View the presentation delivered by speaker Dr. Ousmane Badiane ,

advertisement

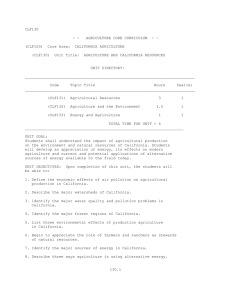

AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES OUSMANE BADIANE Director for Africa International Food Policy Research Institute Friday, July 1, 2016 AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES 1 OVERVIEW OF RECENT GROWTH TRENDS IN AFRICA 2 THE IMPLICATIONS OF CHANGING GLOBAL FOOD MARKETS 3 THE IMPACT OF CHANGING GLOBAL FINANCIAL MARKETS 4 EMERGING AGRICULTURAL POLICY DEVELOPMENTS 5 SUSTAINING AND ACCELERATING THE RECOVERY PROCESS AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES 1 OVERVIEW OF RECENT GROWTH TRENDS IN AFRICA 2 THE IMPLICATIONS OF CHANGING GLOBAL FOOD MARKETS 3 THE IMPACT OF CHANGING GLOBAL FINANCIAL MARKETS 4 EMERGING AGRICULTURAL POLICY DEVELOPMENTS 5 SUSTAINING AND ACCELERATING THE RECOVERY PROCESS PRE-CRISIS ERA COINCIDED WITH LONGEST PERIOD OF SUSTAINED GROWTH SINCE 60S Agriculture, value added (annual % grow th) Percent (%) GDP grow th (annual %) 9 6 3 SOURCE: Badiane 2008: IFPRI Policy Brief No. 9 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 -3 1980 0 THE GROWTH IS ACCELERATING AS WELL AS SPREADING GEOGRAPHICALLY SOURCE: IFPRI / Badiane and Ulimwengu Data from national account s / UN database: http://data.un.org/Explorer.aspx?d=SNAAMA THIS IS REFLECTED IN BETTER PRODUCTIVITY AND TRADE PERFORMANCE 2.5 AGRICULTURAL PRODUCTIVITY AFRICA Value of Ag Inputs Index (1970=1) 2.0 AFRICAN VS WORLD EXPORTS (VOLUME) 125 120 TFP 115 1.5 110 105 1.0 100 95 2001 2002 2003 2004 2005 Average annual growth rate (%) 6 AGRICULTURAL PRODUCTIVITY WORLD 5 2003 2000 1997 1994 1991 1988 1985 1982 1979 1976 1973 1970 0.5 World AFRICAN VS WORLD EXPORTS (VALUE) maize 4 Africa rice 160 wheat 150 155 145 140 135 3 130 125 120 2 115 110 105 1 100 95 2001 0 1963 1967 1971 1975 1979 1983 1987 1991 1995 1999 2003 2002 2003 World 2004 Africa 2005 Percent (%) POVERTY LEVELS HAVE STARTED TO DECLINE BUT NOT FAST ENOUGH TO MEET MDG1 60 Current 50 MDG target 40 30 20 10 POVERTY HEAD COUNT; $1/DAY 0 1990 SOURCE: IFPRI/Fan. 2007H 1995 2000 2005 2010 2015 AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES 1 OVERVIEW OF RECENT GROWTH TRENDS IN AFRICA 2 THE IMPLICATIONS OF CHANGING GLOBAL FOOD MARKETS 3 THE IMPACT OF CHANGING GLOBAL FINANCIAL MARKETS 4 EMERGING AGRICULTURAL POLICY DEVELOPMENTS 5 SUSTAINING AND ACCELERATING THE RECOVERY PROCESS THE GLOBAL FOOD PRICE CRISIS OF 2007-08 800 Corn Price spike Wheat 100 Rice Oil (right scale) 75 400 50 200 25 0 0 Source: J. von Braun; Data from FAO 2009 and IMF 2009. US$/barrel US$/ton 600 125 04 20 Oc t 04 De 20 c 05 Fe b 20 