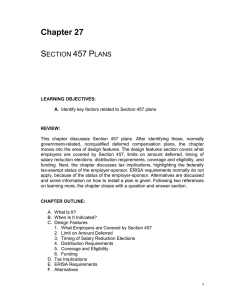

Life Insurance in a Qualified Plan

advertisement

Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan What is it? Qualified plan purchases and owns life insurance on employee using deductible employer contributions to the plan to fund purchase Copyright 2009, The National Underwriter Company 1 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan When is it indicated? • large number of employees covered under qualified plan have unmet life insurance needs • have gaps or limits on other company plans that provide death benefits • want contribution option that would provide tax deduction when qualified plan is over funded or close to full funding limitation Copyright 2009, The National Underwriter Company 2 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan When is it indicated? • highly compensated plan participants face substantial estate taxes on death benefits • life insurance could provide plan participants an additional option for investing their plan accounts • employer wants secure funding vehicle for plan Copyright 2009, The National Underwriter Company 3 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Advantages • favorable tax treatment as compared with individual life policies provided by employer outside qualified plan or personally owned life insurance • safe investment • predictable plan costs Copyright 2009, The National Underwriter Company 4 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Advantages • retirement benefits guaranteed by insurance company as well as employer • death proceeds less policy cash values (pure insurance portion of policy) not subject to income tax • may be able to structure insured plan death benefits to avoid estate tax at participant’s death Copyright 2009, The National Underwriter Company 5 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Advantages • exemption of fully insured from minimum funding standards and actuarial certification requirements reduces administrative costs and reduces complexity of defined benefit plan • some life insurance companies provide low cost installation and administrative services if plan uses their investment products, further reducing cost Copyright 2009, The National Underwriter Company 6 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Disadvantages • relatively low rate of return • policy expenses and commissions may be greater than for comparable investments Copyright 2009, The National Underwriter Company 7 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan How is it used? Insurance Coverage • should provide for all plan participants under nondiscriminatory formula that is related to either – – retirement benefit plan contribution formula Copyright 2009, The National Underwriter Company 8 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan How is it used? Insurance Coverage • can condition coverage on medical exam IF this requirement does not discriminate in favor of highly compensated • can minimize turnover costs with cash value insurance – – make waiting period for insurance longer than plan’s waiting period for entry use term insurance to cover interim Copyright 2009, The National Underwriter Company 9 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan How is it used? How Much Insurance – The ‘Incidental’ Test IRS: any non-retirement benefit in qualified plan is incidental as long as cost of benefit is < 25% of total plan cost Difficult standard to apply Copyright 2009, The National Underwriter Company 10 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan IRS has developed 2 practical tests 1. participant's death benefit must be no more than 100 times the expected monthly benefit 2. Aggregate premiums paid for participant’s insured death benefit are at all times less than these percentages of plan cost for that participant: “ordinary life” insurance term insurance Universal life Copyright 2009, The National Underwriter Company 50% 25% 25% 11 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Life Insurance in Defined Benefit Plans • adds to limit on deductible contribution • in contrast, in defined contribution plan, life insurance costs must be part of contributions to each participant's account Copyright 2009, The National Underwriter Company 12 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Common ways life insurance is used in Defined Benefit Plans • combination plan • envelope funding • fully insured plan Copyright 2009, The National Underwriter Company 13 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Combination Plan • Retirement benefits funded with combination of – – whole life policies assets in separate trust fund (‘side fund’ or ‘conversion fund’) • Approach combines advantages of – – – insured death benefit investment security of policy cash values aggressive investment of side fund assets Copyright 2009, The National Underwriter Company 14 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Combination Plan • Appropriate for smaller pension plans (< 25 employees) • Death benefit for each employee usually determined by 100-to-1 test • Annual plan cost = required insurance premiums + amount deposited in side fund that is determined on actuarial basis Copyright 2009, The National Underwriter Company 15 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Envelope Funding • Insurance policies simply considered plan asset • Actuary determines total annual contributions to plan to provide retirement and death benefits under plan • Employer makes contributions as determined by actuary • Plan trustee purchases assets – including insurance policies – to fund cost of retirement and death benefits Copyright 2009, The National Underwriter Company 16 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Envelope Funding • Keep amount of insured death benefit within incidental limits by – providing death benefit no more than 100 times each participant’s projected monthly pension or – keeping the amount of insurance premiums within appropriate percentage limits Copyright 2009, The National Underwriter Company 17 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Envelope Funding • Requires lower initial contributions to plan than combination plan approach • Long term costs depend on – – – – actual investment results policy dividends benefit administrative costs of the plan Copyright 2009, The National Underwriter Company 18 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Fully Insured Plans Funded exclusively by life insurance or annuity contracts Regaining popularity after pension investors lured away by high interest rates in 1970s and bull market of 1990s Copyright 2009, The National Underwriter Company 19 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Overfunding Problem for Qualified Defined Benefit Plans Tax deductible employer contributions – – must meet actuarially determined minimum funding