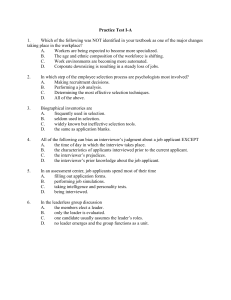

III A. Core concepts features of AGE models

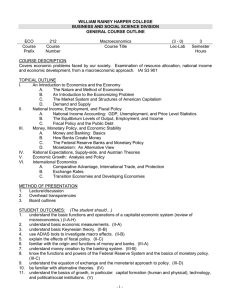

advertisement

III-A

III. AGE analysis of trade, policy

reform and environment

A. Core concepts and structura l features of AGE models

B. Coun try c ase studies

Sour ces:

* Shoven and Wha ll ey 1984

* OEE Chap ter 5

Lee and Rola nd- Holst 1997 & other CGE studies

1

III-A

Concepts and structural features

1.

2.

3.

4.

5.

Overview and a simple AGE structure

Solution procedures for ‘Johansen’ models

Incorporating environmental analysis

Dealing with institutional issues

Dealing with political economy

2

III-A

Overview of AGE models

• Describe Walrasian equilibria in fairly

detailed manner--sufficient to support

policy claims

– Too large to be solved analytically; must use

numerical solutions instead

– But structure and results depend on same

theoretical foundations

• Advantages and disadvantages of size.

3

III-A

Pros and cons of AGE modeling

• √ Capture economy-wide mechanisms and

implications

• X limitations

– ‘Time’ is not explicitly taken into account: major limitations

for analysing impact of exchange rate changes

– ignores risk/uncertainty issues; credit market imperfections

ignored

– aggregations can mask important differences; AGE models

must be used in conjunction with in-depth, ‘micro’ research

and analyses

– resource intensive: only worthwhile when economy-wide

effects are deemed sufficiently important!

4

III-A

An N-good, F-factor economy

• General structure

• Equilibrium conditions

• Closure rules and decisions

5

III-A

Variables in the basic model

P

commodit y p rices (N)

W

mobil e factor prices (F)

R

sector-specific f actor prices (N)

Y

dom. commodit y supplies (N)

X

mobil e factor demands (NF)

D

dom. final demand s (N)

S

net imports (N)

V

factor endow ments (F)

U

agg rega te utilit y (1).

Foreign cu rrency exch. r ate (1)

6

III-A

-- Suppose V and P are giv en, and let = 1 be the numéraire price.

-- Agg rega te revenue is given by G(P,V) = max{PY | V}. From F ONC:

Yj = Yj (P, V)

(j = 1, ..., N),

(5.1)

Wi = Wi(P, V)

(i = 1, ..., F),

(5.2)

Rj = Rj (P, V).

(j = 1, ..., N),

(5.3)

and the p rices of mobil e and specifi c factors:

-- Each sector is a price-taker in factor markets. Th erefore, the outpu t leve l that

maximi zes revenue is also the co st-mi nimi zing level, and from FONC

of the sectoral co st mi nim ization p roblem Cj (W, Yj) = mi n{WX | Yj),

we obtain de ma nds for intersectorall y mobil e factors:

Xij = Xij (W, Yj)

(i = 1, ..., F; j = 1, ..., N). ,

(5.4)

7

III-A

Domestic fi nal dema nds for each commodit y are found from the

expend it ure minimi zation problem E(P,U) = mi n{PD | U}:

Dj = Dj (P, U)

(j = 1, ..., N). ,

(5.5)

Net trade vo lumes are determined by ma rket-clearing conditions:

Sj = Dj – Yj

(j = 1, ..., N), ,

(5.6)

whe re Sj > (<) 0 indicates a ne t impo rt (expo rt) good . Import prices are set

in world markets, whil e for M expo rtables (M Š N), prices are set by

inve rse foreign demand func tions:

Pk = Pk (Sk)

(k = 1, ..., M).

(5.7)

Finall y, the model i s closed by an agg rega te budge t cons traint:

E(P,U) = G(P,V)

(5.8)

8

III-A

Closure

•

•

•

•

No. of equations must match endog. vars.

In (5.1)-(5.8): 4N + F + FN + M + 1 eqns.

But we have 5N + 2F + FN + 2 variables.

Must choose N - M + F + 1 exog. vars

– Declare V exog; (N - M) elements of P, and .

• Now (5.1)-(5.8) solve for Y, W, R, X, D, S

and U as endogenous variables.

