Macroeconomics ECON 2301 Fall 2009 Marilyn Spencer, Ph.D.

advertisement

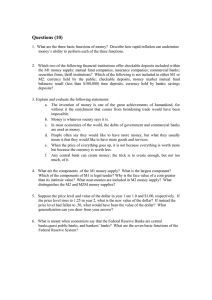

Macroeconomics ECON 2301 Fall 2009 Marilyn Spencer, Ph.D. Professor of Economics Chapter 15 Chapter 15: Money, Banking, and Central Banking Learning Objectives Define the fundamental functions of money Identify key properties that any goods that function as money must possess Explain official definitions of the quantity of money in circulation Understand why financial intermediaries such as banks exist Describe the basic structure of the Federal Reserve System Discuss the major functions of the Federal Reserve 15-3 Money Money Any medium that is universally accepted in an economy both by sellers of goods and services and by creditors as payment for debts 15-4 Table 15-1 Types of Money 15-5 The Functions of Money The 4 functions of money 1. Medium of exchange 2. Unit of accounting 3. Store of value (purchasing power) 4. Standard of deferred payment 15-6 The Functions of Money (cont'd) Medium of Exchange Any item that sellers will accept as payment Barter The direct exchange of goods and services for other goods and services without the use of money 15-7 The Functions of Money (cont'd) Medium of exchange Money facilitates exchange by reducing transaction costs associated with means-ofpayment uncertainty. • Permits specialization, facilitates efficiencies Barter Simply a direct exchange • Double coincidence of wants 15-8 The Functions of Money (cont'd) Unit of Accounting A measure by which prices are expressed The common denominator of the price system A central property of money 15-9 The Functions of Money (cont'd) Store of Value The ability to hold value over time A necessary property of money Money allows you to transfer value (wealth) into the future. 15-10 The Functions of Money (cont'd) Standard of Deferred Payment A property of an item that makes it desirable for use as a means of settling debts maturing in the future An essential property of money 15-11 Liquidity Liquidity The degree to which an asset can be acquired or disposed of without much danger of any intervening loss in nominal value and with small transaction costs Money is the most liquid asset. 15-12 Figure 15-1 Degrees of Liquidity 15-13 Liquidity (cont'd) Question What is the cost of holding money (its opportunity cost)? Answer It is the alternative interest yield obtainable by holding some other asset. 15-14 Monetary Standards, or What Backs Money Questions What backs money? Is it gold, silver, or the federal government? Answer Your confidence 15-15 Monetary Standards, or What Backs Money (cont'd) Transactions Deposits Checkable and debitable account balances in commercial banks and other types of financial institutions, such as credit unions and mutual savings banks Any accounts in financial institutions on which you can easily transmit debit-card and check payments without many restrictions 15-16 Monetary Standards, or What Backs Money (cont'd) Fiduciary Monetary System A system in which currency is issued by the government and its value rests on the public’s confidence that it can be exchanged for goods and services The Latin fiducia means “trust” or “confidence.” 15-17 Monetary Standards, or What Backs Money (cont'd) Currency and transactions deposits are money because of their Acceptability Predictability of value 15-18 Defining Money The size of the Money Supply is important. Changes in the rate at which the money supply increases or decreases affect important economic variables (at least in the short run) such as inflation, interest rates, employment, and the level of real GDP. Money Supply: The amount of money in circulation 15-19 Defining Money (cont'd) Economists use two basic approaches to define and measure money. The transactions approach The liquidity approach 15-20 Defining Money (cont'd) Transactions Approach: A method of measuring the money supply by looking at money as a medium of exchange Liquidity Approach: A method of measuring the money supply by looking at money as a temporary store of value 15-21 Defining Money (cont'd) The transactions approach to measuring money: M1 Currency Checkable (transaction) deposits Traveler’s checks not issued by banks 15-22 Figure 15-2 Composition of the U.S. M1 and M2 Money Supply, 2009, Panel (a) Sources: Federal Reserve Bulletin; Economic Indicators, various issues; author’s estimates. 