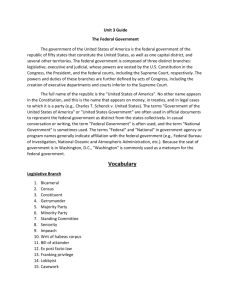

1a

advertisement

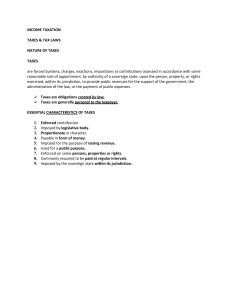

Chapter 1 Types of Taxes and the Jurisdictions that Use Them Welcome to the course As you are aware, having accessed this powerpoint presentation, the slides/lecture comments for this course will be accessible through my web page. Everything else will be accessed through Blackboard. Course grades will be based on homework and 3 exams—each weighted at 25%. As in 5301, I will host weekly conference calls (beginning next week) to discuss issues, answer questions, etc. Definitions Tax = payment to support government contrast with fine/penalty or user fee Taxpayer = person or organization that pays tax (includes individuals and corporations) Incidence refers to ultimate economic burden of a tax. may not be person who pays tax Jurisdiction is the right of a government to tax. Tax formula Tax revenue = rate x base Rate can be flat or graduated (usually progressive) Base may change in response to changes in rate Supply Side Economics Discussion Supply Side Economics – predicated on lowering tax base and corresponding increase in tax rate. Stimulate increases in disposable income, GDP, consumption , consumer confidence, decrease unemployment…Does it work? Jurisdiction Taxpayers are often subject to multiple tax jurisdictions Local (city, county) State Federal Foreign tax authority Conflicts are usually minimized by allowing either: A deduction from the tax base against which the jurisdiction with the secondary claim assesses tax, or A credit against the tax imposed by the jurisdiction with a secondary claim