ppt from class

advertisement

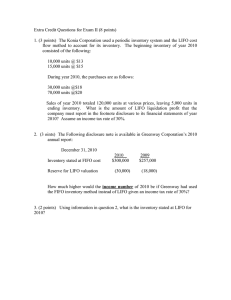

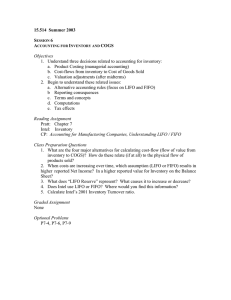

Q 1: Under a periodic inventory system ending inventory and cost of goods sold are determined A. B. C. D. After each sale After each purchase and sale At the end of the accounting period Don’t know Q 2: Which of the following is not an advantage of the perpetual system? A. B. C. D. Useful to determine shrinkage Cheap to use in a manual as well as a computerized system Useful to determine reorder needs Timely updates of inventory balances and cost of goods sold Shrinkage A. B. C. D. Is not a problem in a perpetual system Must be reported as a separate loss on the income statement May be treated as part of cost of goods sold expense Can be deducted as an expense only if it has been reported to the police Beg. inventory: 20 units @ $5 = $100 Purchases: 60 units @ $20 = $1,200 Purchases: 10 units @ $30 = $300 Sales: 70 units. FIFO ending inventory is A. B. C. D. E. $ 100 $ 200 $ 300 $ 250 $ 500 Beg. inventory: 20 units @ $5 = $100 Purchases: 60 units @ $20 = $1,200 Purchases: 10 units @ 30 = $300 Sales: 70 units Using LIFO ending inventory will be A. $ 100 B. $ 200 C. $ 300 D. $ 250 Beg. inventory: 20 units @ $5 = $100 Purchases: 60 units @ $20 = $1,200 Purchases: 10 units @ 30 = $300 Sales: 70 units Under LIFO cost of goods sold will be A. $ 1,200 B. $ 1,244 C. $ 1,400 D. $ 1,500 Q 6: LIFO A. B. C. D. Always results in lower income taxes than FIFO Is used to show higher net income Is not permitted unless the actual flow of inventory is last in, first out Results in higher cost of goods sold during inflation Which of the following statements is false? LIFO A. B. C. D. E. Must be used for financial reporting purposes, if it is used for tax purposes May result in income manipulation Is a method of cheating on income taxes Requires extensive record keeping Is not permitted in all countries LIFO Liquidation A. B. C. D. Occurs because management does not purchase enough inventory May be involuntary May be deliberate to manipulate earnings All of the above Exercise 15 A. B. C. Determine ending inventory using FIFO Determine ending inventory using LIFO Determine ending inventory using Average Cost Dollar Value LIFO A. B. C. D. Is used to manipulate earnings Requires the use of inventory specific pools Eliminates the need to determine if there have been increases or decreases in total inventory Requires the use of price level indexes W Co. uses $ value LIFO. Base year inventory (index 100) cost $ 500,000. On 12/31/06, inventory on hand had a current cost $ 577,500 and base year cost of $ 525,000. The price level index on 12/31/06 is A. B. C. D. .909 1 1.1 1.155 W Co. uses $ value LIFO. Base year inventory (index 100) cost $ 500,000. On 12/31/06, inventory on hand had a current cost $ 577,500 and base year cost of $ 525,000. The price level index on 12/31/06 is 1.1. $value LIFO ending inventory on 12/31/06 is A. B. C. D. 525,000 527,500 552,500 577,500 Exercise 25 Determine ending $ value LIFO inventory for 2002 Determine ending $ value LIFO inventory for 2003 Determine ending $ value LIFO inventory for 2004 Answers 1. 2. 3. 4. 5. 6. 7. 8. 9. C B C E A D D C D 10. A. 18,000(FIFO) 1. 2. 11. 12. 13. 14. B. 13,800 (LIFO) C. 15,858 (Average) D C B $111,500 1. 2. $90,500 95,700