Local Venture Capital Funds: A Way to Support Entrepreneurs

advertisement

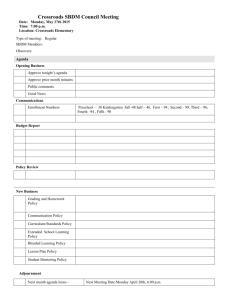

Crossroads Institute Gary Larrowe Extension Specialist VA Tech Fund Goal: $1,000,000 25-40 investors Minimum investment required $500,000 to complete fund. Individual Investment Minimum Investment $10,000 Maximum Investment $100,000 10% due with subscription Balance or part of balance due when capital call is made by the Company. Current Indications of Interest Several Individuals in Carroll County have been used as barometers of interest with positive feedback Closing fund at $1.5 million or October 31, 2004 whichever comes first! Crossroads Venture Capital Fund, LLC Formal Investment Fund Aggregate Intellectual & Financial Resources Comprised of Accredited Investors Managed by formal Board of Managers Investment Motivation 1. Return on Investment 2. Angel Investor opportunities 3. Economic Development 4. Reduce Risk 5. No Sales Commission or other Dilution of Investment and possible tax credits Investment Motivation 6. Limited Management Expenses, more in early years during due diligence 7. Some Legal and Accounting 8. Local Control 9. Regional Economic Power Return on Investment Ideally, the angel fund will have a blended portfolio and receive a weighted return of up to 20% compounded annually. Expectations for Return on Investment within 5 years. Startup Companies Companies less than one year old Companies one to five years Companies five years plus 10x 6x 5x 3x Life of Fund Will invest all funds less a reserve for operating expenses Investment period 2-4 years Expected term 5-7 years End of term, close fund and disburse remaining assets Open new fund if necessary Crossroads Venture Capital Fund, LLC Investment Focus to be Determined by Members: Will consider most industries to include: Manufacturing, Technology, Life Sciences, Warehousing and Distribution Will consider various growth stages of a business: Seed, Early Stage, Start-Ups, Expansions, Owner Transitions Primary Investment Region: Service area of Crossroads Institute Will consider investments outside the region. Crossroads Venture Capital Fund, LLC Investment Expenses to be Determined by Members: Will consider reimbursement fee for due diligence efforts of members ( Preferably Non Cash: stock options or % of deal ) In some cases may hire due diligence to be performed Goal to limit expenses to increase return on investment Management Members Investment Decisions Elect Board of Managers One vote per share Assist with deal flow Due Diligence Board of Managers Direct Due Diligence on investment opportunities Decision makers for the Company Elected by the Members Officers Elected by the Board of Managers Day-to-Day mgmt responsibilities Crossroads Institute Administrative Support Board of Managers: Cross Section of Disciplines Financial/Banking Accounting Legal Operations Marketing Human Resources Risk Management Medical Industry Expertise Advanced Manufacturing Technology Distribution Warehousing Due Diligence Crossroads Institute Administrative Support Call meetings Assist Officers and Board of Managers Coordinate Due Diligence Efforts Assist with preliminary research Resources for research Assist in other areas as needed Stimulate Deal Flow Critical Functions Deal Flow Crossroads Entrepreneurs Establish connections with other Venture Funds and Firms Venture Capital Firms MEMBERS Due Diligence Team Approach Board of Managers and Members Outside Expertise Due Diligence Work Plan Next Steps… Within three months: Complete and Sign Subscription Agreement return with check for 10% of subscription amount to the Crossroads Institute Close Private Placement Offering Memorandum 10/31/04 or at $1.5 million Annual Meeting to Elect Board of Managers 11/04 Cash Checks 11/04 Begin Deal Flow www.CrossroadsVA.org