Increasing share of non-participating business in India – systemic risks associated with it

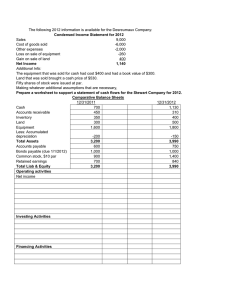

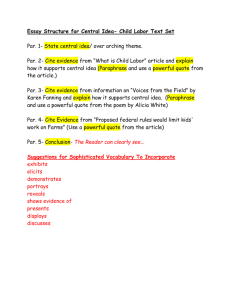

advertisement

Increasing share of non-participating business in India – systemic risks associated with it Archana Anoor, Rahul Khandelwal and Rutika Kumar Guide: Philip Jackson Agenda • Introduction • Life insurance business evolution in India – changes in business mix • Systemic risk – – – – Definition & triggers Macro-level Insurance business (non-par, in particular) Mitigation Measures History of Par and Non- Par in India 12.0 7000 10 yr Gsec Yield Vs Sensex 11.0 6000 10.0 Yield • LIC - Operating as monopoly after nationalization in 1956 • Products sold – Mostly Par 5000 9.0 4000 8.0 3000 7.0 2000 6.0 10 Year Yield 5.0 Sensex 1000 4.0 0 2000 2001 2002 2003 From 2000 to 2004 • Privatization of the sector in 2000 • Products Sold – Similar to LIC and mostly par endowment • Issues on Par portfolio - Sharp dip in interest rates in 2000 to 2004 • IRDA Distribution of Surplus Regulation (2002) - ‘90:10’ gate • Alternatives – Non-linked non par (until 2003-2004 ~ 20%) Sources: IRDA Journal, BSE Sensex website, RBI website, Research Report of Miliman 2004 Sensex Pre 2000 10 Year Yield 2004 From 2007 to 2010 2005 16000 14000 12000 10000 8000 6000 4000 2000 0 Sensex 2006 2007 10 yr Gsec Yield Vs Sensex 12.0 25000 11.0 20000 10.0 Yield • Private Sector - ULIPs (by 2010 NB ~ 80%) and non-linked non par continued • LIC – ULIPs ( ~ 60% in 2007 – 08) and Par continued • Stock market crashed and sharp reductions in interest rates in 2008 – impact on par portfolio again • Non par guaranteed products became more attractive 10 yr Gsec Yield Vs Sensex 12.0 11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 9.0 15000 8.0 10000 7.0 6.0 10 Year Yield 5.0 Sensex 5000 4.0 0 2007 Sources: IRDA Journal, BSE Sensex website, RBI website, Research Report of Miliman 2008 2009 2010 Sensex • ULIPs (non par) were introduced • Rising level of stock market – Sensex Doubled (6K to 12K) • Products Sold – Par mostly by LIC, Non Par (mostly by private players) Yield From 2005 to 2007 Sensex History of Par and Non- Par in India History of Par and Non- Par in India From 2011 to 2012 • Flat market – both equity and bond market • Decrease in ULIPs and increase in trad par and non par business • Reduced distributor compensation in ULIP – Product Regulations 2010 • Negative impact on consumer demand – sharp drop in stock market in 2008 • Mis-selling issues on ULIPs emerged aggressively - 100% allocation charge product and highest NAV products • More guarantees are offered on non par to attract customers(G-sec linked prod) • NB of around 80% in traditional par and non par in 2011-12 NB Premium 12.0 11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 25000 100% 20000 80% 15000 60% 10000 5000 0 2011 2012 10 Year Yield Sensex Sources: IRDA Segment wise data, BSE Sensex website, RBI website Sensex Yield 10 yr Gsec Yield Vs Sensex 40% 20% 0% 2009-10 non par (link) 2010-11 non par (non link) 2011-12 Par History of Par and Non- Par in India Total value of Investments under various funds from 2011 to 2013 • For LIC • ULIP investment reducing – aftermath of stock market shock • Pension and General Annuity & Group Fund increasing – demand of guarantees and annuities • Life Fund steady - attraction of par business continued • For Private Sector • ULIP investment reducing – aftermath of stock market shock • Pension and General Annuity & Group Fund – annuities and group fund • Life Fund increasing speedily - demand of guarantees under non par business Tot Value of Investment under various fund – LIC 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2010 - 11 Sources: IRDA Journal 2011 - 12 2012 - 13 Tot Value of Investment under various fund – Private 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2010 - 11 UL fund 2011 - 12 Pension and GA & GF 2012 - 13 Life Fund History of Par and Non- Par in India From 2013 to Now ULIPs and traditional non par increasing: • Upward trend in sensex – Impacting ULIP sells (since, 2014 Jan the sensex has touched a 33% growth) • Attraction of higher guarantees(GSVs) on non-par – making impact on sales Par business reducing : 12.0 11.0 10.0 9.0 8.0 7.0 6.0 5.0 4.0 30000 10 yr Gsec Yield