Unclassified - Part-time (75% FTE), Special Contract

advertisement

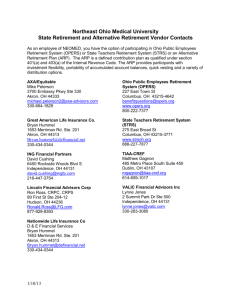

DRAFT DATE NAME STREET ADDRESS CITY, STATE ZIP CODE Dear NAME: I am pleased to offer you the position of (POSITION), in the (DEPARTMENT) at Wright State University effective (DATE) at an annual salary of ($00,000.00) to be paid in equal monthly payments the last working day of each month. This salary supports an appointment at 75% effort. This position is considered a special contract and not a continuing position. (OPTIONAL: Your salary for the month of (MONTH) will be prorated from (PARTIAL MONTH DATE). This offer is contingent upon the successful passage of University mandated background check and education verification. New professional staff members who are appointed to work at least 75% annually are eligible to enroll for retirement benefits in either the Ohio Public Employees Retirement System (OPERS) or the Wright State University Alternative Retirement Plan (ARP). New professional staff members who are appointed to work less than 75% annually are required to enroll in the Ohio Public Employees Retirement System (OPERS). OPERS offers staff members the option to select one of three plans. The plans are (1) the OPERS Traditional Pension Plan where retirement, disability, and survivor benefits are determined by formulas using the retiree's age, service credit, and final average salary, (2) the OPERS Member-Directed Plan where retirement benefits are determined by the amount of money, including investment earnings, which the employee accumulates in an annuity account, and (3) the OPERS Combined Plan which has some elements of the other two OPERS plans. The current employee contribution to any of the three OPERS plans of 10.0% of pay is deducted on a pre-tax basis from the employee's earnings and is deposited in the employee's personal account at OPERS. The current amount of the 14.00% of earnings employer contribution which is deposited in the employee's OPERS account depends on which OPERS plan the employee elects. With the Alternative Retirement Plan the employee's retirement benefit is determined by the amount of money, including investment earnings, which the employee accumulates in an annuity account. The current employee contribution to the ARP of 10.0 % of pay is deducted on a pre-tax basis from the employee's earnings and is deposited in the employee's account with an approved annuity carrier that the employee selects. The current employer contribution to the ARP in an amount equal to 13.23% of the employee's pay is also deposited in the employee's ARP account, with a contribution of .77% being deposited in the OPERS general liability fund. NAME DATE Page two All WSU employees are exempt from Social Security contributions on earnings from the university. WSU employees hired on or after March 31, 1986 are required to pay a Medicare contribution of 1.45% of their earnings. In addition to the OPERS program, the University provides group life, medical, dental, vision, and long term disability insurance. The employee pays a portion of the costs for some of these programs. Certain educational benefits are also available to employees and their eligible dependents. The university, of course, must make certain deductions from your salary for federal, state, and local taxes. Administrative staff members working 100% of a full-time position earn sick leave at the rate of 1.25 days (10 hours) of sick leave per month. There is no limit on the accrual of sick leave hours. Sick leave hours may be used for your illness or injury or for the illness, injury, or death of a member of your immediate family. Sick leave with pay may be requested only for sick time earned. Administrative staff members working 100% of a full-time position earn vacation at the rate of 1.83 days (14.67 hours) per month. This is equivalent to 22 days of vacation annually. Those who have 25 or more years of Ohio public service earn vacation at the rate of 2.08 days (16.67 hours) per month. This is equivalent to 25 days annually for a full-time employee. Vacation leave is prorated for staff working less than 100% of full time. Annually on August 31 the amount of accrued but unused vacation for an unclassified staff member is reduced to the amount the employee could earn in two years (44 days for a full-time employee). There are 10 paid holidays per year. As a special contract employee, vacation is for use only within the appointment period and no payment for unused vacation time will be made upon termination. There are 10 paid holidays per year. All employees, citizens and noncitizens, hired after November 6, 1986 and working in the United States must complete a U.S. Citizenship and Immigration Services Form I-9. The I-9 Form is included with the new hire paperwork received at orientation. Employees must present an original document or documents that establish identity and employment eligibility within 3 business days of the date employment begins. We are confident that you will be a valuable addition to Wright State University and sincerely hope you will accept this offer. Please sign below indicating your acceptance of this offer. Please return the original to me by (DATE) and keep the copy for your files. Sincerely yours, APPROPRIATE DEPARTMENT HEAD TITLE, DEPARTMENT Enclosure I accept the offer contained herein as indicated by my signature below. EMPLOYEE NAME _______________________ DATE