amount cannot exceed “full funding limitation” Law limits interest rates that can be used in determining plan liabilities Copyright 2009, The National Underwriter Company 20 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan A Solution – Fully Insured Plans [IRC Section 412(i) plans] Exempt from minimum funding rules Avoids overfunding problem Copyright 2009, The National Underwriter Company 21 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Plan is Fully Insured for Plan Year IF • plan funded exclusively by purchase of individual insurance contracts • contracts can be – – individual or group life insurance, annuity contracts or combination • have level annual (or more frequent) premiums extending to retirement for each individual Copyright 2009, The National Underwriter Company 22 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Plan is Fully Insured for Plan Year IF • plan benefits are equal to the contract benefits and guaranteed by licensed insurance company • premiums paid without lapse or reinstated after lapse • no rights under the contracts subject to security interest during plan year • no policy loans outstanding at any time during plan year Copyright 2009, The National Underwriter Company 23 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Fully Insured Plans • must be nondiscriminatory regarding – – – rights benefits features • benefit formulas of plans satisfying safe harbor and specified uniformity requirements are considered nondiscriminatory in – – contributions benefits Copyright 2009, The National Underwriter Company 24 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Fully Insured Plans: Other Advantages • • • • simplified ERISA reporting requirements do not need certification by enrolled actuary reduced cost and complexity of plan administration exempt from requirement of quarterly pension deposits but subject to Pension Benefit Guaranty (PBGC) coverage and annual premium requirements Copyright 2009, The National Underwriter Company 25 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Fully Insured Plans: How Does it Work? • can be used with new or existing plan • employer can be corporation or unincorporated business • typically uses group contract with individual accounts for participants Copyright 2009, The National Underwriter Company 26 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Fully Insured Plans: How Does it Work? • insurance company guarantees all benefits • premium based on guaranteed interest and annuity rates; conservative estimates results in larger initial deposits than in typical uninsured plan Copyright 2009, The National Underwriter Company 27 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Fully Insured Plans: How Does it Work? • use of excess earnings to reduce future premiums means funding level high at beginning, resulting in – – maximization of overall tax deduction possibility of tax deduction for existing plan that has reached full funding limitation with uninsured funding Copyright 2009, The National Underwriter Company 28 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Life Insurance in Defined Contribution Plans • part of each participant’s account can be used to purchase insurance on the participant’s life • insurance purchase can be – – – voluntary provided automatically as plan benefit provided at plan administrator’s option (on a nondiscriminatory basis) Copyright 2009, The National Underwriter Company 29 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Life Insurance in Defined Contribution Plans • insurance amount must be kept within incidental limits • generally best to keep percentage contributions under full limits to maintain investment flexibility and employer ability to reduce contributions in lean years • since IRS limit tests are computed in the aggregate, may be able to purchase a considerable amount of insurance in a later year Copyright 2009, The National Underwriter Company 30 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Life Insurance in Defined Contribution Plans • in-service cash distributions allowed in profit sharing plans prior to termination of employment • can be used without limit to purchase life insurance Copyright 2009, The National Underwriter Company 31 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Tax Implications 1. if amount of life insurance within incidental limits, employer plan contributions are tax deductible 2. economic value of pure insurance on participant’s life is taxed annually to participant at levels specified by the IRS; participant contributions are subtracted Copyright 2009, The National Underwriter Company 32 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Tax Implications 3. taxation of insured death benefit – – – pure insurance part is income tax free to plan beneficiary total of all Table 2001 (formerly P.S. 58) costs paid by participant recovered tax free remaining distribution taxed as qualified plan distribution Copyright 2009, The National Underwriter Company 33 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Tax Implications 4. insurance in a plan usually provides tax advantages not available for individual life policies provided by employer outside qualified plan or personally owned life insurance 5. may be possible to exclude insured portion of qualified plan death benefits from decedent’s estate for federal estate tax purposes Copyright 2009, The National Underwriter Company 34 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Alternatives 1. personally owned life insurance 2. group-term life insurance 3. life insurance financing in a nonqualified deferred compensation plan 4. split-dollar life insurance Copyright 2009, The National Underwriter Company 35 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan True or False? 1. Life insurance provides one of the safest available investments for a qualified plan. 2. To be nondiscriminatory, the same amount of life insurance must be given to each employee. 3. Life insurance is advantageous in a defined contribution plan because it adds to the limit on deductible contributions. Copyright 2009, The National Underwriter Company 36 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan True or False? 4. In combination plans, retirement benefits are funded with whole life and assets in a separate trust fund. 5. Fully insured plans must be nondiscriminatory with respect to rights, benefits, and features. 6. Split dollar life insurance is an alternative to life insurance in a qualified plan. 7. Life insurance can be used in a Keogh plan. Copyright 2009, The National Underwriter Company 37 Life Insurance in a Qualified Chapter 13 Employee Benefit & Retirement Planning Plan Discussion Question What are the considerations in determining whether fully insured funding is advisable from an economic, investment point of view? Copyright 2009, The National Underwriter Company 38