213 syllabus- First semester- 2012.doc

advertisement

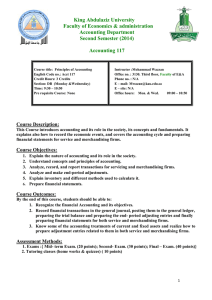

King Abdulaziz University

Faculty of Economics & administration

Accounting Department

First Semester (2012)

Accounting 213

Course title: Principles of Accounting II

English Code no.: Acct 213

Credit Hours: 3

Section: DA (Sunday & Tuesday)

Time: 09:30 – 10:50

Pre requisite Course: Acct. 117

Instructor :Khalid Said Bashnini

Office no. : 341, 3rd floor, Faculty of E&A

Phone no. : 6952000 Extension ( 68673)

E – mail: kbashnini@ hotmail.com

E – site: http:// kbashnini.kau.edu.sa/

Office hours: Sat.

11:16:00

Sun. & Tues.

12:30 – 14:30

Course Description:

This course introduces the accounting system for a large size company where the special journals and

subsidiary ledgers are used. It covers the major characteristics and accounting entries for formation and

profit distribution of partnerships and corporations. Financial statements analysis is also included.

Classifications of manufacturing costs and the flow of costs in a job order costing system and break-even

analysis are also covered.

Course Objectives:

1.

2.

3.

4.

Analyze and record transactions for large-size companies.

Analyze, record and report transactions for partnerships and corporations.

Analyze and interpret financial statements.

Summarize and apply financial and managerial accounting terms, concepts and principles.

5. Analyze the break-even point.

Course Outcomes:

By the end of this course, students should be able to:

1. Handle records of large size companies.

2. Recognize company's formation (both partnership and corporation), and distribution of their

profits.

3. Analyze financial statements.

4. Determine the unit cost for job order systems.

Assessment Methods:

1. Exams:{ Mid- term Exam. (30 points ); Second- Exam. (30 points); Final – Exam. (40

points)}

2. Participation.

3.Assignments

Main Reference:

Weygandt, Kimmel and Kieso. Accounting Principles, International Students Version. (John Wiley &

Sons, Inc., 9th ed., 2010).

1

Supplementary Reference:

Larson, Wild, and Chiappetta. Fundamental Accounting Principles, (McGraw-Hill, 17ed, 2005).

Acct. 213 Syllabus

Chapter

CH.7

Contents

Accounting Information Systems:

1. SUBSIDIARY LEDGER.

2. SPECIAL JOURNALS

Ch.12

Accounting for Partnership:

1. THE PARTNERSHIP FORM OF ORGANIZATION.

2. BASIC PARTENERSHIP ACCOUNTING

3. THE BASES FOR DIVIDING NET INCOME OR NET LOSS

4. PARTNERSHIP FINANCIAL STATEMENTS

CH.13

Corporations: Organization and Capital Stock Transactions:

1. THE CORPORATE FORM OF ORGANIZATION

2. ACCOUNTING FOR ISSUES OF COMMON STOCK

3. PREFERRED STOCK

4. STATEMENT PRESENTATION

Page

300-321

305- 307

308-321

528- 538

528-532

533-538

568-591

570-579

579-582

586-587

587-588

Mid -term Exam. ( Covers CH.7, 12 and 13)

CH.14

CH.18

CH.19

CH.20

CH.22

Corporations: Dividends, Retained Earnings, and Income Reporting:

1.DIVIDENDS: Cash Dividends, Stock Dividends, Stock Splits.

Financial Statement Analysis:

1. BASICS OF FINANCIAL STATEMENT ANALYSIS.

2. HORIZONTAL ANALYSIS.

3. VERTICAL ANALYSIS.

4. RATIO ANALYSIS.

Managerial Accounting

1. MANAGERIAL COST CONCEPTS: Manufacturing cost, Direct Materials, Direct

Labor, Manufacturing Overhead

Second Exam. ( Covers CH.14, 18 and 19)

Job Order Costing:

1. COST ACCOUNTING SYSTEMS.

2. JOB ODER COST FLOW.

Cost – Volume – Profit (CVP):

1. COST BEHAVIOR ANALYSIS: Variable Costs, Fixed Costs, Mixed Costs.

2. COST-VOLUME-PROFIT (CVP) ANALYSIS: Basic Components, CVP Income

Statement, Contribution Margin Per Unit, Contribution Margin Ratio, Break-Even

Analysis, Target Net Income, Margin of Safety.

606-617

790-811

792-793

793-796

797-799

799-811

849-850

849-850

886-905

888-890

890-905

--------976-983

983-991

Reference site:

http://eu.wiley.com/WileyCDA/WileyTitle/productCd-0470409460.html

Students

Companion Sites

:كيفية الدخول إلى موقع المحاضر

http:// kbashnini.kau.edu.sa / ادخل إلى موقع المحاضر.1

.. أدخل إلى خانة الملفات ثم أضغط على السيره الذاتيه.2

2