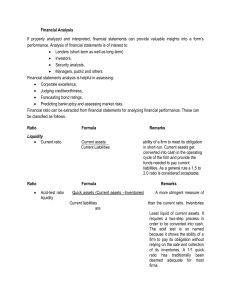

Study Session 8 Cross-Reference to CFA Institute Assigned Reading #28 - Financial Analysis Techniques Sample Balance Sheet Year Current year Previous year $ 1 05 205 310 $95 1 95 290 620 580 1 ,800 360 1,440 $ 1 ,700 340 1 ,360 $2,060 $ 1 ,940 $110 160 55 325 $90 140 45 $275 610 1 05 $690 95 300 400 320 1,020 300 400 1 80 880 $2,060 $ 1 ,940 Assets Cash and marketable securities Receivables Inventories Total current assets Gross property, plant, and equipment Accumulated depreciation Net property, plant, and equipment Total assets Liabilities Payables Short-term debt Current portion of long-term debt Current liabilities Long-term debt Deferred taxes Common stock Additional paid in capital Retained earnings Common shareholders equity Total liabilities and equity SamEle Income Statement Year Current y_ear Sales $4,000 Cost of goods sold 3,000 Gross profit Operating expenses 1 ,000 650 Operating profit Interest expense 350 50 Earnings before taxes Taxes 300 1 00 Net income 200 Common dividends Page 1 58 60 ©2012 Kaplan, Inc. Study Session 8 Cross-Reference to CFA Institute Assigned Reading #28 - Financial Analysis Techniques Financial Ratio Template Current Year Last Year Industry Current ratio 2.1 1 .5 Quick ratio 1.1 0.9 Days of sales outstanding 1 8 .9 18.0 Inventory turnover 1 0.7 12.0 Total asset turnover 2.3 2.4 Working capital turnover 14.5 1 1 .8 Gross profit margin 27.4% 29.3 % Net profit margin 5.8% 6.5 % Return on total capital 21.1% 22.4% Return on common equity 24. 1 % 1 9.8 % Debt-to-equity 99.4% 35.7% Interest coverage 5.9 9.2 ©20 1 2 Kaplan, Inc. Page 159