05 Ap 20 r 05 J 2 0 un e 05 Au g 20 05 20 Oct 05 De 20 c 06 Fe b 20 06 Ap 20 r 06 J 2 0 un e 06 Au g 20 06 20 Oct 06 De 20 07 c FE 20 07 B AP 20 R 07 20 JUN 07 AU 20 07 G OC 20 T 07 DE 20 C 08 FE 20 08 B AP R 20 WAS THERE A FOOD PRICE CRISIS IN AFRICA? ECOWAS Countries 3 2,5 2 1,5 1 0,5 0 Sorghumdawanu Cowpeadawanu Source: ReSAKSS West Africa Node millet bamako rizdakar MilletNiamey WAS THERE A FOOD PRICE CRISIS IN AFRICA? Food Price Indices COMESA Countries 160 FAO global food price index 150 Ethiopia 140 Burundi 130 Kenya 120 Tanzania 110 Madagascar 100 Malaw i 90 Zambia 80 Uganda 70 Mar07 Jul-0 Source: ReSAKSS East Africa Node 7 N ov- 07 Mar08 Rw anda LONG TERM WORLD FOOD PRICE TRENDS AND GROWTH RECOVERY IN AFRICA US$/ton 300 200 100 0 2000 Rice Oilseeds 2005 2010 Wheat Soybean Source: IFPRI / M. Rosegrant (prelim. results with IMPACT-WATER). 2015 Maize FACTORS BEHIND FOOD PRICE TRENDS INCOME & POPULATION GROWTH, MEAT AND DAIRY CONSUMPTION 2005/1990 ratios of per capita consumption India China Brazil Nigeria Cereals 1.0 0.8 1.2 1.0 Meat 1.2 2.4 1.7 1.0 Milk 1.2 3.0 1.2 1.3 Fish 1.2 2.3 0.9 0.8 Fruits 1.3 3.5 0.8 1.1 Vegetables 1.3 2.9 1.3 1.3 Source: IFPRI/ v. Braun - Data from FAO 2007. FACTORS BEHIND FOOD PRICE TRENDS VERY SLOW GROWTH IN FOOD PRODUCTION OVER THE LAST DECADE Total Million tons Million tons 1,200 2,000 900 1,600 600 1,200 300 0 800 1999 Wheat 2000 2001 2002 2003 Coarse grains Source: IFPRI / v. Braun - Data from FAO 2003, 2005-08. 2004 2005 Rice * Forecast. 2006 2007* Total (right) VULNERABILITY OF AGRICULTURE TO GLOBAL MARKET CHANGES RATIO VALUE AGRIC TRADE TO AGRIC GDP 2000 - 2006 0.7 RATIO VALUE AGRIC TRADE TO AGRIC GDP 2000 - 2006 7.0 ASIA S. LANKA CARIBBEAN 0.6 6.0 0.5 5.0 0.4 4.0 0.3 3.0 0.2 2.0 TRINIDAD & T 1.0 0.1 HAITI INDIA - - Individual Countries Individual Countries RATIO VALUE AGRIC TRADE TO AGRIC GDP 2000 - 2006 RATIO VALUE AGRIC TRADE TO AGRIC GDP 2000 - 2006 1.4 1.2 DRC AFRICA 1 CHILE S. AMERICA 1.2 1.0 0.8 0.8 0.6 0.6 0.4 0.4 0.2 COLUMBIA 0.2 CAR 0 Individual Countries NOTES: Agricultural trade is the value of agricultural exports plus value of agricultural imports SOURCES: Agricultural trade: Food and Agriculture Organization, FOASTAT 2008 Agricultural value added: World Development Indicators, 2008 Individual Countries AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES 1 OVERVIEW OF RECENT GROWTH TRENDS IN AFRICA 2 THE IMPLICATIONS OF CHANGING GLOBAL FOOD MARKETS 3 THE IMPACT OF CHANGING GLOBAL FINANCIAL MARKETS 4 EMERGING AGRICULTURAL POLICY DEVELOPMENTS 5 SUSTAINING AND ACCELERATING THE RECOVERY PROCESS IMPACT OF THE FINANCIAL CRISIS ON AGRICULTURE THE IMPACT