Vs Sensex 25000 20000 15000 10000 10 Year Yield Sensex 5000 0 2012 2013 Sources: BSE Sensex website, RBI website 2013 2014 Sensex Yield • Enhanced Guarantees – Ensuring 0% customer IRR(@4%) – PRE raised • Enhanced Cost – Complexity/additional governance requirement • Downward mean reverting trend in Gsec yield - started impacting par portfolio • Lower profitability – ’90/10 gate’ Prospective Regulation - ‘0% customer IRR on Par and Illustrated MB of 90% of premiums paid on ULIPs @4%’ • Easier to illustrate for ULIPs - less guarantees than par • More obvious for non par savings contracts (not a reg requirement) • Move towards non-par is expected. Systemic Risk Image source: http://www.gardalundur.is/g/images/stories/domino-effect.jpg Systemic risk Definitions: • • • • Contagion Chain Reaction Collapse or failure of a major part of financial system Domino effect Triggers: • External e.g. contagion fears in non-insurance operations • Internal • Covered in more detail later (sources of systemic risk) Indicators of systemic Risk Conclusions of Geneva association Systemic Risk Working Group FSB/IAIS defined criteria to assess an institution's systemic risk • Size • Substitutability • Interconnectedness • Speed of loss of transmission to other parties - slow pace of claim settlement in insurance industry Application of criteria to main activities of insurers & reinsurers • Investment management • Liability origination • Risk transfer • Capital Management Conclusion : Insurers do not pass systemic relevance test • Limited size means effect of financial markets not disruptive • Slow speed of their impact allows insurers to absorb them e.g, raising capital or orderly wind up •FSB, Features of interconnectedness means contagion risk limited Source: IAIS Do the findings apply to Indian insurance industry? Size: Volume of financial services provided by the individual component of the financial system If LIC is listed it could be the most valuable Indian company at Rs.4.5 – 5 lakh crore (Business Standard, June 2014) If above metrics are aggregated for all insurers the impact will be higher Do the findings apply to Indian insurance industry? (contd) Test for Substitutability • Does the insurer have any technical specifics or play such a unique role in a market that it would be difficult to substitute an equivalent actor in the short-term if the institution were to disappear? • Is the capacity that the institution deploys to its market so large or unique that others could not step in with capacity sufficient to enable the market to clear? Interconnectedness: Only if risk can be transmitted then the institution or its activities present a risk for the system • • • • • Insurers as owners of financial assets Linkage between company and financial system Linkage between insurers and bank Linkage between insurers and reinsurers Insurance companies within complex financial services groups Do the findings apply to Indian insurance industry? (contd) Time • Immediate shock or a slowly ticking bomb? Pace of transmission • Slow pace might increase substitutability for rebuilding capital e.g. slow pace of claim settlement in insurance industry Other factors added by IAIS • How leveraged is an institution and its investments? • Liquidity risk and maturity mismatches • Complexity : Lack of transparency implied by complexity – unclear to regulators, market participants and the company what exposure it has • Global activity Sources of systemic risk – insurance industry Systemic risk – insurance industry Characteristics of insurance industry • Up-front premiums – contribute to stability, insurance industry is self-funding • However, upfront commission, acquisition costs with future profits – make it more vulnerable • Large AUMs (roughly 10% of world’s total financial assets*), expanding industry => net buyers of assets, long term nature, unlike other investors insurers’ assets must have direct relevance to liabilities • Characterisitics of non-par business: • High guarantees (fixed, non-discretionary) • Competitive market (so low premiums) • Therefore, inability to adjust resiliently to shocks * International Financial Services Research, Oct 2009 Systemic risk – insurance industry Investment related: • • • • • • • • • • Buying habits that lead to Concentration risk Insurers primary owners