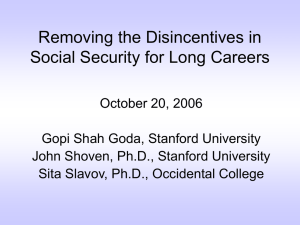

Removing the Disincentives of Long Careers in Social Security

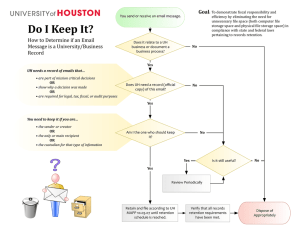

advertisement

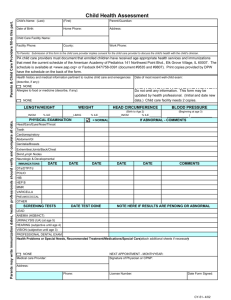

Removing the Disincentives of Long Careers in Social Security August 10, 2006 Gopi Shah Goda, Stanford University John Shoven, Ph.D., Stanford University Sita Slavov, Ph.D., Occidental College Motivation • Life expectancy has improved dramatically since the introduction of Social Security – Period life expectancy for 20-year-olds in 1935 was 66 for males, 69 for females – Today, 20-year-old males have life expectancy of 76, and females have life expectancy of 80 • However, men are retiring much earlier 2 Labor Force Participation by Age for Men, 1965 and 2003 100.0 90.0 80.0 Early Retirees Retiring 4 Years Younger Percent in Labor Force 70.0 60.0 3 Years Younger 1965 2003 50.0 40.0 30.0 20.0 10.0 0.0 55 57 59 61 63 65 Age 67 69 71 73 75+ 3 Labor Force Participation of Men by Remaining Life Expectancy Average Length of Retirement Up Almost 50% Since 1965! 100.0 90.0 Labor Force Participation 80.0 7.0 Years 70.0 60.0 5.5 Years 50.0 40.0 30.0 1965 20.0 2003 10.0 0.0 8 10 12 14 16 18 20 22 24 Remaining Life Expectancy 4 What are implicit Social Security tax rates? • The implicit Social Security tax rate is the change in the net Social Security tax as a percentage of earnings ImplicitSo cSecTaxRatex PayrollTax es x 12 PIAx DAVg ( x, NRA) Earnings x 5 Assumptions • Single male worker who starts working at age 20, and retires at the NRA • Assume 2005 benefit rules persist • Earnings by age simulated using a time-series of average wages for U.S. and an age-wage profile constructed from 2001 and 2002 CPS • OASI tax rate = 10.6% maximum implicit tax • Real wage growth = 1% • Real discount rate = 2% • Work years are “front-ended” 6 0.1 Implicit Tax Rate 0.05 0 average 10th %ile 90th %ile full cap -0.05 -0.1 15 20 25 30 Career Length 35 40 45 7 0.1 Implicit Tax Rate 0.05 0 average 10th %ile 90th %ile full cap -0.05 -0.1 15 20 25 30 Career Length 35 40 45 8 0.1 Implicit Tax Rate 0.05 0 average 10th %ile 90th %ile full cap -0.05 -0.1 15 20 25 30 Career Length 35 40 45 9 Male Mortality 0.1 Implicit Tax Rate 0.05 0 average 10th %ile 90th %ile full cap -0.05 -0.1 15 20 25 30 Career Length 35 40 45 10 Female Mortality 0.1 Implicit Tax Rate 0.05 0 average 10th %ile 90th %ile full cap -0.05 -0.1 15 20 25 30 Career Length 35 40 45 11 Why do we see these patterns? • Once a person works 35 years, additional years of earnings are no longer replacing zeroes – they are replacing lower earnings years • Each additional year of work does not count the same because of the way the system handles progressivity 12 What do implicit tax rates look like for actual earnings histories? • Benefits and Earnings Public Use File, 2004 • 1% sample of SSA beneficiaries in December 2004 • Limit attention to beneficiaries receiving retirement benefits based on their own earnings histories, and who started working 1951 or later • This leaves 123,552 individuals in the sample – 75,368 men and 48,184 women – Birth years range from 1910 to 1942 • Earnings above the cap are not available • No way to link couples in the data 13 14 15 16 Three Possible Reforms 1. Use 40 years rather than 35 in the