CHANNELS 1 RECESSION – EXPORT DEMAND - TERMS OF TRADE 2 LIQUIDITY TRAP – FDI – REMITTANCES -TRADE CREDIT 3 FOREX AND FISCAL DEFICITS 4 DOMESTIC AND ASSISTANCE POLICY RESPONSES AG. REVENUES AG. FINANCE AG EXPENDITURE / INVESTMENT SECTOR RESPONSE IMPLICATIONS OF THE FINANCIAL CRISIS DEMAND, PRICES, AND AFRICAN EXPORTS 150 100 50 0 102.00% 3500 100 3000 2500 80 2000 60 1500 40 1000 20 500 0 0 108.00% IMPACT ON OVERALL AFRICAN EXPORTS 4000 Cocoa 2000M1 2000M5 2000M9 2001M1 2001M5 2001M9 2002M1 2002M5 2002M9 2003M1 2003M5 2003M9 2004M1 2004M5 2004M9 2005M1 2005M5 2005M9 2006M1 2006M5 2006M9 2007M1 2007M5 2007M9 2008M1 2008M5 2008M9 2009M1 2009M5 2009M9 200 Cotton 120 Coffee, Cotton , US cents/ pound 250 Coffee, Robusta 101.00% 106.00% 100.00% 104.00% 99.00% 102.00% IMPACT ON AGRICULTURAL EXPORTS Recession 98.00% 100.00% Recession (decline in demand) + stronger Finance constraints (+2.66xestimates) 97.00% + Finance constraints (actual country estimates) 96.00% 95.00% 2007 2008 + stronger Finance constraints 2009 98.00% + Finance constraints 96.00% 94.00% 2007 2010 2011 Source: IFPRI/Estrades and Laborde Price data from IMF World Economic Outlook 2012 2008 2009 2010 2011 2012 Cocoa, US $/ton 140 Commodity Fuel Index Food Index Index of Agricultural Raw Materials Index of Industrial Inputs 2000M1 2000M5 2000M9 2001M1 2001M5 2001M9 2002M1 2002M5 2002M9 2003M1 2003M5 2003M9 2004M1 2004M5 2004M9 2005M1 2005M5 2005M9 2006M1 2006M5 2006M9 2007M1 2007M5 2007M9 2008M1 2008M5 2008M9 2009M1 2009M5 2009M9 Price Index, 2005= 100 300 TRADE FINANCE RESTRICTION ANDOVERALL ECONOMIC GROWTH IN AFRICA 0.0% -0.1% -0.1% -0.2% -0.2% -0.3% -0.3% -0.4% -0.4% -0.5% Base case Finance constraints (actual country estimates) Strong + case stronger Finance constraints (+2.66x actual estimates) Real GDP, percentage change 2007-2009 related to trade finance restriction Source: IFPRI/Estrades and Laborde Page 19 2 4 FDI AND AGRICULTURAL SECTOR GROWTH IN AFRICA Burkina Faso Malawi Mali Mozambique Rwanda Niger Zimbabwe Senegal Chad Benin Madagascar Guinea Angola C. Africa Rep. Zambia Togo Gabon Burundi Somalia Congo Liberia Mauritania Mauritius S. Leone Gambia Eritrea Botswana Comoros Eq. Guinea G. Bissau Swaziland Lesotho Cape Verde Seychelles S. Tome and Principe -4 -2 0 Kenya Nigeria Sudan Algeria Egypt Ethiopia Tanzania Morocco South Africa Ghana C. Ivoire Cameroon Tunisia Uganda Congo (DRC) Djibouti 0 2 4 Log of Net FDI 6 8 Source: IFPRI/Badiane and Ulimwengu Page 20 10 10 FINANCIAL CRISIS, DEVELOPMENT ASSISTANCE AND AGRICULTURAL GROWTH Swaziland 1970-1980 Rwanda Lesotho 1981-1990 Guinea-Bissau Cameroon 5 Comoros Cape Verde Mauritania Uganda Chad