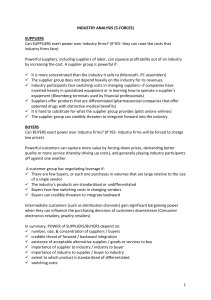

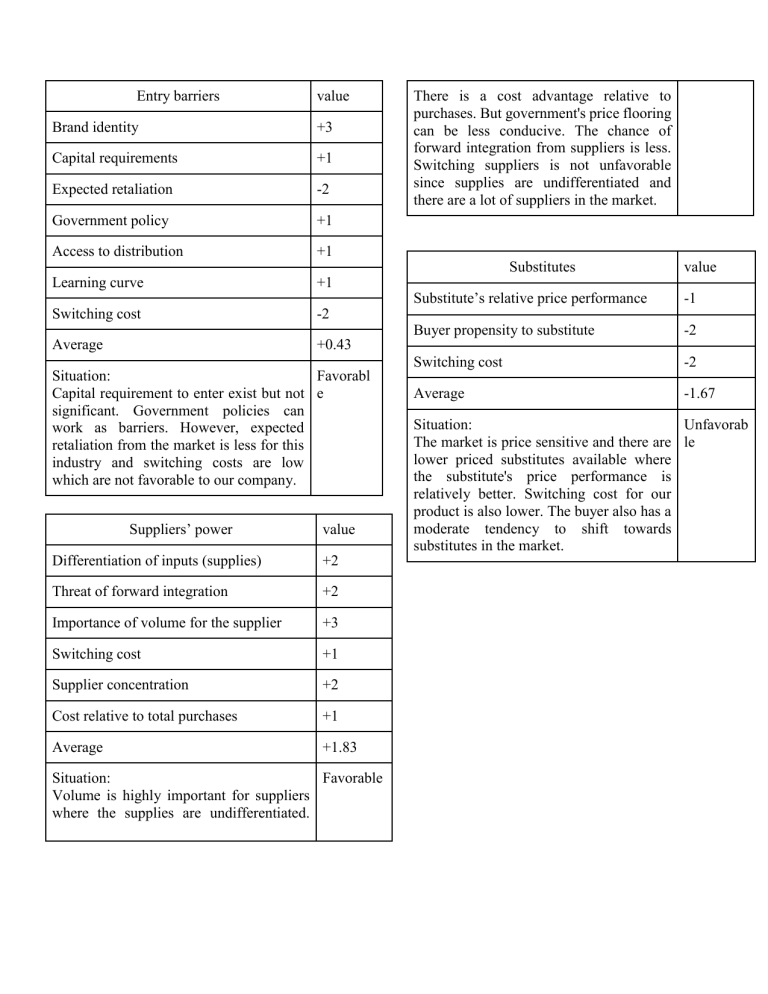

Market Analysis: Entry Barriers, Suppliers, Substitutes

advertisement

Entry barriers value Brand identity +3 Capital requirements +1 Expected retaliation -2 Government policy +1 Access to distribution +1 Learning curve +1 Switching cost -2 Average +0.43 There is a cost advantage relative to purchases. But government's price flooring can be less conducive. The chance of forward integration from suppliers is less. Switching suppliers is not unfavorable since supplies are undifferentiated and there are a lot of suppliers in the market. Substitutes Situation: Favorabl Capital requirement to enter exist but not e significant. Government policies can work as barriers. However, expected retaliation from the market is less for this industry and switching costs are low which are not favorable to our company. Suppliers’ power value Differentiation of inputs (supplies) +2 Threat of forward integration +2 Importance of volume for the supplier +3 Switching cost +1 Supplier concentration +2 Cost relative to total purchases +1 Average +1.83 Situation: Favorable Volume is highly important for suppliers where the supplies are undifferentiated. value Substitute’s relative price performance -1 Buyer propensity to substitute -2 Switching cost -2 Average -1.67 Situation: Unfavorab The market is price sensitive and there are le lower priced substitutes available where the substitute's price performance is relatively better. Switching cost for our product is also lower. The buyer also has a moderate tendency to shift towards substitutes in the market.