9

III-A

Closure rules and decisions

• Other closures are possible

– ‘Neoclassical’ closure has all domestic prices

flexible

– Alternatives: e.g. fix wages, allow

unemployment in labor market.

• These choices reflect our beliefs or

observations about the real world.

10

III-A

Other features

• Can add in

–

–

–

–

–

–

Intermediate inputs

Products distinguished by source

Different kinds of labor

Many sources of final demand

Trade and transport ‘margins’

Tariffs, taxes, and other policies … etc.

• Again, real-world conditions should motivate

these.

11

III-A

Solving the model: the

‘Johansen’ AGE structure

• First-order approximations to changes in variable

values

• Models solved in proportional (percentage)

changes of variables, or ‘hat calculus’.

• Advantages:

– Models are linear in variables

– Parameter values are intuitive and accessible (shares,

elasticities)

– Simulation results are additive in separate shocks

12

III-A

Features of Johansen models

• Parameter values are shares and elasticities

• Quick checks:

– Homogeneity & ‘balance’ of underlying data base.

• Solution is by matrix inversion

– Entire model is a system of linear equations

• Examples of Johansen-style models:

– ORANI (Australian economy)

– GTAP (international agricultural trade)

– Model OEE, Ch.6

13

III-A

The AGE model

1.

2.

3.

4.

5.

6.

7.

Output supplies and factor demands (N+FN)

Zero pure profits in production (N)

Factor market clearing conditions (F)

Consumer demands for goods (N)

Net trade in commodities (N)

Export prices (M)

Aggregate budget constraint (1)

14

III-A

Variables solved within model

1.

2.

3.

4.

5.

6.

7.

Output supplies and factor demands (N+FN)

Returns to sector-specific factors (N)

Mobile factor prices (F)

Consumer demands for goods (N)

Net imports (N)

Export prices (M)

Aggregate real income (1)

15

III-A

Data base

• The model in proportional change form uses

data on production, consumption, trade,…

all in the form of

– Shares (e.g. employment shares by sector)

– Elasticities (e.g. parameters of demand and

supply functions).

• Easy to check ‘balance’ of data base

• Easy to interpret results.

16

III-A

Environmental analysis in GE

• Most AGE models constructed for more

general analytical purposes: environmental

structure is added later

• Given uncertainty about env. variables and

valuations this may be appropriate!

• Industrial emissions

• Natural resource degradation

• Questions about institutions.

17

III-A

Industrial emissions: AHTI

Fertilizer

Rubber/Plas tic/Chem Prod.

Paper Products

Non-Ferr. Basic Metals

Garments

Wood Products

Cement & Non-Metallic

Other Textiles

Mis c. Manufacturing

Coal & Petroleum Prod.

Metal Products

Textile & Knitting

Oils and Fats

Electrical Machinery

Milk and Dairy

Transport Equipment

Other Foods

Sugar Milling/Refining

Animal Feeds

Beverages and Tobacco

Meat & Meat Prod.

Feed Milling

0

20

40

60

Linear AHTI value .

80

100

120

18

III-A

Deforestation & land degradation

• Commercial and non-comm’l deforestation:

does timber have market value?

– Non-comm’l deforestation is driven by search

for land, and responds to changes in the

marginal valuation of land in agricultural

production...

– … although institutional setting also matters

(more later)

19

III-A

Land degradation

• Hard to measure, and problems of

aggregation.

• Can use information on erosion rates by

crop, together with land use data, to build

‘baseline’ data set.

– Then erosion changes can be inferred from

changes in land use

• Production externalities: technical ‘regress’.

20

III-A

Institutional issues

1. Trees may be cut (or planted) to establish

property rights over land.

2. In open access forests (non-commercial),

opportunity cost of forest is set by ag. land

values and clearing costs.

3. In commercial forestry, timber

harvesting/replanting also depends on property

rights.

•

Will an increase in timber prices promote or retard

tree-felling in aggregate? Depends on prop. rts.

21

III-A

Institutions in AGE models

• Can incorporate open access (quantity vs.

price adjustment in market clearing)

• Distinguish between commercial forestry

and land colonization by farmers

• In latter case, implied land values indicate

pressures for deforestation.

22

III-A

Dealing with political economy

• Economists’ welfare weights seldom

coincide with those of policy-makers!

– This extends to valuations of environmenteconomy tradeoffs.

• AGE results can be re-cast to reflect

alternative sets of priorities…

23