Gambia Niger Nigeria Djibouti 0 5 Liberia Tanzania Mozambique Algeria Kenya Namibia Zimbabwe Benin Somalia Congo Guinea Sierra Leone Egypt Morocco Zambia C. African Rep. Burundi Sudan Senegal DRC Madagascar Ghana Angola B. Faso Togo 0 Benin MoroccoMali Namibia Angola Tunisia B. Faso Zimbabwe Tanzania Kenya Uganda Leone Lesotho NigeriaSierraBurundi Somalia Senegal Egypt Algeria Guinea Togo Zambia DRC Congo Swaziland C. African Rep. Ghana Cameroon Madagascar Chad Niger Sudan Gambia Rwanda Malawi S. T.and Principe Agricultural growth (%) Tunisia C. Ivoire Malawi Mali Comoros Cape Verde Djibouti Mauritania C. Ivoire Mozambique S. T.and Principe Liberia -5 -5 Guinea-Bissau 50 100 Per capita aid (us dollar) 10 Sudan 150 0 50 100 150 Per capita aid (us dollar) 200 250 15 0 1991-1999 Liberia Angola Nigeria Sierra Leone 2000-2006 10 S. T.and Principe 0 Burundi Somalia Angola -5 Morocco Congo Rwanda Algeria Niger Tanzania Mozambique Egypt Gambia Ghana B. Faso Guinea ChadBenin Cameroon Djibouti C.Sudan African Rep. Mali Comoros Kenya Somalia Namibia Uganda Malawi Tunisia Madagascar Guinea-Bissau Zambia Togo Senegal Liberia Mauritania C. Swaziland Ivoire Burundi Lesotho DRC Cape Verde 5 5 0 Agricultural growth (%) B. Faso Chad Malawi Morocco Zambia Benin Niger Algeria Mozambique Gambia Ghana Namibia Uganda Tunisia Togo Tanzania Nigeria Zimbabwe C.Guinea African Rep. Egypt DRC MaliSenegal Guinea-Bissau Djibouti Cameroon Comoros Kenya Madagascar C. Rwanda Ivoire Mauritania Swaziland Lesotho Congo S. T.and Principe Cape Verde Zimbabwe -5 -10 Sierra Leone 0 100 200 Per capita aid (us dollar) Source: IFPRI/Badiane and Ulimwengu 300 400 0 50 100 150 Per capita aid (us dollar) 200 250 Page 21 (%) MACROECONOMIC RAMIFICATIONS OF THE FINANCIAL CRISIS IN AFRICA 6 Africa: Current Account Balance as Share of GDP Overall Fiscal Balance, Including Grants (as % of GDP) 6 5 4 4 3 2 2 1 -2 -4 2010 2009 2008 2007 2006 -2 2005 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2004 1997-2002 -1 2003 0 0 -3 -6 Private Financial Flows to Africa External debt, as share of GDP Source: IMF World Economic Outlook 2010 Inflation, average consumer prices 2009 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2008 0 2007 10 2006 20 2005 30 2004 40 2003 50 2002 billions of US $ 60 50 45 40 35 30 25 20 15 10 5 0 2001 70 Africa: Inflation and External Debt as Share of GDP 1998-2000 (%) -4 Page 22 THE IMPACT OF THE FINANCIAL CRISIS ON GROWTH TRENDS IN AFRICA 8 7 6 Annual Percent Change (%) 5 4 3 2 1 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -1 -2 World Source: IMF World Economic Outlook Africa Page 23 AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES 