MRS Grant Seminar 2014

advertisement

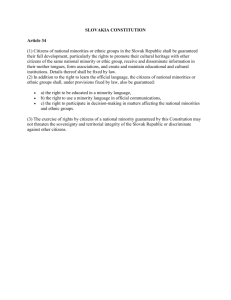

The U.S. Department of Education’s Minorities and Retirement Security (MRS) Program: First MRS Grant Seminar June 10, 2014 CHICAGO STATE UNIVERSITY Department of Computer Science, Mathematics, & Economics, Project Director and Faculty Mentors: Aref Hervani Elizabeth Arnott-Hill Philip Aka MRS Grant U.S. Education Department and Social Security Administration Award Four Grants to Improve Retirement Security within Minority Low-Income Communities: Florida A&M University, Tallahassee Chicago State University University of Houston-Downtown Hampton University The purpose of the program is twofold: (1)to provide opportunities for graduate students at institutions with high proportions of minority and low income students to conduct rigorous research in these needed fields. (2)to address the financial literacy and retirement planning needs within minority and low-income communities. Goals and Objectives: Goal I Goal I: Diversify the literature on minorities, and retirement security and financial literacy interventions by increasing the volume of research and publishing of minority scientists. Goal I: Outcome By the end of the grant cycle, the research and scholarly activity produced by the fellow strained in the project show a significant increase in the number and quality of academic writings in the area of inquiry suitable for publishing. Goals and Objectives: Goal II Goal II: Improve the academic currency of minority student scientists who conduct high quality research in areas of retirement security, financial literacy, and/or financial decision-making within minority and low-income communities. Goal II: Outcome There will be a significant increase in the number of welltrained minority scientists who are able to conduct research in areas of retirement security, financial literacy, and/or financial decision-making within minority and low-income communities. Goals and Objectives: Goal III Goal III: Implement on-going assessment activities that will demonstrate project outcomes. Goal III: Outcome The final evaluation will demonstrate how well the project met the goals and objectives set forth in grant application and if stakeholders derived a benefit. Summary of Major Activities Research Program The project is designed as an intensive research apprenticeship for minority student scientists. The research project is designed to collect data from low-income and minority communities as it relates to financial literacy and financial decisionmaking interventions, analyze, build models, make recommendations. Research Program The first year would be spent on doing: (a) (b) (c) (d) A comprehensive literature review Analyze and evaluate the existing methodologies utilized by previous studies Identify regional data sources Conduct preliminary regression analysis, evaluate current or build new mathematical models using the existing data for the south side Research Program (e) (f) (g) Present the preliminary findings and models. Construct Survey Questionnaires and identify ways through which SQ could be distributed, completed, and collected. Investigate the associated costs and time required for SQ completion. Research Workgroups: Actions Fellows are assigned to one of three interdisciplinary research workgroups of 2-3 students per team. Fellows will have access to all mentors Research Workgroups Group I will design a research program to analyze/collect data on the impact, scope and duration of behavioral change among minority groups who have participated in financial literacy interventions. Group II will design a research program to analyze/collect data that focuses on demographics and wealth disparities among retiring low income and minority groups. Group III will be trained to analyze the findings from Group I and Group II in order to develop mathematical models on retirement security and financial literacy for low income and minority communities. Research Workgroups Group I: will design a research program to analyze/collect data on the impact, scope and duration of behavioral change among minority groups who have participated in financial literacy interventions. Faculty Mentor: Dr. Elizabeth Arnott-Hills Student Fellows: Austin Percy Torell Pernel Tamara Williams Research Workgroups Group II: will design a research program to analyze/collect data that focuses on demographics and wealth disparities among retiring low income and minority groups. Faculty Mentor: Dr. Philip Aka Student Fellows: Rosemary Spaulding Thomas Buckner Keith Brown Research Workgroups Group III: will be trained to analyze the findings from Group I and Group II in order to develop mathematical models on retirement security and financial literacy for low income and minority communities. Faculty Mentor: Dr. Aref A. Hervani Student Fellows: Saeid Delnavaz Koffi Dossussssss? Professional Development and Support Publishing / Writing Workshops: A series of workshops that will focus on enhancing the quality of the written and oral presentations of the fellows’ research and introducing them to the intricacies of getting work accepted by scholarly publications will be conducted. Standing Seminar: Biweekly throughout the academic year, the fellows will make presentations on the papers they are assigned to read to peers and mentors. MRS Program Student Fellows Student’ Name Major Beginning Date Ending Date