REVIEW FOR TEST III Micro.doc

advertisement

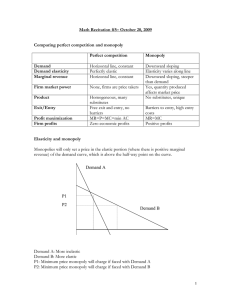

STUDY GUIDE AND REVIEW FOR TEST III Econ 2302 Microeconomics Test covers Chapters 12 – 17 12. 13. 14. 15. 16. 17. Perfect Competition Monopoly Oligopoly Monopolistic Competition Externalities and Public Goods Asymmetric Information (Adverse Selection and Moral Hazard) I. Understand these four Market structures: perfect competitor monopoly monopolistic competitor oligopoly Know examples and characteristics of each market structure: number of firms, nature of demand, and nature of product—differentiated or not (i.e. fungible) , ease of a firm to enter or exit the industry Understand these key decision points: maximum profit position; breakeven point; shutdown and exit industry points. The short term economic environment is in some ways the same for the Monopoly, Oligopoly, and Monopolistic Competitor. The Monopoly is content to stay in the short-term position forever, but needs barriers of entry in order to preserve its monopoly position. So its short term is the same as its long term as long as it is successful in remaining a monopoly. The others are pushed into a different long term equilibrium position, because other firms enter the industry as long as there is a profit. When all profit is squeezed out, i.e. when P = ATC, other firms are no longer are attracted to enter the industry. Neither do they need to exit since recall that the ATC includes both explicit and implicit costs, and one of the implicit costs is the opportunity cost of the inputs of the firm’s owner. Thus, his/her normal profit is included. This is the minimum that keeps him or her in the business. Thus, at the breakeven point there is no economic profit, but there is the included normal profit. This is equal to the imputed value of the owner’s opportunity cost. So, at the long term breakeven position there is no attraction for firms to enter or exit. II. Understand the characteristics of each of the market structures. Consider these salient characteristics: Number of firms; nature of the product the firm produces; ease or difficulty of entry and exit -- barriers to entry; ability to influence price; the nature of its demand curve, etc. To these also consider how firms in each market structure might advertise or conduct research and development. Know examples of firms in each of these four market structures. III, Consider these basics that apply to all firms in any of these market structures. A. To maximize the firm’s profit each seeks to produce at an output level at which MC = MR. B. They all have fixed costs and variable costs C. Eventually marginal costs rise. In the early levels of production, MC may fall. But eventually they rise because eventually diminishing returns set in. D. Marginal costs may fall (pulling down average costs) as firms benefit from division of labor and specialization. However, when diminishing returns set in, marginal coast rise and pull up average total cost. E. With the cost of each extra unit of output (MC), the Average Total cost is being redefined. If lower than ATC, MC pulls the average down. If higher than ATC, then MC pulls the average up…..So, MC always crosses the ATC at the minimum ATC. (Think about my example of your Grade Point Average and each marginal course you take.) F. The decision to close down or not depends on whether price covers variable costs or not. If Price is greater than average variable costs, then the excess pays part of fixed cost, rendering it advantageous to continue in business even at a loss. That loss is less than closing the business completely, since if the business is closed, it would still have to pay the fixed cost. The firm does not need to lose more than the Fixed Cost. IV. Consider these basics that are different among the market structures A.. The Nature of the demand and Marginal Revenue. 1. The Perfect Competitor is a market taker since the Perfect Competitor faces a perfectly elastic demand curve. Depicted by a horizontal demand curve. The Perfect Competitor can sell any quantity at the industry price. 2. Since the Perfect Competitor’s demand curve does not decline, the marginal revenue curve does not decline either. 3. Thus, Marginal revenue is equal to Price for the Perfect Competitor 4. Marginal Revenue is less than Price for the Monopoly, the Monopolistic Competitor, and the Oligopoly. They may sell more output, but they do so at a lower price. And as Price declines Marginal Revenue also falls. If they choose a higher price, they give up some quantity demanded. These firms face a Price – Quantity Demanded decision. B. For the Perfect Competitor in the long run P=MR=MC= ATC at its minimum Thus, in the long term breakeven point, (when all firms entering and exiting the industry is completed), society is getting the maximum output, at the minimum average cost, and at a Price that equals marginal cost. Price represents the benefit derived for the buyer. Thus, marginal benefit = marginal cost. This maximizes society’s position and is the maximum efficiency of resource