Chp 2 HW Solutions 02_Ch_2_HW_Sol.doc

advertisement

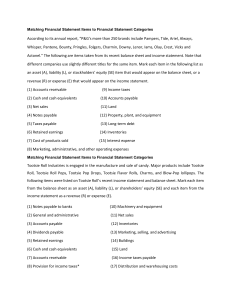

BRIEF EXERCISE 2-2 GEORGES COMPANY Partial Balance Sheet Current assets Cash ......................................................................................... Short-term investments .......................................................... Accounts receivable ............................................................... Supplies ................................................................................... Prepaid insurance ................................................................... Total current assets......................................................... Order based on liquidity. $10,400 8,200 14,000 3,800 2,600 $39,000 BRIEF EXERCISE 2-3 Earnings per share = = Net income-Preferred stock dividends Average common shares outstanding $220 million – $0 = $.66 per share 333 million shares EPS is a required disclosure on all income statements. BRIEF EXERCISE 2-4 ICS DRE IRE DRE Issued new shares of common stock Paid a cash dividend Reported net income of $75,000 Reported net loss of $20,000 BRIEF EXERCISE 2-9 (a) Relevant. (b) Faithful representation. (c) Consistency. BRIEF EXERCISE 2-10 (a) (b) (c) (d) 1. 2. 3. 4. Predictive value. Neutral. Verifiable. Timely. DO IT! 2-4 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Monetary unit assumption Faithful representation Economic entity assumption Cost constraint Consistency Cost principle Relevance Periodicity assumption Full disclosure principle Materiality constraint Going concern assumption Comparability EXERCISE 2-1 CL CA PPE PPE CA CL IA CL Accounts payable CA Accounts receivable LTI Accumulated depreciation—equipment PPE Buildings LTL Cash CA Interest payable PPE Goodwill CA Income taxes payable Inventory Investments Land Mortgage payable Supplies Equipment Prepaid rent EXERCISE 2-2 CA PPE IA CL Prepaid advertising Equipment Trademarks Salaries and wages payable IA LTL SE PPE Patents Bonds payable Common stock Accumulated CL SE CA LTI Income taxes payable Retained earnings Accounts receivable Land held for future use depreciation—equipment CL Unearned sales revenue CA Inventory EXERCISE 2-5 VICTORY COMPANY Balance Sheet December 31, 2012 Assets Current assets Cash .................................................... Accounts receivable .......................... Prepaid insurance .............................. Total current assets.................... Property, plant, and equipment Land .................................................... Buildings ............................................. $105,800 Less: Accumulated depreciation— buildings .................................. 45,600 Equipment .......................................... 82,400 Less: Accumulated depreciation— equipment ............................... 18,720 Total Property, plant and equipment Total assets ................................. $11,840 12,600 3,200 $ 27,640 61,200 60,200 63,680 185,080 $212,720 Liabilities and Stockholders’ Equity Current liabilities Accounts payable .............................. Current maturity of note payable ........ Total current liabilities ............... Long-term liabilities Note payable ($93,600 – $13,600) ...... Total liabilities ............................. Stockholders’ equity Common stock ................................... Retained earnings ($40,000 + $6,020*) ........................... Total stockholders’ equity ......... Total liabilities and stockholders’ equity ................ 9,500 13,600Interest payable 26,700 80,000 106,700 60,000 46,020 106,020 $212,720 *Net income = $14,700 – $780 – $5,300 – $2,600 = $6,020 EXERCISE 2-12 (a) (b) (c) (d) (e) (f) 2 6 3 4 5 1 Going concern assumption Economic entity assumption Monetary unit assumption Periodicity assumption Cost principle Full disclosure principle BYP 2-2 (a) COMPARATIVE ANALYSIS PROBLEM ($ in thousands) Hershey Foods Tootsie Roll 1. Working capital $1,385,434 – $910,628 = $474,806 $211,878 – $56,066 = $155,812 2. Current ratio $1,385,434 ÷ $910,628 = 1.5:1 $211,878 ÷ $56,066 = 3.8:1 3. Debt to total assets ratio $2,914,692 $185,762 * 5. Earnings per share $435,994 – 0 = 79.3% $3,675,031 227,517 = 22.2% $838,247 = $1.92 $53,475 – 0 = $0.95 56,072 *$56,066 + $129,696 (b) Liquidity Hershey Foods appears more liquid since it has about $319 million more working capital than Tootsie Roll. But, looking at the current ratios, we see that Tootsie Roll’s ratio is more than two and a half time greater than Hershey’s. Both seem solid regarding liquidity. Solvency Based on the debt to total assets ratio, Tootsie Roll is more solvent. Tootsie Roll’s debt to total assets ratio is significantly lower than Hershey’s and, therefore, Tootsie Roll would be considered better able to pay its debts as they come due. Profitability While earnings per share cannot be used to compare profitability between companies, net income can. Hershey’s net income is more than 8-times as great as Tootsie Roll but it is three times as large in regard to assets.