Group I Percy A. Austin Torrel Pernell Masters of Science in Math Master of Science in Computer Science Tamara D. Williams Masters of Art in community Counseling Group II Jennifer I. Jacobs Masters of Arts in Education Science Rosemary Masters of Arts in Education Science Spaulding Buckner, Thomas Masters of Art in Counseling Koffi Dossou Master of Science in Computer Science Group III Kyle Boatright Master of GIS Saeid Delnavaz Master of GIS Keith Brown Masters of Science in Math Feb 1st , 2014 Feb 1st , 2014 April 8th, 2014 Feb 1st , 2014 April 15th, 2014 April 8th, 2014 May 22nd , 2014 Feb 30th Feb 1st , 2014 Feb 1st , 2014 June 1st, 2014 April 30th MRS Program Student Fellows: time Efforts Student Name Starting Date February March April May June anticipated Total Hours Worked Percy A. Austin 2/1 60 60 60 60 60 300 Torrel Pernell 2/1 60 60 60 60 60 300 Kyle Boatright 2/1 60 60 60 -- Saeid Delnavaz 2/1 60 60 60 60 Jennifer I. Jacobs 2/15 45 30 -- -- Tamara D. Williams 4/8 -- -- 52.5 Buckner, Thomas 4/8 -- -- Rosemary Spaulding 4/15 -- Koffi Dossou 5/15 Keith Brown 6/01 Total Students Hours -- 180 60 300 60 60 172.5 52.5 60 60 172.5 -- 45 60 60 165 -- -- -- 30 60 90 -- -- -- -- 60 60 285 270 350 480 1,675 390 -- Progress Report: Student’s Work Student’ Name Total Number of Articles Analyzed Jan Feb March April, May June Group I Percy A. Austin Torrel Pernell Tamara Williams Subtotal Group II Jennifer I. Jacobs Rosemary Spaulding Subtotal Group III Kyle Boatright Saeid Delnavaz Buckner, Thomas Subtotal Total 16 16 16 16 32 32 12 16 12 16 16 16 16 16 R R 12 12 8 8 32 32 R R 12 12 76 80 32 Data Data 16 16 16 16 Data 16 16 48 R R R 32 32 28 92 28 24 52 32 32 28 92 236 Progress Report: Student’s Work Student’ Name Total Number of Pages Written Feb March April, May June Group I Percy A. Austin Torrel Pernell Tamara Williams Subtotal 48 48 0 96 48 48 0 96 30 30 36 96 Data Data 48 48 0 0 30 30 96 96 84 276 Group II Jennifer I. Jacobs Rosemary Spaulding Subtotal 0 36 0 36 0 48 0 48 0 0 24 24 0 0 48 48 0 0 30 30 0 84 72 156 Group III Kyle Boatright Saeid Delnavaz Buckner, Thomas Subtotal 48 48 0 96 48 48 0 96 30 30 36 96 0 Data 48 48 0 0 30 0 96 96 84 276 Total 228 240 96 144 90 708 MRS Program Student Fellows: Data Collection Data Collected: State of Illinois (1) Pension plan participation for Whites and Low Income Minorities. (2) Household Asset for Whites and Low Income Minorities. (3) Marital Status for Whites and Low Income Minorities. (number of married & single people). (4) Asset allocation for Whites and Low Income Minorities. Income Levels for Whites and Low Income Minorities. MRS Program Student Fellows: Data Collection Partial Data Collected: State of Illinois (1) Retirement account balances for Whites and Low Income Minorities. (2) Social Security payout for Whites and Low Income Minorities . (3) Employment-based retirement plans for Whites and Low Income Minorities. (4) Education levels for Whites and Low Income Minorities (college & Masters graduates). (5) Home ownership for Whites and Low Income Minorities . (6) Rental Housing for Whites and Low Income Minorities MRS Program Student Fellows: Data Collection Needed Partial Data Collected: State of Illinois Mutual funds for Whites and Low Income Minorities. Level of Saving for Whites and Low Income Minorities . Credit card debt for Whites and Low Income Minorities . Amount of Social Security income & withdrawal for Whites and Low Income Minorities. Household Size for Whites and Low Income Minorities . Owner for Whites and Low Income Minorities . Gender for Whites and Low Income Minorities. Financial Net Worth for Whites and Low Income Minorities Progress Report: Seminars Seminar Dates Student Presenter Topic Presented February 24, 2014 (1) Percy A. Austin (2) Torrel Pernell (3) Jennifer I. Jacobs (4) Kyle Boatright (5) Saeid Delnavaz Literature Review Major cultural and historical issues that surrounds the minorities’ financial status (1) Percy A. Austin (2) Torrel Pernell (3) Jennifer I. Jacobs (4) Kyle Boatright (5) Saeid Delnavaz Literature Review Major cultural and historical issues that surrounds the minorities’ financial status March 7, 2014 Progress Report: Seminars Seminar Dates March 28, 2014 Student Presenter Topic Presented 1) Percy A. Austin (2) Torrel Pernell (3) Jennifer I. Jacobs (4) Kyle Boatright (5) Saeid Delnavaz Analyze and evaluate: (a) the existing methodologies utilized by previous studies (b) mathematical models on retirement security and financial literacy for low income and minority communities. 1) Percy A. Austin (2) Torrel Pernell (3) Kyle Boatright (4) Saeid Delnavaz Analysis & evaluation of the methods used in the studies and the specific results that were obtained. Formulate a clear conclusion(s) about the factors that influence behavioral change. (1) Percy A. Austin (2) Torrel Pernell (3) Saeid Delnavaz (4) Tamara D. Williams (5) Buckner, Thomas (6) Rosemary Spaulding (1) Present & Discuss Data Identification & Collection (2)Major cultural and historical issues that surrounds the minorities’ financial status April 25, 2014 May 30, 2014 Progress Report: Minorities Retirement Security Center http://www.csu.edu/mrsc/ Progress Report: Community Contact The Illinois Department of Aging Dr. John Holton, Director of the Illinois Department of Aging. Fathers, Families and Healthy Communities Dr. Kirk E. Harris, MPA, JD, PhD, Esq. Senior Advisor Thank You