of financial securities Decide on type of securities to buy and when to sell Favour certain type of securities Investment strategies impacted by regulatory restrictions on holding certain assets which best match liabilities Leads to coordinated investment activities by insurers Systemic risk due to coordinated activity: Can inflate bubbles in certain securities or sectors related to those securities Ignite or exacerbate fire sale of assets as soon as their credit rating goes down to avoid regulatory ramifications. This will aggravate further downgrading of assets contributing to their sudden illiquidity Systemic risk – insurance industry Investment related: • Sale of investment oriented products guaranteeing contractuallyspecified investment returns to policyholders • CPPI strategy • ALM risk • Mismatch: Long term guarantees Vs unavailability of long term stocks • Reinvestment risk • Liquidity risk: • Reduced liquidity of certain assets or liquidity crunch in banking operations • long term nature of assets => liquidity lock-in • Mostly planned claims e.g. maturity but policyholders can accelerate this through surrenders => liquidity risk • Policyholder exercise options, change behaviour e.g. large surrenders when market move adversely Systemic risk – insurance industry Investment related (continued): • Severe economic or market downturn • Adverse interest rate movements (low interest rates, high inflation) – affect on guarantees inherent in non-par portfolio, exacerbated if no hedging and priced riskily (i.e. using high yields) • Eventually, one or a combination of above risks could affect insurer’s financial position Systemic risk – insurance industry Underwriting/core insurance related: • Claims are contingent on risk events happening a catastrophe can lead to insurance run- pandemic, terrorist attack • Slow pace might increase substitutability for rebuilding capital e.g. slow pace of claim settlement in insurance industry • no sudden run-off claims paid a slow pace, not paid immediately after a catastrophe therefore, however: • An adverse A/E could potentially lead to running into risk, with high mortality risk in term, longevity risk in annuities • Industry-wide common standards of underwriting: common inadequacy, mis-estimations could be detrimental • Imbalance between pricing & underwriting Policyholder runs • Increase in policyholder withdrawals due to: • Worries about insurer's solvency • Fall in markets and liquidity needs • Policyholder buying ULIPs not aware of risks • Regulator prescribed Guaranteed Surrender value Systemic risk – insurance industry Counter-party (reinsurer, in particular): • Same reinsurers are used by multiple market players – failure of one big reinsurer can cause systemic risk • Withdrawal of reinsurance cover for particular events e.g. after 9/11, no terrorism cover • Prescriptive Reinsurance guidelines: • Maximising retention within India - concentration risk as diversification of risk will not occur • Reinsurers exiting market or reinsurance not available on favourable terms? • No reinsurance support on data, product design etc Systemic risk – insurance industry Other: • Regulatory risk, sudden change in legal/regulatory framework • On the other hand, during the onset of a systemic risk, regulators’ early intervention e.g. relaxing capital requirements temporarily prevent crisis from happening • Systemic risks associated with long term trends e.g. climate change, longevity • Other causes: over-valuation of assets, ill-managed rapid growth • Operational risks Systemic Risk – manage/mitigate? Systemic risk mitigation measures Implement comprehensive, integrated and principle-based supervision of Insurance Strengthen liquidity risk management e.g, liquidity stress tests Enhance regulation of financial guarantee insurance Increased monitoring of macro/industry-level prudence with adequate insurance representation Industry-wide risk management practices e.g. stringent regulatory reserving, risk based capital? Individual insurers – (1) good underwriting is first line of defense (2) ALM exercises coupled with resilience tests (3) ERM Questions? Appendix: Sources/Reference Links • • • • • • <www.genevaassociation.org> <www.irda.gov.in> <www.bseindia.com> <www.rbi.org.in> <www.milliman.com> <www.financialstabilityboard.org>