Specialty Crops Situation and Outlook Greg E. Fonsah

advertisement

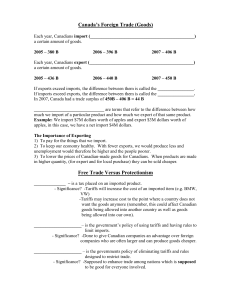

Specialty Crops Situation and Outlook Greg E. Fonsah Assistant Professor and Extension Economist Department of Agricultural and Applied Economics University of Georgia Tifton, GA 31793 Highlights The United States continues to enjoy a positive aggregate agricultural trade balances for the past seven year. Total agricultural exports were $53.6 billion, $49.1 billion, $50.7 billion, $52.7 billion, $53.3 billion and $55.5 billion (estimated Aug. 2003) for 1998, 1999, 2000, 2001, 2002, 2003 and 2004 respectively (Fig. 1). The projection for 2004 U.S. agricultural trade stands at $57.0 billion. On the other hand, the value of U.S. agricultural imports were $36.8, $37.3 billion, $38.9 billion, $39.0 billion, $41.0 billion, and $45.0 billion (estimated August 2003) in 1998, 1999, 2000, 2001, 2002, 2003 and 2004 respectively. The 2004 U.S. agricultural import trade is projected at $47.5 billion. Comparing the export versus the import trade projections leave an impressive positive balance of trade in favor of the United States agricultural sector. Fig 1: U.S. Agricultural trade, fiscal years 1998-2004, year ending September 30 60 18 16 14 40 12 10 30 8 20 6 4 (Billion of dollars) (Billion of dollars) 50 Exports Imports Balance 10 2 0 0 1998 1999 2000 2001 2002 2003 2004 Years Source: USDA AES-39 Outlook, Aug. 26, 2003 and USDA, USDC (2003) AES-38 Outlook, May 27. However, as the gap between export and import continues to narrow, there has been a persistent downward trend on export surplus since 2001. Consequently, the $9.1 billion export surplus forecasted for 2004 is the lowest since 1998. Although there was a 12 percent increase in import trade, exports trade only increased by 3 percent during the same year. Further, imports (c.i.f.) and imports (customs value) both increased by 12 percent from 2002 to 2003, while there was –33 percent export minus c.i.f. imports and –23 percent exports minus customs-valued imports during the same period. Present Situation Fresh market vegetable and melon acreage dropped by 0.4 percent in 2002 and 2 percent in 2003. The increased acreage for broccoli, cauliflower, sweet corn, and cucumber were not enough to offset the overall fall in production acreage, which stood at 308,100 acres in 2003. Prices received by farmers and shippers fell by 12 percent in summer 2002 but increased 5-10 percent in summer 2003. Total fresh market export trade volume in 2002 was 39,322 million cwt compared to almost double the total import trade of 65,609 million cwt. Severe heat wave in the West and East created tomato supply shortage and triggered better shipping point prices through mid-August. Summer season fresh market melon (cantaloupe, honeydew and watermelon) recorded 2 percent increase in production acreage at 124,300. At the national level, the U.S. vegetable industry recorded 8.5 percent increase in area harvested in 2002 and 3.7 percent decrease in 2003 (Fig. 2). 7000 1330 6900 1320 6800 1310 6700 1300 6600 1290 6500 1280 6400 1270 6300 1260 6200 1250 6100 1240 6000 1230 2001 2002 (Mil. cwt) (1000 acres) Fig. 2: U.S. Vegetable Industry: Area and Production, 2001-2003 A. Harv Production 2003 Source: USDA (2003) Vegetables and Melons Outlook. On the other hand, total production rose 4.8 percent in 2002 and fell 1.1 percent in 2003 at 1307 million cwt. Crop value experience a huge 41.7 percent increase from 2001 to 2002 and remained stagnated thereafter (Fig. 3). Meanwhile, unit value for vegetables increased from $18.99 per cwt., to $20.33 per cwt in 2002 and remained the same in 2003. Fig. 3: U.S. Vegetable Industry: Crop and Unit Value, 2001-2003 (Million dollars) 15537 11.9 15500 11.88 11.88 15400 11.86 15300 11.84 11.83 15200 11.82 15100 11.8 15000 11.78 14927 14900 11.76 11.76 14800 11.74 14700 11.72 14600 11.7 2001 2002 (Dollars per cwt) 15550 15600 Crop value Unit value 2003 Source: USDA (2003) Vegetables and Melons Outlook. Import Supply Factors that influenced U.S. food imports for the past two decades included temporal dynamics in domestic food supply chain due weather and other unforeseen conditions, high purchasing power parity for imported food due to the protracted strength of U.S. dollar compared with other foreign currencies, acquired taste preferences created by ethnic influx and growing immigrant population, newly acquired flavor for nontraditional American menu such as tropical fruits and crops, steady and reliable overseas suppliers especially during off season, innovated ocean transportation that facilitates transshipment, controlled atmosphere and warehouse facilities and increased disposable income amongst others. Specific factors that contributed to the increase in U.S. imported goods for the past decade are red meats, fish and shellfish. Furthermore, vegetables such as onions, peppers, tomatoes, cucumbers, olives, and asparagus showed remarkable growth. Fresh and frozen fruits such as pears, melons, grapes, and avocados made appreciable contributions to the import growth. More so, the economic slump in most Asian countries rendered the U.S. market favorable for Australian and New Zealand meat as import rose from 6.5 to over 9 percent in carcass weight. The North American Free Trade Agreement (NAFTA) has been instrumental also in improving trade ties between Canada, Mexico and the United States. While Canada has recently snatched the leading role as number one importer of U.S. fruits, vegetables, grains, oilseed and meat from Japan, Mexico is increasing its grip in this market as 27 and 38 percent of U.S. fruit and vegetable imports originates from Mexico. The