allocation. C. For the other market structures, P > MR =MC and the firm’s maximum profit output quantity is not at the minimum ATC. Society would be willing to pay a Price higher than Marginal Cost, but this position is not in the maximum profit making interest of the firm, who stops at MC =MR, which is < P. Understand that this concept is at the heart of antitrust legislation that seeks to prevent or at least regulate chartered monopolies and oligopolies. This position is a hotly debated position among economists, business persons, lawyers, and the issues associated with these concepts fill law libraries. Understand these concepts so you can enter this discussion. (Good Luck.) D. With an understanding of firms in the four market structures, how would you assess their behavior with advertising decisions, with research and development decisions? Pricing and output decisions? V. Understand these points for each of the markets structures: G. Profit maximization point: MC = MR H. The Breakeven point: Zero Economic Profit P = ATC I. The shut down -- go out of business point. P can’t cover AVC VI. Understand these concepts and points: Monopolies can be resource monopolies; sanctioned monopolies sustained by copyrights, patents, or charters; or natural monopolies that exist because a market can sustain only one firm – a forced division would cause each to “ride up its cost curve” and be unable to survive or it might survive at the added expense to consumers. Society often extends a franchise that allows a monopoly but Society regulates rates. This is a compromise to obtain the advantage of size but avoid the abuse of power. Oligopolies have few participants (2 – 12) and are best understood through game theory: the few firms strategically engage in price and business actions but avoid the illegal practice of explicit collusion. They sometimes undertake implicit price leadership behavior, and actions that can be depicted by kinked or cornered demand curves. These arise if other firms match one firm’s reduction in price, but do not match an increase in price. Oligopolies would like to be monopolies. There are a few firms and they know each other and they can see benefits if they collude. (However, they can go to jail for colluding. Don’t even think about it!) Oligopolies are sometimes defined by Market share concentration, for example, the “four firm ratio.” (The top 4 firms in an industry comprise about 45% market share) Oligopolies that form cartels are in essence trying to behave as a monopoly. OPEC is an example. (Cartels to fix price and interfere with commerce are not legal in the U.S.) Barriers to entry clearly may arise from controlling a basic resource, by copyright or patent, or by large financial requirements. What is meant by “a normal profit”? What are “accounting profits” and “economic profits”? VII. Other Concepts: What is meant by Resource Monopoly? (A firm controls all the basic resource supply – e.g. for a time, DeBeers controlled diamonds; Alcoa controlled aluminum.) What is a Natural Monopoly? (the capital requirements and the size of the market allow only one successful firm in a particular market – often: a utility company such as a power plant.) VIII. Be comfortable with the following dynamics underlying the cost and revenue curves: Profit Maximization point/loss minimization point is : MC = MR This is fundamental to all market structures. Total revenue (Price x Quantity) Marginal Revenue Why does Marginal Revenue = Price for the Perfect Competitor? Why is MR < P for all the other market structures? Review all costs: Total cost = fixed cost + variable cost Understand average Variable cost AVC average fixed cost AFC Marginal costs MC Average total costs ATC Law of Diminishing Marginal Returns (for example: using a plant more intensely; adding more of some factors of production while holding others constant—the output of the factor held constant will at some point diminish – this is where “diminishing returns set in”..) When does the firm exit the business? The Shut down point for a firm (price is less than AVC. A firm’s Maximum loss is its fixed cost, so if all variable costs are being covered, the firm is able to pay part of the fixed cost. Thus, it is better to continue in business even it is operating at a loss. The loss would be even greater if it shut down, since it would still be responsible for the full fixed cost. In the long run, it of course would have to shut down if TR < TC which is to say if ATC < AR (P). Importance of MC = MR (Profit maximization or loss minimization rule). This is a fundamental for all firms in all market structures. For the Perfect Competitor MR = P; for the others MR < P Review: What are Explicit and Implicit costs ? Total Revenue – Total Cost = Profit Accounting Profits (Total Revenue less explicit cost) Economic Profit (Total Revenue less both explicit and implicit cost). This is the same as saying Total Revenue less Total Costs (Total cost to an economist includes both explicit and implicit costs) What is meant by Normal profit? (the opportunity cost of the firm