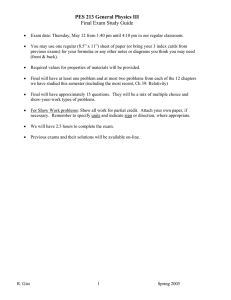

ACNT 2304 Intermediate II.doc

advertisement

Accounting Southwest College Center of Excellence – Business Administration Department Chair – Dr. Marina Grau Program Coordinator – Charles Lewis FALL 2015 ACNT 2304 – INTERMEDIATE ACCOUNTING II Meeting days and Time: THURSDAY 6-9PM Course Reference Number: Instructor: Donald R. Bond, CPA Instructor of Accounting Office Hours: By appointment Office No: 713-718-7865 Email: donald.bond@hccs.edu Basic Course Goals Intermediate Accounting is divided into two (2) courses at Houston Community College and most other universities, Intermediate Accounting I (ACNT 2303) and Intermediate Accounting II (ACNT 2304). The primary purpose of this course is to provide a handson approach to the study of accounting. Many students must take an accounting course in preparation for an academic degree or technical program. Employers may require accounting skills, or a student may be self-employed and need to do his/her own bookkeeping. This course is designed to meet these needs, in both manual and computerized settings Course Description: Continued in-depth analysis of generally accepted accounting principles underlying the preparation of financial statements including comparative analysis and statement of cash flows. Topics included are bonds, leases, pension plans, corporate paid-in-capital, special purpose securities, retained earnings, tax allocation, inflation accounting, funds statement, and financial statement analysis. Textbook and Related Material Required for the course Text: Intermediate Accounting 15th Ed., by Donald E. Kieso, Jerry J. Weygandt and Terry D. Warfield, Publisher: Wiley and Company ISBN: 978-1-118-93878-2 (full 24 chapter book) Evaluation and Requirements: Students are expected to read all assigned chapters, complete and submit all assignments on due dates, and attend all classes. The nature of the course is such that perfect attendance is essential for mastery of the course content. A missed class can never be duplicated. Accounting is best learned through doing. Therefore, there are always homework assignments to do. This will require a considerable commitment of time and effort from you. Typically, the successful student in college can count on 3 hours of independent study for every hour in the classroom. Students are responsible for the “learning objectives” at the beginning of each chapter. Accounting is a subject that cannot be mastered passively. The concepts and ideas can be compared to building blocks – each serves as a foundation for new ones. It is extremely important that each student be actively involved in the learning process. This requires intensive study of each chapter, the study guide, and continuous application of the ideas to homework problems. Your final grade for this course will be based on how well you do in meeting the evaluation requirements listed on your assignment schedule and applying the grading scale which is listed below. It’s very important to read the text before coming to lecture. By reading the text students should be able to follow the lecture, do well on quizzes and examinations. Students are responsible for all textbook material covered, assigned outside readings, and material discussed in class, unless specifically excluded by the instructor. Exams will consist primarily of problems, short answer, and multiple-choice questions. There are no makeup exams. I will not DROP an exam. Also, during the exams students will not be allowed to leave the classroom until the end of the allotted time. Semester Outline: The semester schedule is subject to modification. All changes to the syllabus will be announced in the class. Assigned exercises and problems are given for reinforcement of materials covered in the class. The syllabus indicates the assignments. Course Learning Outcomes: 1. Identify the various types of current liabilities and describe how they are valued. 2. Distinguish between long term and short term liabilities. 3. Explain how contingencies affect financial statements. 4. Identify the various types of bond issues and describe how they are valued. 5. Apply the methods of bond discount and premium amortization. 6. Describe the accounting procedures for extinguishment of debt. 7. Explain the accounting procedures for long-term notes payable. 8. Explain the reporting of off-balance sheet financing arrangements. 9. Calculate stockholders’ equity. 10. Account for various types of stock transactions. 11. Explain the difference between dilative and non-dilative securities. 12. Calculate earnings per share. 13. Identify the categories of equity and debt securities and describe the accounting and reporting treatment for each category. 14. Discuss the accounting for impairments of debt and equity investments. 15. Identify differences between pretax financial income and taxable income. 16. Describe various temporary and permanent differences and how they are handled. 17. Apply accounting procedures for a loss carryback and a loss carryforward. 18. Identify types of pension plans and their characteristics. 19. Explain alternative measures for valuing the pension obligation. 20. Identify the components of pension expense. 21. Describe the reporting requirements for pension plans in financial statements. 22. Contrast the accounting criteria and procedures for capital leases and operating leases. 23. Identify the types of accounting changes and how to account for these changes. 24. Describe the accounting for correction of errors. 25. Describe the purpose of the statement of cash flows and the difference methods of calculating cash flows. 26. Identify the major classifications of cash flows. 27. Prepare a statement of cash flows. GRADING: 2 Sectional Exams Final examination Project Homework Quizzes Total 300 points 150 points 100 points 400 points 100 points 1050 points Final letter grades will be determined using the standard Texas Southern University scale as follows: A Percent 100-90 B Percent 80-89 C Percent 70-79 D Percent 60-69 F < 60 SPECIAL NOTICE: The final examination is MANDATORY and cannot be dropped! It will be a comprehensive examination. Drops and Withdrawals: It is the responsibility of each student to officially drop or withdraw from a course. Failure to officially withdraw may result in the student receiving a grade of F in the course. International Students: Receiving a W in the course may affect the status of your student visa. Once a W is given for the course, it can not be changed to an F because of visa considerations. New Policy: Students who repeat a course three or more time may soon face significant tuition/fee increases at Texas public colleges and universities. Please seek tutoring or other assistance prior to considering course withdrawal. Class Attendance: Students are expected to attend class regularly. Students are responsible for materials covered during their absences. Students with Disabilities Any student with a documented disability (e.g. physical, learning, psychiatric, vision, hearing, etc.) who needs to arrange reasonable accommodations must contact the Disabilities Services Office at the beginning of each semester. Faculty is authorized to provide only the accommodations requested by the Disability Support Services Offices. Academic Honesty Students are responsible for conducting themselves with honor and integrity in fulfilling course requirements. Penalties and/or disciplinary proceedings may be initiated against a student accused of scholastic dishonesty. Assignment Schedule An assignment schedule is attached to this syllabus. This schedule will be followed throughout this course. Any modification to this schedule will be announced in class. ACNT 2304 HCC DATE 09/03 DAY CH T 13 TOPIC Classes Begin Current Liabilities and Contingencies 09/03 09/10 09/17 09/24 10/01 10/08 10/15 10/22 10/29 10/30 11/05 11/12 11/19 11/26 12/03 T T T T T T T T 14 15 16 T T T T T 21 22 23 Long-Term Liabilities Stockholders’ Equity Dilutive Securities and Earnings Per Share Exam #1 Chapters 13-15 Investments Revenue Recognition Accounting for Income Taxes Accounting for Pensions and Postretirement Exam #2 Chapters 16-19 LAST DAY TO WITHDRAW Accounting for Leases Accounting Changes and Error Analysis Statement of Cash Flows HOLIDAY Full Disclosure in Financial Reporting 12/03 12/10 T T 17 18 19 20 24 Review for final exam Final Exam Chapters 13-24 IN CLASS Homework and Quizzes will be announced in class.