U.S. Vegetable Industry continues to experience strong import growth, 5.9 and 11.4 percents in 2002 and 2003 respectively (Fig. 4). Incidentally, export demand remain stagnant during the same time period. Per capita use slightly fell in 2002 and made a drastic come back in 2003. Fig. 4: U.S. Vegetable Industry: Import, Export and Per Capita Use, 2001-2003 6000 446 445 444 443 4000 442 3000 441 440 2000 (Pounds) (Million dollars) 5000 Imports Exports Per Capita use 439 438 1000 437 0 436 2001 2002 2003 Source: USDA (2003) Vegetables and Melons Outlook. Export Demand Although the U.S. vegetable industry export trade slightly increased from 2001 to 2003, the dollar value was lower than the import trade, thus reflecting a negative U.S. vegetable trade balance (Fig. 4). For instance, dry bean exports to the United Kingdom, Mexico and Japan fell by 20, 17 and 13 percent respectively this year compared to 2002. Although export of kidney, black and pinto bean increased, there was an aggregate 2 percent decrease in dry bean export in 2003. The production and sales of specialty mushrooms such as shiitake and oyster have been consistent for the past two years at 13 million pounds per year with a sales value of $37 million. Steady growth has been recorded for brown agaricus mushrooms (including Portobello and crimini varieties) for the past three years. Although the prices have not changed during the same time frame, the crop presently accounts for $140 million sales value, thus over 18% increase compared with 2002. China is the leading producer (41%) and exporter (two-thirds of dried and 44% canned) of the world’s mushrooms. However, the Netherlands regained their number one position of fresh mushrooms exporter, which they lost in 2000. The U.S. is ranked second in production and 12th in fresh mushrooms export. The consistent appreciation of the U.S. dollar has adversely affected the overall U.S. trade balances and compromised our leading position and competitiveness in the world market. This could be partially blamed for the stagnated export growth, as most nations cannot afford our products. Domestic Demand In the past two decades, the U.S. per capita food consumption escalated from 1800 pounds in the early 1980s to 2000 pounds per year in 2000, thus reflecting 11.1 percent increase in average import share calculated from units of weight, and includes total food consumed (Fig. 5). Fig. 5: Selected Import Share of U.S. Food Consumption, 1981-2001. 80 (Percentage) 70 60 50 40 30 20 10 0 81-85 86-90 91-95 Ave Import Fruits/products 1996 1997 1998 Fish/Shellfish Vegetables 1999 2000 2001 Crops/products Veg. Oil Source: USDA Outlook (2003). FAU-79-01, July. Fish and shellfish dominates import share by a large margin. Crops and products include coffee, cocoa, tea, wine and beer while fruits and products include fruit juices and nuts. Consumption of fruits, vegetables and cereals increased over 20 percent compared with only 7 percent increase for animal products (Fig. 5). Fruits, vegetable production and marketing continue to be one of the rapidly growing industries despite the ever increasing pests and disease problems, numerous restrictions, high cost of production, limited market windows, extremely high regional and international competition. This positive trend in the U.S. consumer behavioral patterns stems from the on-going consumer awareness and health conscious education and advertisement programs. Future Trend With the depreciating trend of the U.S. dollars against other foreign currencies (March 2002- May 2003), U.S. agricultural export trade by volume and value are expected to escalate as our commodities, including specialty crops will become competitive in the world market and affordable to other nations. The magnitude of the increase in agricultural commodity trade is yet to be determined since further depreciation through 2003 and first quarter of 2004 are anticipated. Export of fruits, vegetables, fruit juice, wine and grain products and processed items to Canada are expected to reach record high in 2004. Although China is our main competitor in the Japanese market, the present downward trend in the strength of the dollar is expected to boost export to Japan and put pressure on China. The largest U.S. agricultural export to China occurred in May 2003 and this trend is expected to increase in 2004 for the following reasons: (a) China is now a membership of the World Trade Organization (b) China needs more soybean for their oilseed processing industry and (c) China has increased the purchase of cotton, livestock products (calf skins, and mink pelts) from the United States. Mexico and Russia remain the area of concern for the U.S. export trade. Although export volume and value for Mexico is expected to stay the same at a record high of $7.9 billion, and Mexico is still our third largest trading partner, export of soybean meal, tobacco, vegetable oils, red meat and poultry meat decreased. References 1. Jerardo, A (2003) “Import Share of U.S. Food Consumption Stable At 11 Percent”, Electronic Outlook Report from the Economic Research Service, FAU79-01, (July), United States Department of Agriculture. 2. Lucier, G. and C. Plummer (2003) “Vegetables and Melons Outlook”. Electronic Outlook Report from the Economic Research Service, VGS-298, (Aug), United States Department of Agriculture. 3. Fonsah, E.G (2003) “The Impact of NAFTA on U.S. Fruits and Vegetable Industry”. The Georgia Economic Issues Newsletter, Vol. 19, Issue 3 (July), The University of Georgia, Department of Agricultural and Applied Economics, Cooperative Extension Service, College of Agricultural and Environmental Sciences, Athens, GA 30602.