NZQA registered unit standard 28371 version 1 Page 1 of 3

advertisement

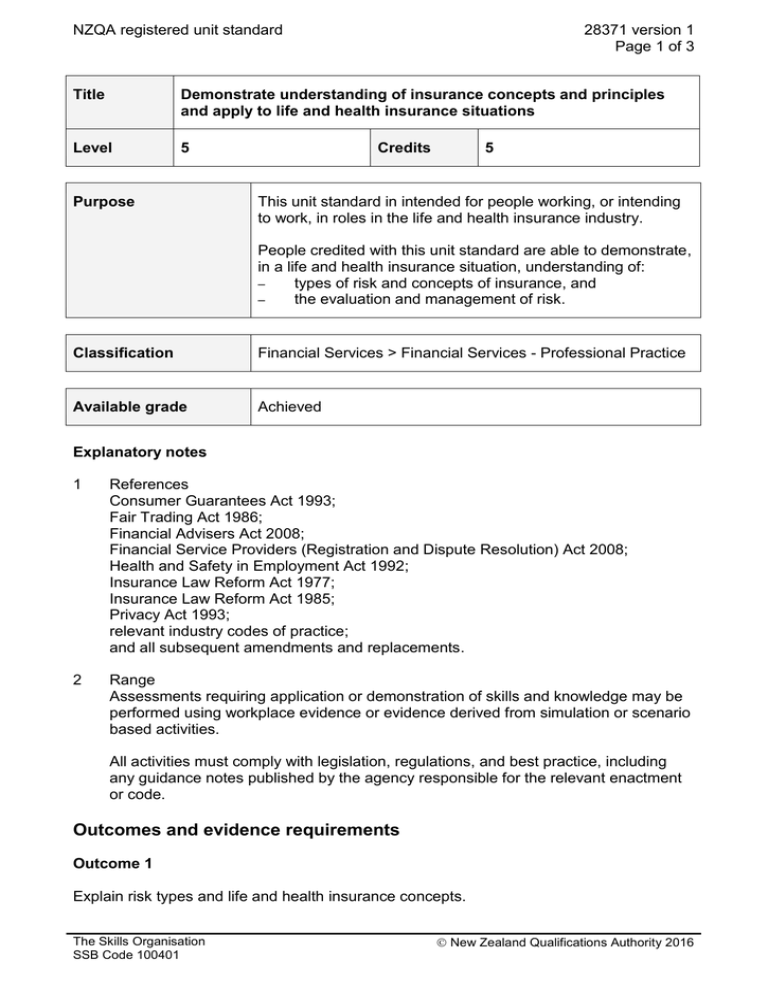

NZQA registered unit standard 28371 version 1 Page 1 of 3 Title Demonstrate understanding of insurance concepts and principles and apply to life and health insurance situations Level 5 Purpose Credits 5 This unit standard in intended for people working, or intending to work, in roles in the life and health insurance industry. People credited with this unit standard are able to demonstrate, in a life and health insurance situation, understanding of: – types of risk and concepts of insurance, and – the evaluation and management of risk. Classification Financial Services > Financial Services - Professional Practice Available grade Achieved Explanatory notes 1 References Consumer Guarantees Act 1993; Fair Trading Act 1986; Financial Advisers Act 2008; Financial Service Providers (Registration and Dispute Resolution) Act 2008; Health and Safety in Employment Act 1992; Insurance Law Reform Act 1977; Insurance Law Reform Act 1985; Privacy Act 1993; relevant industry codes of practice; and all subsequent amendments and replacements. 2 Range Assessments requiring application or demonstration of skills and knowledge may be performed using workplace evidence or evidence derived from simulation or scenario based activities. All activities must comply with legislation, regulations, and best practice, including any guidance notes published by the agency responsible for the relevant enactment or code. Outcomes and evidence requirements Outcome 1 Explain risk types and life and health insurance concepts. The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016 NZQA registered unit standard 28371 version 1 Page 2 of 3 Evidence requirements 1.1 Describe types of risk in terms of their relevance to insurance products. Range risk includes but is not limited to – pure risks such as personal, property liability and non-performance; and speculative risks such as investment risks associated with some insurance products and companies. 1.2 Explain client aversion to or tolerance for risk in terms of attitude to risk and capacity to cope with risk. 1.3 Explain key insurance concepts in terms of the attributes and applicability. Range insurance as a vehicle to transfer risk, what risks are insurable, utmost good faith, compensation not enrichment, reinsurance, significance of correct policy ownership from a claims and a taxation point of view; tax includes – income tax, FBT, GST, company tax. Outcome 2 Explain risk exposure and risk management processes applying to life and health insurance situations. Evidence requirements 2.1 Evaluate exposures to risk in terms of probability of risk, potential severity and/or impact of risk consequences. Range 2.2 costs, financial benefits, non-financial benefits, direct losses, consequential losses, hidden losses. Explain methods of handling risk in reference to the result achieved and the relationship with insurance. Range methods of managing risk include – identification, avoidance, mitigation, financing, acceptance, transfer. 2.3 Using workplace, scenario or case study based evidence identify and evaluate exposures to risk, explain which types of risk are insurable and which are not, demonstrate methods of dealing with each, and determine an appropriate response based on risk management process. 2.4 Demonstrate an understanding of what differentiates a standard client situation from a non-standard client situation. Range The Skills Organisation SSB Code 100401 standard client situation – single need, ordinary premium rates; within the guide; non-standard client situation – multiple needs, outside the guide. For example, extreme Body Mass Index, hazardous pursuits or occupations. New Zealand Qualifications Authority 2016 NZQA registered unit standard Planned review date 28371 version 1 Page 3 of 3 31 December 2017 Status information and last date for assessment for superseded versions Process Version Date Last Date for Assessment Registration 1 19 February 2015 N/A Consent and Moderation Requirements (CMR) reference 0003 This CMR can be accessed at http://www.nzqa.govt.nz/framework/search/index.do. Please note Providers must be granted consent to assess against standards (accredited) by NZQA, before they can report credits from assessment against unit standards or deliver courses of study leading to that assessment. Industry Training Organisations must be granted consent to assess against standards by NZQA before they can register credits from assessment against unit standards. Providers and Industry Training Organisations, which have been granted consent and which are assessing against unit standards must engage with the moderation system that applies to those standards. Requirements for consent to assess and an outline of the moderation system that applies to this standard are outlined in the Consent and Moderation Requirements (CMR). The CMR also includes useful information about special requirements for organisations wishing to develop education and training programmes, such as minimum qualifications for tutors and assessors, and special resource requirements. Comments on this unit standard Please contact The Skills Organisation reviewcomments@skills.org.nz if you wish to suggest changes to the content of this unit standard. The Skills Organisation SSB Code 100401 New Zealand Qualifications Authority 2016