (Delmar, 1997) (sales, assets, and no. of employees B. INDIVIDUAL FACTORS 8. Innovation 9. Need for Autonomy 10. Risk taking 11. Proactivity (Ross, 1986; 1987) Hostility: Market Changes and Competitive Pressures (Miller and Friesen, 1982) October 13-14, 2007 Rome, Italy 27 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Table 1: Definitions of corporate entrepreneurship Author/s & Yr / Definition Burgelman (1983) Corporate entrepreneurship refers to the process whereby the firms engage in diversification through internal development, which requires new resource combinations to extend the firm's activities in areas unrelated, or marginally related, to its current domain of competence and corresponding opportunity set (p. 1349) Chung & Gibbons (1997) Corporate entrepreneurship is an organizational process for transforming individual initiavtive and ideas into actions through the management of uncertainties (p. 14). Covin & Slevin (1991) Corporate entrepreneurship involves extending the firm's domain of competence through internally generated new resource combinations (p. 7). Guth & Ginsberg (1990) Corporate entrepreneurship encompasses two types of phenomena and the processes surrounding them: (1) the birth of new businesses within existing organizations, i.e., internal innovation or venturing; and (2) the transformation of organizations through renewal of the key ideas on which they are built, i.e. strategic renewal (p. 5). Jennings & Lumpkin (1989) Corporate entrepreneurship is defined as the extent to which new products and/or new markets are developed. An organization is entrepreneurial if it develops a higher than average number of new products and enter into new markets (p. 489). Schendel (1990) Corporate entrepreneurship involves the notion of birth of new businesses within ongoing businesses, and the transformation of stagnant, on-going businesses in need of revival or transformation (p. 2). Spann, Adams, & Wortman (1988) Corporate entrepreneurship is the establishment of a separate corporate organization (often in the form of a profit center, strategic business unit, division, or subsidiary) to introduce a new product, serve or create a new market, or utilize a new technology (p. 149). Vesper (1984) Corporate entrepreneurship involves employee initiative from below in the organization to undertake something new. An innovation that is created by subordinates without being asked, expected, or perhaps even given permission by higher management to do so (p. 295). October 13-14, 2007 Rome, Italy 28 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Table 1: Definitions of corporate entrepreneurship (cont’d) Zahra (1993; 1995, 1996) Corporate entrepreneurship is a process of organizational renewal that has two distinct but related dimensions: innovation and venturing, and strategic renewal (p. 321). It is the the sum of a company’s innovation, renewal, and venturing efforts. Innovation involves creating and introducing products, production processes, and organizational systems. Renewal means revitalizing the company's operations by changing the scope of its business, its competitive approaches or both. It also means building or acquiring new capabilities and then creatively leveraging them to add value for shareholders. Venturing means that the firm will enter new businesses by expanding operations in existing or new markets (1995, p. 227; 1996, p. 1715). Source: Modified and adopted from Sharma, Pramodita (1999), Toward a reconciliation of the definitional issues in the field of corporate entrepreneurship. Entrepreneurship: Theory & Practice, Spring 99, Vol. 23 Issue 3, p11. October 13-14, 2007 Rome, Italy 29 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Table 2 Frequency of responses to corporate entrepreneurship and environmental hostility Disagree Agree Disagree moderatel Disagree Agree moderatel Agree Item very much y slightly slightly y very much Innovation 0% 0% 2% 58% 34% 6% Co autonomy 1% 4% 12% 44% 34% 4% Co proactive 2% 0% 12% 36% 24% 26% Mgt Support 0% 2% 10% 28% 46% 14% Co Risk 6% 8% 10% 28% 26% 22% Org Structure 0% 0% 4% 18% 38% 40% Reward 6% 4% 4% 16% 36% 34% CE at Company level 2% 3% 8% 33% 34% 21% Individual Innovation 0% 0% 0% 12% 48% 40% Desire for autonomy 0% 0% 0% 4% 66% 30% Individual Risk 10% 2% 10% 42% 24% 12% Individual Proactive 0% 0% 6% 30% 34% 30% CE at Individual Level 3% 1% 4% 22% 43% 28% Overall CE 2% 2% 6% 27% 39% 24% Environment Hostility 2% 2% 10% 54% 24% 8% October 13-14, 2007 Rome, Italy 30 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Table 3: Corporate entrepreneurship and company growth (result of regression analysis) Method of the Linear Models Model 1 Backward Regression Variables Coef f. Constant Cotonomy Coproact Corisk Orgstruct Myfreedo m 2.279 -.284 .219 .164 -.228 -.250 t-Test 4.922 -4.859 3.414 4.405 -3.718 -2.796 Partial Regressio p-Value R2 Correlatio n Symbol n x0 0.001 0.724 -.763 x1 0.001 .638 x2 0.003 .730 x3 0.001 -.670 x4 0.002 -.561 x5 0.012 The Model gives the following equation: Y = 2.279-0.284*x1 + 0.219*x2 + 0.164*x3 –0.228 x4-0.250 x5 F overall = p-value = 8.936 0.001 Where Y is company growth p value is the level of significance October 13-14, 2007 Rome, Italy 31 (R2 = 0.724) 7th Global Conference on Business & Economics ISBN : 978-0-9742114-9-7 Table 4: Corporate entrepreneurship and company growth within a hostile environment (result of regression analysis) Method of Variables the Linear Test Models Model 2 Backward Regression Coeff . Constant 2.408 Cotonomy -0.292 Coproct 0.251 Corisk 0.137 Orgstruct -0.232 Myfreedom -0.272 t-test Partial Correlatio n 5.821 -5.643 -.830 4.282 .706 4.141 .638 -4.284 -.752 -3.396 -.660 Regressio p-Value R2 n Symbol x0 x1 x2 x3 x4 x5 0.001 0.001 0.003 0.010 0.001 0.007 The Model gives the following equation: Y = 2.408-.292*x1 + 0.251*x2 + 0.137*x3 - 0.232* x4 - 0.272* x5 F overall = 10.615 p value = 0.001 Where Y is employees’ satisfaction about their work condition p value is the level of significance October 13-14, 2007 Rome, Italy 32 (R2 = 0.803) 0.80 3