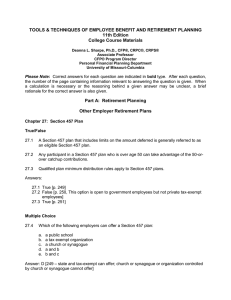

Chapter 27 S 457 P

advertisement

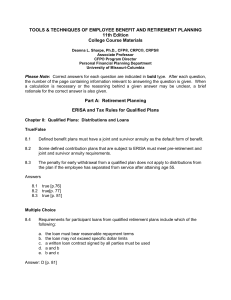

Chapter 27 SECTION 457 PLANS LEARNING OBJECTIVES: A. Identify key factors related to Section 457 plans REVIEW: This chapter discusses Section 457 plans. After identifying these, normally government-related, nonqualified deferred compensation plans, the chapter moves into the area of design features. The design features section covers what employers are covered by Section 457, limits on amount deferred, timing of salary reduction elections. distribution requirements, coverage and eligibility, and funding. Next, the chapter discusses tax implications, highlighting the federally tax-exempt status of the employer-sponsor. ERISA requirements normally do not apply, because of the status of the employer-sponsor. Alternatives are discussed and some information on how to install a plan is given. Following two references on learning more, the chapter closes with a question and answer section. CHAPTER OUTLINE: A. What Is It? B. When Is It Indicated? C. Design Features 1. What Employers are Covered by Section 457 2. Limit on Amount Deferred 3. Timing of Salary Reduction Elections 4. Distribution Requirements 5. Coverage and Eligibility 6. Funding D. Tax Implications E. ERISA Requirements F. Alternatives 1 Chapter 27 G. H. I. J. How To Install A Plan Where Can I Find Out More About It? Questions And Answers Chapter Endnotes FEATURED TOPICS: Section 457 Plans CFP® CERTIFICATION EXAMINATION TOPIC: Topic 61: Types of retirement plans A. Characteristics Topic 63: Other tax-advantaged retirement plans A. Types and basic provisions 6) Section 457 plans COMPETENCY: Upon completion of this chapter, the student should be able to: 1. Identify key factors related to Section 457 plans KEY WORDS: Section 457 plan, nongovernmental tax-exempt organization DISCUSSION: 1. Discuss how Section 457 plans relate to qualified retirement plans. 2. Discuss the tax implications related to Section 457 plans. QUESTIONS: Chapter 27 1. Which of the following organization types are eligible to use a Section 457 plan? (1) church or synagogue (2) a state agency (3) a public school district (4) a sewage authority a. b. c. d. (1) only (1) and (2) only (1) (2) and (3) only (2) (3) and (4) only Chapter 27, p. 249 2. Which of the following would be considered an unforeseeable emergency that would permit distributions from a Section 457 plan? a. b. c. d. loss of property due to casualty purchase of a residence college education of children significant investment losses due to stock market fluctuations Chapter 27, pp. 250, 253 3. What alternatives are not normally available for governmental (non-public school) employers who want to provide retirement benefits to employees? (1) qualified pension plan (2) Section 403(b) plans (3) qualified profit sharing plan (4) 401(k) plans a. b. c. d. (1) and (3) only (2) and (4) only (1) (2) and (3) only (2) (3) and (4) only Chapter 27, p. 252 4. At what point are deferrals under an ineligible plan normally taxed? Chapter 27 a. b. c. d. immediately upon reaching age 65 in the first taxable year in which there is no substantial risk of forfeiture when the employer declares the deferral Chapter 27, p. 253 ANSWERS: 1. d 2. a 3. b 4. c