AIME calculation 2. Disentangle career length and progressivity Current PIA Calculation 1 w PIA f * NRA earnt T w t AIME (includes zeros) y 1 w f * * NRA earnt PIA wt T y Proposed PIA Calculation 1 w y * f * NRA earnt T wt y career modified AIME length (does not include zeros) adjustment 17 PIA Under Current and Proposed Law 2000 1800 1600 1400 PIA formula under Current Law (AIME calculation includes zeros) PIA 1200 1000 800 PIA formula under Proposed Law for Low, Middle, and High Income Earner (AIME calculation does not include zeros) 600 400 Position on ray depends on career length. 200 0 0 500 1000 1500 2000 2500 AIME 3000 3500 4000 4500 5000 18 Three Possible Reforms 1. Use 40 years rather than 35 in the AIME calculation 2. Disentangle career length and progressivity 3. Establish a “paid-up” category of workers who have worked a full career of 40 years 19 Monthly Primary Insurance Amount Under Current and Proposed Law Average Income Earner $1,400 $1,200 2006 Dollars $1,000 $800 $600 $400 Proposed Law PIA $200 Current Law PIA $0 10 15 20 25 30 35 40 45 Career Length (years) 20 average 10th %ile 90th %ile full cap 0.1 Implicit Tax Rate 0.05 0 -0.05 -0.1 15 20 25 30 Career Length 35 40 45 21 average 10th %ile 90th %ile full cap 0.1 Implicit Tax Rate 0.05 0 -0.05 -0.1 15 20 25 30 Career Length 35 40 45 22 average 10th %ile 90th %ile full cap 0.1 Implicit Tax Rate 0.05 0 -0.05 -0.1 15 20 25 30 Career Length 35 40 45 23 average 10th %ile 90th %ile full cap 0.1 Implicit Tax Rate 0.05 0 -0.05 -0.1 15 20 25 30 Career Length 35 40 45 24 average 10th %ile 90th %ile full cap 0.1 Implicit Tax Rate 0.05 0 -0.05 -0.1 15 20 25 30 Career Length 35 40 45 25 average 10th %ile 90th %ile full cap 0.1 Implicit Tax Rate 0.05 0 -0.05 -0.1 15 20 25 30 Career Length 35 40 45 26 average 10th %ile 90th %ile full cap 0.1 Implicit Tax Rate 0.05 0 -0.05 -0.1 15 20 25 30 Career Length 35 40 45 27 28 29 What impact do these reforms have on progressivity? IRRs for Workers with 30-Year Career Current Law Proposed Law Low Income Earner 2.64% 2.55% Average Income Earner 1.34% 1.34% High Income Earner 0.81% 0.86% 30 What impact do these reforms have on women? • Since women in the sample are more likely to experience shorter careers, the reforms disproportionately affect women • Benefit levels are 2.44% higher for males, 0.07% higher for females (vs. 1.52% overall) • We look at policies to alleviate this redistribution… 31 What impact do these reforms have on women? Percentage Change in PIA by Gender and Years of Credit Given for Women Male Benefits Female Benefits Total No Credit 2.44% 0.07% 1.52% 1-Year Credit 2.44% 3.29% 2.77% 2-Year Credit 2.44% 6.42% 4.00% 3-Year Credit 2.44% 9.45% 5.18% 32 Summary • Flat payroll taxes and the current benefit formula together imply that workers face increasing disincentives for working long careers • This may be contributing to what could be suboptimally long retirement periods 33 Summary • Policies that flatten the pattern of implicit taxes as individuals age would reduce the disincentives of working longer careers • These policies can be enacted in ways that are either revenue- or benefit-neutral in aggregate • These policies would involve some redistribution from individuals who work short careers to individuals who work long careers 34