1 OVERVIEW OF RECENT GROWTH TRENDS IN AFRICA 2 THE IMPLICATIONS OF CHANGING GLOBAL FOOD MARKETS 3 THE IMPACT OF CHANGING GLOBAL FINANCIAL MARKETS 4 EMERGING AGRICULTURAL POLICY DEVELOPMENTS 5 SUSTAINING AND ACCELERATING THE RECOVERY PROCESS THE COMPREHENSIVE AFRICA AGRICULTURE DEVELOPMENT PROGRAMME (CAADP) PILLAR FRAMEWORKS SECTOR COMPACTS KNOWLEDGE SYSTEMS STRATEGIC ISSUES LT INVEST. OPTIONS BENCHMARKING SUCCESS FACTORS COMMITMENTS -SECTOR POLICIES - BUDGET POLICIES - DEV. ASSISTANCE PEER REVIEW BEST PRACTICES POLICY ELEMENTS SHARED LT FRAMEWORK FOR ACTION MUTUAL LEARNING - POLICY DIALOGUE DEVELOPMENT PARTNERSHIP AND ACCOUNTABILITY EVIDENCE/OUTCOME BASED PLANNING AND IMPLEMENTATION BETTER POLICY, GROWTH, POVERTY, AND FOOD SECURITY OUTCOMES Page 25 OBJECTIVES AND OUTCOMES OF COUNTRY ROUND TABLE AND COMPACT 1. MAKE SURE THAT THE COUNTRY IS ON TRACK TO ACHIEVE THE CAADP GROWTH AND BUDGETARY OBJECTIVES, IF NOT OBJECTIVE OF ROUND TABLES OUTCOMES OF ROUND TABLES: CAADP COMPACT 2. IDENTIFY EVENTUAL GAPS IN TERMS OF SECTOR POLICY, BUDGETARY, AND INVESTMENT MEASURES ELABORATION OF A COUNTRY CAADP COMPACT TO GUIDE THE IMPLEMENTATION OF CAADP IN THE LONG TERM , INCLUDING: 1. COMMITMENTS IN TERMS OF SECTOR POLICIES, PUBLIC EXPENDITURES, AND DEVELOPMENT ASSISTANCE 2. ESTABLISHEMENT OF PARTNERSHIPS AND ALLIANCES FOR SUCCESSFUL IMPLEMENTATION OF CAADP 3. CREATION OF A MECHANISM FOR PEER REVIEW AND DIALOGUE TO TRACK IMPEMENTATION PERFORMANCE AND THE PROGRESS IN MEETING THE AGREED ON COMMITEMENTS CREATING THE CONDITIONS FOR BETTER DEVELOPMENT OUTCOMES I. DEVELOPED COMPREHENSIVE AND OBJECTIVE DRIVEN STRATEGY FRAMEWORK WITH LIMITED SET OF CLEAR TARGETS II. EVALUATE COUNTRY EFFORTS AGAINST DEFINED TARGETS SHARED INVESTMENT AND PARTNERSHIP FRAMEWORK III. SPECIFY ALTERNATIVE ACTION SCENARIOS AND OUTCOMES BASELINES - MILESTONES - ACTION TARGETS - TOOLS IV. SET UP BENCHMARKING AND LEARNING MECHANISMS KNOWLEDGE SYSTEMS INFRASTRUCTURE V. ESTABLISH POLICY REVIEW AND DIALOGUE PLATFORM INCLUSIVE FORA AT COUNTRY LEVEL AND BEYOND AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES 1 OVERVIEW OF RECENT GROWTH TRENDS IN AFRICA 2 THE IMPLICATIONS OF CHANGING GLOBAL FOOD MARKETS 3 THE IMPACT OF CHANGING GLOBAL FINANCIAL MARKETS 4 EMERGING AGRICULTURAL POLICY DEVELOPMENTS 5 SUSTAINING AND ACCELERATING THE RECOVERY PROCESS LONG TERM CHALLENGE NO. 1 BRIDGING THE GROWTH GAP TO ACCELERATE POVERTY REDUCTION 100 Actual Poverty Rate in 1990 90 80 (%) 70 60 Target Poverty Rate in 2015 2015 Target Poverty Rate 50 40 30 20 10 Projected 2015 Poverty Rate under CAADP 6% Growth Rate Togo Kenya Ghana Burkina Faso Zambia Niger Benin Uganda