213 syllabus- first semester-2014.doc

advertisement

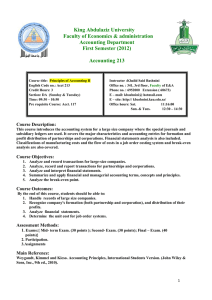

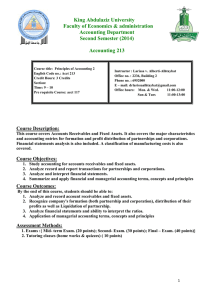

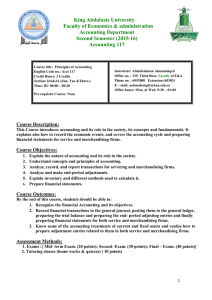

King Abdulaziz University

Faculty of Economics & administration

Accounting Department

First Semester (2014)

Accounting 213

Course title: Principles of Accounting II

English Code no.: Acct 213

Credit Hours: 3 Credits

Section: GB (Monday & Wednesday)

Time: 11:00 – 12:20

Pre requisite Course: Acct. 117

Instructor : Turki Jabarah ALJohni

Office no. : 3136, 3rd floor, Faculty of E&A

Phone no. : 6952000 Extension (68673)

E – mail: gabarah@gmail.com

E – site: http://www.kau.edu.sa/DRS0007186.aspx

Office hours: Sun.

10:00 - 15:00

Mon. & Wed.

12:30 – 15:00

Course Description:

This course covers the major characteristics and accounting entries for formation and profit

distribution of partnerships and corporations. Financial statements analysis is also included. A

classification of manufacturing costs is also covered.

Course Objectives:

1.

2.

3.

4.

Study accounting for receivables and fixed assets.

Analyze record and report transactions for partnerships and corporations.

Analyze and interpret financial statements.

Summarize and apply financial and managerial accounting terms, concepts and principles

Course Outcomes:

By the end of this course, students should be able to:

1. Analyze and record account receivables and fixed assets.

2. Recognize company's formation (both partnership and corporation), and distribution of

their profits.

3. Analyze financial statements.

4. Application of managerial accounting terms, concepts and principles

Assessment Methods:

Exams :{ Mid- term Exam. (30 points); Second- Exam. (30 points); Final – Exam. (40

points)}

Main Reference:

Weygandt, Kimmel and Kieso. Accounting Principles, 9th Edition, International Students Version.

(John Wiley & Sons, Inc, 2010).

Supplementary Reference:

Larson, Wild, and Chiappetta. Fundamental Accounting Principles, (McGraw-Hill, 17ed, 2010).

Attendance:

1. Class attendance is very important to achieve the best understanding of the course material

since topics are closely related and dependent. Each class benefits from the attendance and

participation of all students. Late arrivals are disruptive to the class and show disrespect to

1

those who are on time. Students who miss 25% of term lectures will get a “DN” grade.

2. Attending the Tutorial classes is highly recommended as this will enable you understand the

material faster.

Minimizing Disruptions:

Mobile phones should be turned off during class. You should avoid engaging in side conversations

during class

Cheating:

Cheating of any form will result in your being assigned an “F” grade for the course. Note that you

may not use your mobile phone during lectures and examinations.

Examination Absence:

If you miss an examination, you will be assigned a grade of “0” for the particular exam. Note that

a make-up examination will not be administered.

Acct. 213 Syllabus

Chapter

CH. 9

Contents

Accounting for Receivables

Pages

396 - 415

CH. 10

Plant Assets, Natural Resources, and Intangible Assets

436 - 459

Mid -term Exam. ( Covers CHs .9 and 10) - Thursday 4-1- 1435 H; 2-4

pm.

Ch.12

Accounting for Partnership

526 - 544

CH.13

Corporations: Organization and Capital Stock Transactions

568 - 588

CH.14

Second Exam. ( Covers CHs. 12 and 13) - Thursday 9-2- 1435 H ; 2-4 pm.

Corporations: Dividends, Retained Earnings, and Income Reporting

606 - 623

CH.18

Financial Statement Analysis

790 - 817

CH.19

Managerial Accounting

842 - 860

Final Exam. ( Comprehensive; Covers CH. 14, 18, 19 and previous

chapters)

2