15-23 Figure 15-2 Composition of the U.S. M1 and M2 Money Supply, 2009, Panel (b) Sources: Federal Reserve Bulletin; Economic Indicators, various issues; author’s estimates. 15-24 Defining Money (cont'd) M1 1. Currency • Minted coins and paper currency not deposited in financial institutions • The bulk of currency “in circulation” actually does not circulate within the U.S. borders. 15-25 Defining Money (cont'd) M1 2. Transactions deposits: Any deposits in a thrift institution or a commercial bank on which a check may be written or debit card used • Thrift Institution: Financial institutions that receive most of their funds from the savings of the public 15-26 Defining Money (cont'd) M1 3. Traveler’s Checks: Financial instruments purchased from a bank or a nonbanking organization and signed during purchase that can be used as cash upon a second signature by the purchaser 15-27 Defining Money (cont'd) The liquidity approach to measuring money: M2 Near Moneys Assets that are almost money Highly liquid Easily converted to cash Time deposits are an example. 15-28 Defining Money (cont'd) The liquidity approach: M2 = M1 + 1. Savings and small denomination time deposits 2. Balances in retail money market mutual funds 3. Money market deposit accounts (MMDAs) 15-29 Defining Money (cont'd) M2 1. Savings Deposits: Interest-earning funds that can be withdrawn at any time without payment of a penalty. Depository Institutions accept deposits from savers and lend those funds out. Time Deposit: A deposit in a financial institution that requires notice of intent to withdraw or must be left for an agreed period • Early withdrawal may result in a penalty 15-30 Defining Money (cont'd) M2 2. Money Market Mutual Funds: Funds obtained from the public that investment companies hold in common • Funds used to acquire short-maturity credit instruments – CD’s, U.S. government securities » CD: Time deposit with fixed maturity 15-31 Defining Money (cont'd) M2 3. Money Market Deposit Accounts (MMDAs): Accounts issued by banks yielding a market rate of interest with a minimum balance requirement and a limit on transactions • They have no minimum maturity 15-32 Defining the U.S. Money Supply Question Which definition of money correlates best with economic activity? Answer M2, although some businesspeople and policymakers prefer MZM (money-at-zeromaturity) which includes all MMFs but excludes all deposits with fixed maturities. • MZM entails adding deposits without set maturities to M1. 15-33 Financial Intermediation & Banks (cont'd) Direct finance: Individuals purchase bonds from a business Indirect finance Individuals hold money in a bank The bank lends the money to a business 15-34 Financial Intermediation & Banks (cont'd) Financial Intermediation: The process by which financial institutions accept savings from businesses, households, and governments and lend the savings to other businesses, households, and governments 15-35 Figure 15-4 The Process of Financial Intermediation 15-36 Financial Intermediation & Banks (cont'd) Question Why might people wish to direct their funds through a bank instead of lending directly to a business? Answers Asymmetric information Adverse selection Moral hazard Larger scale and lower management costs 15-37 Financial Intermediation & Banks (cont'd) Asymmetric Information: Information possessed by one party in a financial transaction but not by the other Adverse Selection: The likelihood that borrowers may use their borrowed funds for high-risk projects 15-38 Financial Intermediation & Banks (cont'd) Moral Hazard (in this context): The possibility that a borrower might engage in riskier behavior after a loan has been obtained Larger scale and lower management costs People can pool funds in an intermediary, reducing costs, risks. Pension funds and investment companies are examples. 15-39 Financial Intermediation & Banks (cont'd) Liabilities: Amounts owed The sources of funds for financial intermediaries Assets: Amounts owned The uses of funds by financial intermediaries 15-40 Table 15-2 Financial Intermediaries and Their Assets and Liabilities 15-41 Financial Intermediation & Banks (cont'd) Payment Intermediaries: Institutions that facilitate transfers of funds between depositors who hold transactions deposits with those institutions Payment Intermediation: A recent study revealed that revenues derived from debit-card and checking transfer services accounted for 28% of the bank’s total earnings. Another 10% of earnings were generated from processing payments for credit cards, stocks, and bonds. 