owner’s own time or use of the owner’s own capital or land)-- i.e. what he/she could make working for someone else.) Price taker – such as the perfect competitor who has no control over price. Cartels and cartel pricing (Oligopolies behaving as monopoly as OPEC tries to do) What is Collusion? (We saw in game theory that unregulated oligopolies tend toward collusion.) What is meant by the kinked demand curve (or cornered demand curve)? elastic above a price point and inelastic below it: this renders it kinked. (Airline fare matching on downside and not matching on upside . is good example of cornered demand curve.) Balanced and unbalanced Oligopoly What is the Herfindahl-Hirschman Index? How is it used by Federal Trade Commission or Justice Department? < 1000 generally no concern with concentration in an industry 1000—1800 mergers and acquisitions may be questioned, especially if result increases H-H Index by 100 or more > 1800 almost certain concern and perhaps merger or acquisition disallowed if H-H Index increases by 50 or more IX. EXTERNALITIES A. A pure Free market (ala Adam Smith and the “invisible hand”) results in an equilibrium price based on supply and demand, and this price influences how we as a society allocate our scarce resources. However, this process may not include “spillover” costs or benefits that affect third parties. When these external costs or benefits are not considered, society’s resources are not allocated in an optimum manner. Since economics wrestles with the allocation of society’s scarce resources, we must consider EXTERNALITIES. B. Negative externalities exist when external COSTS exist; Positive externalities Exist when external benefits exist. Negative externalities. Cigarette smoking and medical costs associated with lung cancer or environmental pollution were examples of negative externalities discussed in class. Unless we internalize these externalities we would overproduce cigarettes as well as the goods that are associated with the environmental pollution. Positive externalities. The “spillover” benefit from education is an example we discussed in class. Unless we “internalize these benefits from education, we would under produce education. Depending on circumstances, we can use fines, taxes, subsidies, legal proceedings, etc. to solve problems arising for externalities. In some cases the private sector can sort out and correct externalities – Ronald Coarse who advocates what we know as the Coarse Theorem argues that The state is not always the only solution to solving externality issues. X. PUBLIC GOODS A. Public goods have two defining characteristics: they are non-rival and nonexcludeable . Understand the distinction between rival and non-rival Understand the difference between excludeable and non-excludeable B. The private sector eagerly produces goods that are rival and excludeable, but there is little or no incentive for the private sector to produce goods that are non-rival and non-excludeable. Hence we may have a “market failure” to produce goods and services such as: national defense, street lights, judicial systems, etc. If produced at all, these goods and services are Produced by the state. C. Be clear that the state often produces “private goods”: such as a cabin at a Texas state park. Such a good or service is excludeable and rival. We do this because we consider these goods “Merit Goods” -- good for society. We consider art galleries, libraries, parks, etc. to be merit goods. (“Demerit goods” are goods that we as a society consider “bad” for us— e.g. cigarettes or alcohol. These often attract taxes and regulation.) D. Other concepts to review: Freerider; “tragedy of the commons” XI. ASYMETRIC INFORMATION A. Adverse selection. A situation in which an informed party benefits in an exchange because he or she knows more than the other party. A health insurance company wants to sell insurance to a whole group. If it is NOT a group policy, and each person is allowed individually to buy or not buy the insurance. Those that know they are healthy and know they rarely Get sick or call a doctor, may opt out of buying the insurance policy. They basically “self-insure themselves”. The statistical base now changes for the insurance company. The selection process may ultimately lead to the insurance company only insuring hypochondriacs. This is why insurance companies want group policies – they can calculate the probabilities statistically and charge rates accordingly. They do not want to be caught with adverse selection working against them. B. Moral Hazard refers to changing your behavior and taking more risk after you are insured. Consider our recent banking crisis: Banks normally scrutinize applicants very thoroughly before making loans. After the banks were guaranteed protection by government agencies, the banks made NINJA loans (“No Income; No Job, Allright”) or “Liars’s Loans: The Bank: “What’s your income?” Applicant: “A million a year.” The Bank” “Fine, here’s your loan.” After being insured, the bank changed its “moral obligation to perform as it was expected to.”