Rwanda Mozambique Malawi 0 LONG TERM CHALLENGE NO. 2 BRIDGING THE EXPENDITURE GAP TO ACCELERATE GROWTH 100 Actual Poverty Rate in 1990 90 80 (%) 70 60 Target Poverty Rate 2015 Target Poverty Ratein 2015 50 40 30 20 10 Projected 2015 Poverty Rate under CAADP 6% Growth Rate Projected Required Spending Growth to Achieve CAADP 6% Growth Rate Source: Dollar a Day Poverty Rates from World Bank, PovCal Net, 2008 [poverty line $1.25]; Projected CAADP Poverty Rates from various IFPRI country CAADP Growth Simulation Studies Togo Kenya Ghana Burkina Faso Zambia Niger Benin Uganda Rwanda Mozambique Malawi 0 THE EXPENDITURE CONVERGENCE AGENDA: MAXIMIZING SYNERGY BETWEEN GROWTH AND SOCIAL INVESTMENTS 600 500 400 300 200 100 0 Agriculture Education Health Social Security Sources: Government spending: Global database on public spending, DSGD, IFPRI, 2009; and ODA: OECD, 2008 EFFECT OF 10% INCREASE IN SERVICES EXPENDITURE ON SOCIAL OUTCOMES, AGRICULTURAL EFFICIENCY, AND POVERTY HEALTH SERVICES EDUCATION SERVICES MEETING THE DOUBLE CHALLENGE OF GROWTH ACCELERATION AND SOCIAL PROTECTION BASIC STRATEGIC QUESTIONS 1 HOW TO MAXIMIZE LONG TERM GROWTH WHILE MEETING SHORT TERM SOCIAL NEEDS 2 HOW TO MAXIMIZE SYNERGY BETWEEN SOCIAL SERVICES AND PRODUCTIVITY ENHANCING INVESTMENTS 3 HOW TO EXPLOIT GROWTH EXTERNALITIES OF SOCIAL SERVICES 4 HOW TO IMPROVE CONSIDERATION OF GROWTH SYNERGIES IN BUDGET PLANNING AND NEGOTIATIONS AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES CONCLUSIONS 1 HAS REMARKABLE RECOVERY COMPENSATED FOR THE 2.5 DECADE ECON. STAGNATION? NO o STILL LARGE POCKETS OF POVERTY o PROGRESS TOWARDS POVERTY MDG PICKED UP PACE BUT NOT ENOUGH FOR MOST o NEED TO ACCELERATE AND BROADEN GROWTH TO REDUCE POVERTY FASTER Page 34 AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES CONCLUSIONS 2 GLOBAL CRISES ARE A THREAT BUT ALSO FULL OF OPPORTUNITIES FOR AFRICAN ECONOMIES AFRICAN ECONOMIES HAVE SHOWN GREATER RESILIENCE THAN DURING PAST CRISES AFRICAN AGRICULTURE IS WELL POSITIONED TO COMPETE AND BENEFIT FROM LONG TERM GLOBAL PRICE TRENDS UNPRECEDENTED CONTINENT WIDE EFFORTS UNDER CAADP TO: o IMPROVE POLICY PLANNING / IMPLEMENTATION o RAISE GOVERNMENTS INVESTMENT IN AGRICULTURE. Page 35 AGRICULTURAL AND ECONOMC GROWTH RECOVERY IN AFRICA IN THE CONTEXT OF GLOBAL CRISES CONCLUSIONS 3 THE RECOVERY OF LAST 15 YEARS HAS CREATED A STRONG FOUNDATION TO BUILD UPON BETTER CONDITIONS FOR HIGHER RETURNS TO INVESTMENTS IN AND ASSISTANCE TO AFRICA UNPRECEDENTED CONTINENT WIDE EFFORTS UNDER CAADP TO: o IMPROVE POLICY PLANNING / IMPLEMENTATION o RAISE GOVERNMENTS INVESTMENT IN AGRICULTURE o AND SUSTAIN / DEEPENTHE RECOVERY PROCESS Page 36