15-42 Figure 15-5 How a Debit-Card Transaction Clears 15-43 Federal Deposit Insurance In 1933, at the height of bank failures, the Federal Deposit Insurance Corporation (FDIC) was founded to insure the funds of depositors and remove the reason for runs on banks. FDIC: a government agency that insures the deposits held in banks and most other depository institutions; all U.S. banks are insured this way. Federal Deposit Insurance (cont’d) As can be seen in Figure 15-5, bank failure rates dropped dramatically after passage of this legislation. From WWII to 1984, fewer than nine banks failed per year. From 1985 to the beginning of 1993, however, 1,065 commercial banks failed – averaging 120 bank failures per year. More than 150 banks have failed within this past year. Figure 15-5 Bank Failures Source: Federal Deposit Insurance Corporation. Federal Deposit Insurance (cont’d) Bank Runs: Attempts by many of a bank’s depositors to convert transactions and time deposits into currency out of fear that the bank’s liabilities may exceed its assets. Financial Deposit Insurance (cont’d) The FDIC charges premiums to depository institutions based on their total deposits. These premiums go into funds that would reimburse depositors in the event of bank failures. This bolsters depositors’ trust in the system and gives them incentive to leave their deposits in the bank, even in the face of talk of bank failures. Financial Deposit Insurance (cont’d) Until the 1990s, all insured depository institutions paid the same fee for coverage, regardless of how risky their assets were. Banks then had an incentive to invest in more assets of higher risk (and higher yield). The FDIC and other federal agencies possess regulatory powers to offset the risk-taking temptations. Higher capital requirements were imposed in the early 1990s and adjusted in 2000. Financial Intermediation and Banks Most nations have a banking system that includes two types of institutions: 1. One type consists of private banking institutions. 2. The other type of institution is a central bank. 15-50 The Federal Reserve System: The U.S. Central Bank Central banks and their roles 1. Perform banking functions for their nations’ governments 2. Provide financial services for private banks 3. Conduct their nations’ monetary policies Financial Intermediation & Banks (cont'd) Central Bank A banker’s bank, usually an official institution that also serves as a country’s treasury’s bank Central banks normally regulate commercial banks. 15-52 The Federal Reserve System The Fed The Federal Reserve System; the central bank of the United States The most important regulatory agency in the U.S. monetary system Established in 1913 by the Federal Reserve Act 15-53 The Federal Reserve System (cont'd) Organization of the Fed Board of Governors • 7 members, 14-year terms Federal Reserve Banks (12 Districts) • 25 branches Federal Open Market Committee (FOMC) • BOG plus 5 presidents of district banks 15-54 Figure 15-6 Organization of the Federal Reserve System 15-55 Figure 15-7 The Federal Reserve System 15-56 The Federal Reserve System (cont'd) Depository institutions 7,500 commercial banks 1,300 savings and loans 11,000 credit unions All may purchase Fed services 15-57 The Federal Reserve System (cont'd) Functions of the Fed 1. Supplies the economy with fiduciary currency 2. Provides a payment-clearing system 3. Holds depository institutions’ reserves 4. Acts as the government’s fiscal agent 5. Supervises depository institutions 6. Acts as a “lender of last resort” 7. Regulates the money supply 8. Intervenes in foreign currency markets 15-58 Issues and Applications: Check Clearing, a Rapidly Diminishing Fed Function The volume of checks cleared by the Fed grew rapidly during the 1980s. So why has the Fed’s check clearing speed dropped since the 1990s? The reason is not due to inefficiency; rather, checks are falling out of favor. Electronic payments by households and businesses—debit cards, Internet bill pay, Web based services. Government