Coates

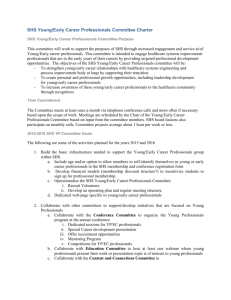

advertisement