Econ212 Study Guide for Exam Two

advertisement

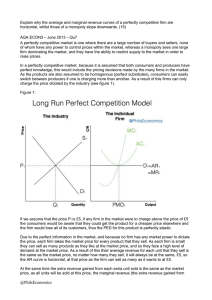

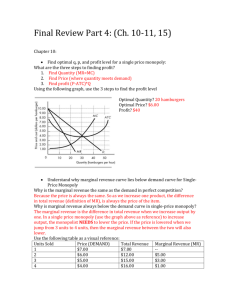

Study Guide for Exam Two Economics 212 Exam date: 7 December 2011 The most important part of the next exam is Industrial Organization, Chapters 14 through 17 in the text. The second most important part of the next exam is Markets for Factors of Production, Chapter 18. 13. Know the differences among economic profit, normal profit, and accounting profit. (321-322) Know the difference between long and short run as give on p. 324. Know the cost definitions given in Table 13.4 (335) Know the definition of economies of scale. (339) 14. Know the four types of industrial organization (348) and the characteristics of each; for example, number of firms, type of product, barriers to entry, whether the firm is a price taker or a price setter, and whether a socially efficient output level is achieved. Know how the PC firm decides how much to produce. (352) Know when the PC firm will shut down. (354) Know when PC firms will enter and exit in the long run and what effects this process produces. (363-365) 15. Know how a monopoly arises and the three types of monopolies. (376) Know the difference between a single-price monopoly and price-discriminating monopoly and why a monopoly might seek to price discriminate. (378, 391) Know how a monopoly arrives at a profit-maximizing price and output decision. (383) Know how to define rent seeking behavior and why it is socially undesirable. (387) Know the types of monopoly regulation and their goals as given in section 15.5. In particular, know the difference between the average cost pricing rule and marginal cost pricing rule. (398-399) 16. Page 1 of 2 Know how MC firms arrive at profit maximizing output. (414) 17. Know the argument made in The Oligopoly Cartel Dilemma . (438) Know how the Nash Equilibrium is achieved. (442) Know the aims, goals, and history of antitrust legislation. ((449-451) 18. Understand how a firm’s demand for a factor of production is related to that factor’s value of marginal product. (462-463, 473, 474,) 7. Know how price supports and subsidies distort efficient outcomes. (181-182) 8. Understand the concept of tax incidence and know how to determine who is really paying a tax. (190191) Understand the relationships among price elasticities, taxes, and efficient outcomes. (193-194) Know the difference between a marginal tax rate and an average tax rate. (197) 9. Understand how gains from trade can be achieved. (77, 220-221) Understand the effects of tariffs and quotas. (224-227) Know the arguments and counter arguments for trade restrictions. (231-235) 10. Know the concept of Marginal Social Cost and how externalities lead to socially inefficient output decisions. (245-247) Know the concept of Marginal Social Benefit and how externalities lead to socially inefficient output decisions. (255) Know the Coase Theorem. (248) Page 2 of 2