transfers are transmitted electronically -Social Security, Medicare, Medicaid, military pay. 15-59 Figure 15-8 The Volume and Value of Federal Reserve Check Clearings Since 1985 15-60 The Federal Reserve System: U.S. Central Bank (cont’d) Lender of last resort: The Federal Reserve’s role as an institution that is willing and able to lend a temporary illiquid bank that is otherwise in good financial condition to prevent the bank’s illiquid position from leading to a general loss of confidence in that bank or in others. Issues and Applications: The Crash of 2008 and the Decline of Investment Banking Since the 1990’s, two of the largest financial intermediaries in the world have been Fannie Mae and Freddie Mac. These institutions have specialized in buying hundreds of billions of dollars of private mortgage loans from banking institutions with funds that they raised by issuing mortgage-backed securities purchased by private investors. Both Fannie Mae and Freddie Mac have been government sponsored enterprises. Issues and Applications: The Crash of 2008 and the Decline of Investment Banking (cont'd) This meant that if either institution became unable to honor its obligations, most investors anticipated that the federal government would step in to bail them out. In the summer and fall of 2008, this is exactly what happened. Between 2007 and 2008, average U.S. housing prices declined by more than 15%. When people stopped paying on their mortgages, receipts by Fannie Mae and Freddie Mac plummeted. Both experienced billions of dollars of losses. Because investors had known that the government stood behind the institutions’ mortgage-backed securities, they were willing to regard them as nearly free of risk. Issues and Applications: The Crash of 2008 and the Decline of Investment Banking (cont’d) This had given Fannie Mae and Freddie Mac an incentive to issue too many of these securities and to purchase too many low-quality, risky mortgages from banking institutions. A similar problem also caused “investment banks” to cease to exist. Why do you suppose that many economists suggest that a major U.S. government push for Fannie Mae and Freddie Mac to encourage more lending to lower-income households in the 2000s helped to enlarge the “moral hazard” problem? Summary of Learning Objectives The key functions of money 1. Medium of exchange 2. Unit of accounting 3. Store of value 4. Standard of deferred payment Important properties of goods that serve as money Acceptability, confidence, and predictable value 15-65 Summary of Learning Objectives (cont'd) Official definitions of the quantity of money in circulation M1: the narrow definition, focuses on money’s role as a medium of exchange M2: a broader one, stresses money’s role as a temporary store of value 15-66 Summary of Learning Objectives (cont'd) Why financial intermediaries such as banks exist Asymmetric information can lead to adverse selection and moral hazard problems Savers benefit from the economies of scale The basic structure of the Federal Reserve System 12 district banks with 25 branches Governed by Board of Governors Federal Open Market Committee 15-67 Summary of Learning Objectives (cont'd) Features of Federal Deposit Insurance Provides deposit insurance by charging some depository institutions premiums based on the value of their deposits. These funds are placed in accounts for use in reimbursing failed banks’ depositors. This creates adverse selection and moral hazard problems. Summary of Learning Objectives (cont'd) The basic structure of the Federal Reserve System 12 district banks with 25 branches Governed by Board of Governors Federal Open Market Committee Summary of Learning Objectives (cont'd) Major functions of the Federal Reserve 1. Supply the economy with currency 2. Provide systems for transmitting and clearing payments 3. Holding depository institutions’ reserves 4. Acting as the government’s fiscal agent 5. Supervising banks 6. Acting as a “lender of last resort” 7. Regulating the money supply 8. Intervening in foreign exchange markets 15-70 Assignment to be completed before class November 16: Read Chapter 16 & also read these endof-chapter Problems: 14th ed:16-1, 16-2, 16-4, 16-7, 16-9, 16-12 & 16-15, on pp. 420-421. 15th ed:16-1, 16-2, 16-4, 16-7, 16-9, 16-10 & 16-13, on pp. 420-421.