– Challenging the Financial Crisis Commission The Unpreventable Crisis By Christoph Meyer

advertisement

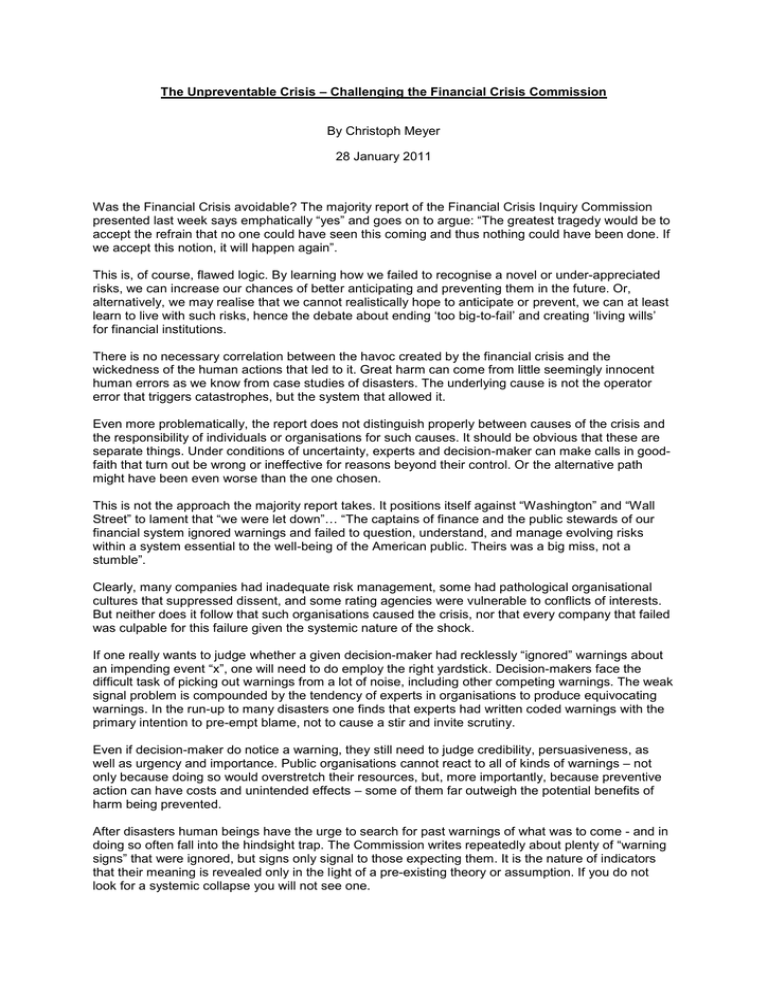

The Unpreventable Crisis – Challenging the Financial Crisis Commission By Christoph Meyer 28 January 2011 Was the Financial Crisis avoidable? The majority report of the Financial Crisis Inquiry Commission presented last week says emphatically “yes” and goes on to argue: “The greatest tragedy would be to accept the refrain that no one could have seen this coming and thus nothing could have been done. If we accept this notion, it will happen again”. This is, of course, flawed logic. By learning how we failed to recognise a novel or under-appreciated risks, we can increase our chances of better anticipating and preventing them in the future. Or, alternatively, we may realise that we cannot realistically hope to anticipate or prevent, we can at least learn to live with such risks, hence the debate about ending ‘too big-to-fail’ and creating ‘living wills’ for financial institutions. There is no necessary correlation between the havoc created by the financial crisis and the wickedness of the human actions that led to it. Great harm can come from little seemingly innocent human errors as we know from case studies of disasters. The underlying cause is not the operator error that triggers catastrophes, but the system that allowed it. Even more problematically, the report does not distinguish properly between causes of the crisis and the responsibility of individuals or organisations for such causes. It should be obvious that these are separate things. Under conditions of uncertainty, experts and decision-maker can make calls in goodfaith that turn out be wrong or ineffective for reasons beyond their control. Or the alternative path might have been even worse than the one chosen. This is not the approach the majority report takes. It positions itself against “Washington” and “Wall Street” to lament that “we were let down”… “The captains of finance and the public stewards of our financial system ignored warnings and failed to question, understand, and manage evolving risks within a system essential to the well-being of the American public. Theirs was a big miss, not a stumble”. Clearly, many companies had inadequate risk management, some had pathological organisational cultures that suppressed dissent, and some rating agencies were vulnerable to conflicts of interests. But neither does it follow that such organisations caused the crisis, nor that every company that failed was culpable for this failure given the systemic nature of the shock. If one really wants to judge whether a given decision-maker had recklessly “ignored” warnings about an impending event “x”, one will need to do employ the right yardstick. Decision-makers face the difficult task of picking out warnings from a lot of noise, including other competing warnings. The weak signal problem is compounded by the tendency of experts in organisations to produce equivocating warnings. In the run-up to many disasters one finds that experts had written coded warnings with the primary intention to pre-empt blame, not to cause a stir and invite scrutiny. Even if decision-maker do notice a warning, they still need to judge credibility, persuasiveness, as well as urgency and importance. Public organisations cannot react to all of kinds of warnings – not only because doing so would overstretch their resources, but, more importantly, because preventive action can have costs and unintended effects – some of them far outweigh the potential benefits of harm being prevented. After disasters human beings have the urge to search for past warnings of what was to come - and in doing so often fall into the hindsight trap. The Commission writes repeatedly about plenty of “warning signs” that were ignored, but signs only signal to those expecting them. It is the nature of indicators that their meaning is revealed only in the light of a pre-existing theory or assumption. If you do not look for a systemic collapse you will not see one. In the case of the financial crisis we know today of relatively few credible warnings such as those by the Chief Economist of the IMF, Raghu Rajan. Given the sheer noise of market chatter, the reality is that there were virtually no early warnings that were at least roughly right about the crisis as it actually unfolded. While a few people made a huge profit from their bets on a massive fall, most knowledgeable and prudent investors did not. Risks of default and contagion were not properly assessed by those with the mandate and the incentive to do so. Private investors assumed that major investment banks would always be bailed out as happened with Bear Sterns. Central Bankers thought that private investors would not allow such large risks to build up in institutions they own. And everyone assumed that risks were diversified when in fact they were becoming concentrated. Rather than judging the actions of politicians and regulators by the information they had at the time and placing their responsibility for causes into its proper context, the majority opinion paints the picture of the crisis being “the result of human mistakes, misjudgments, and misdeeds that resulted in systemic failures”. To be fair, all public inquiries struggle when faced with a public clamouring for shaming as the effects of the crisis are still felt. But some succeed nevertheless such as the 9/11 Commission. Perhaps the best lesson to be drawn from the financial crisis as well as from this report is to “beware your assumptions”. Christoph Meyer is Director of the Foresight Project at King’s College London. He is editor of Warning, Forecasting and Preventing Transnational Risks (Palgrave, with Chiara de Franco)