Strategey Theory Slides

advertisement

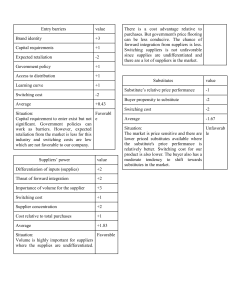

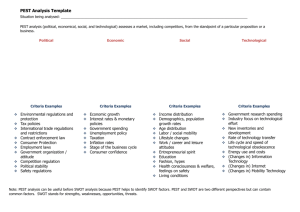

Strategy and Industry Analysis GBUS 600 SWOT PEST and Strategy What you have NOT thought about will come back to haunt you! PEST • Political factors include areas such as tax policy, employment laws, environmental regulations, trade restrictions and tariffs and political stability. • Economic factors are growth, interest rates, foreign conditions, exchange rates, and prices. • Social factors often look at the cultural aspects and include health consciousness, population growth rate, age distribution, career attitudes and emphasis on safety. • Technological factors include ecological and environmental aspects. Technological factors look at elements such as R&D activity, automation, technology incentives and the rate of technological change. SWOT • Internal – This is company specific! – Strengths – Weaknesses • External – Opportunities – Threats Goal! • To achieve AND sustain an above average rate of return. • HOW? – Position your company where the industry is the weakest. What do others NOT do? – Exploit changes in the FORCEs. – Rearrange the forces in you favor. Industry (Porter) Overview! • What forces are powerful and can reduce profits and what forces are weak and can be exploited. • 5-forces – Entry – Buyer power – Seller power – Substitutes – Rivalry Entry • • • • Supply-side: huge fixed costs (scale). Demand-side: buyer loyalty (scale). Switching costs. Capital requirements – Inventory – Financing • Distribution channels • GOVERNMENT! Supplier Power • Switching costs • Limited substitutes • Forward integration Who are your suppliers? Buyer Power • Few buyers • Price sensitive (elasticity of demand) – Large share of budget – Limited income – Quality does NOT matter much – Easy substitutes Rivalry • • • • Numerous competitors Slow growth Difficult to exit Homogeneity Substitutes • • • • There is a substitute for everything! Definition of industry matters. Switching costs? Price-performance tradeoff. Common Pitfalls* • Defining the industry too broadly or too narrowly. • Making lists instead of engaging in rigorous analysis. • Paying equal attention to all of the forces rather than digging deeply into the most important ones. • Confusing effect (price sensitivity) with cause (buyer economics). • Using static analysis that ignores industry trends. • Confusing cyclical or transient changes with true structural changes. • Using the framework to declare an industry attractive or unattractive rather than using it to guide strategic choices. *Porter, Michael E., “The Five Competitive Forces that Shape Strategy.” Harvard Business Review – reprint, January 2008, p.16. STRATEGY • Any good strategy starts with a statement of where you are going! – a VISION! • Mission – why we exist, what we do. • Values – what we believe in (ethics, green, …) • Vision – what we want to be! Your Strategy • If it is the same as any competitors, you do not have one. • GOALS – SMART – Specific, measurable, assessable, reasonable, time bound. • Scope – whom do we serve? • Benefits of a strategy?