Sept 26, 2014

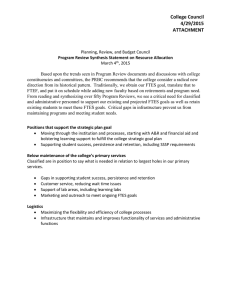

advertisement

Peralta Community College District Planning and Budgeting Council Date of Meeting: September 26, 2014 Present: Norma Ambriz-Galaviz, Timothy Brice, Tamika Brown, Paula Coil, Lisa Cook, Matthew Goldstein, Rick Greenspan, Stefanie Harding, Brandi Howard, Jennifer Lenahan, Anna O’Neal, Carl Oliver, Mike Orkin, Tae-Soon Park, Jeramy Rolley, Jennifer Shanoski, Cleavon Smith, Sui Song, Elnora Webb Chair/Co-Chair: Susan Rinne, Karolyn van Putten Guests: Thuy Thi Nguyen, Charles Neal Facilitator/Recorder: Linda Sanford, Joseph Bielanski Absent: Debbie Budd, Drew Gephart, Eric Gravenberg, Sadiq Ikharo, Jenny Lowood, Calvin Madlock, Trulie Thompson. Agenda Item Meeting Called to Order 1. Agenda Review 2. Review of Minutes Committee Goal Strategic Planning Goal and/or Institutional Objective Discussion Follow-up Action Decisions (Shared Agreement/ Resolved or Unresolved} Time: 9:10AM APPROVED Corrections to the minutes. Page 2 of 7: The search for the VC of Finance was not abandoned. The search was completed, but the District decided not to move forward with the finalist. The District was looking at a different direction. Page 4 of 7: Louis Quidlen should be Louis Quindlen. APPROVED as amended Abstain: 5 1 3. Review of PBC 201415 Goals developed at the Summit meeting 4. 2014-15 Final Budget 6. Monitor Progress in the Integrated Planning and Budgeting Calendar D.3 Institutional Effectiveness The wording of PBC Goal #7 was revised APPROVED as amended E.2 Budget to Improve Student Success E.3 Fiscal Oversight The Final Budget was presented to the Board of Trustees (BOT) at their September 9, 2014 meeting for adoption. Highlights from the presentation: State Budget: To pay down/eliminate the wall of debt; $10 billion Focusing on new money for education An initiative on the November ballot for a Rainy Day Fund (RDF). If capital gains exceed 8% of General Fund, those funds will be deposited into the RDF. Half of those funds would be used to pay off liabilities and debt for 15 years. If there is a disaster or emergency within the State, the Governor has the ability to draw from that fund. Positive Triggers: First time in many years. If revenue comes in higher, it will activate positive triggers in the budget. CalSTRS: For 2014-15, The PBC Goals document will be updated to include the revision to Goal #7. The PowerPoint presentation that was presented to the BOT will be posted online. 2 employers are faced with a .63% increase in STRS contribution. Peralta is paying 8.88% from 8.25%. Faculty is paying 8.15% instead of 8%. State is paying 6.3% instead of 3%. The increase is scheduled to go up to 19.1% for employers and 10.25% for employees. The increase equates to about $14 million in additional expense for the District over the span of seven years. COLA = .85% (half of prior year) Access (growth) = 2.75% SSSP = $100 million. Mandates: Release time for negotiations. Funding will be allocated per FTES instead of filing mandated cost claims. We are expected to receive around $500,000 this year. Scheduled Maintenance and Instructional Equipment: Last year, we received $225,000 for each with a 1:1 match requirement. This year, we received $2.3 million to be split between the two with no match requirement unless we are doing a barrier removal (which we are not). The split amount would be decided by the District. It was decided at a Mr. Greenspan would like to see a report (APU and clarification) as to how the decision was made for the split. 3 Chancellor’s Cabinet meeting that $1.9 million is going to scheduled maintenance, $200,000 for library materials, and $200,000 for instructional equipment. Per VC Rinne, we were required to report to the State Chancellor’s Office by September 15, 2014 as to how we are going to split the funding. The letter from the State Chancellor’s office was received on September 1, 2014. Technical Assistance Team: The State Chancellor’s Office received nine new positions. The State Chancellor’s Office is trying to setup a method to assist colleges that might have accreditation issues. This method won’t charge the colleges for their service. Formula for Growth Allocation: Previously growth allocation was based on the prior year annual report’s funded base + 3% on top. For 2015-16, there will be a new formula based on economic factors. Career Development and College Programs (CDCP): Used to be funded at a quarter level of credit, but now it will be funded at full credit base 4 ($4600 per credit). Caution and Concerns: Prop. 30 allowed us to maintain the same level of access to our students. If Prop. 30 goes away, we’ll lose $13 to $15 million. Part of the sales tax increase ends in 2016 (21% of Prop. 30 revenue). The rest is set to expire in 2018; therefore we need to plan for it. STRS obligation Deficit in continuing exposure to property taxes and fees. PCCD Budget: COLA = .85% (half of prior year); $2.2 million Access (growth) = 2.75%; $846,989 DSPS: Budgeted at105% from prior year. SSSP: Allocation was received earlier this week. The four colleges funding almost doubled from prior year. Student Equity Plan: $1.3 million district-wide. Distribution amount will be based on a recommendation from the Chancellor’s Cabinet. CalPERS: PERS conducts two annual evaluations (July 1st and January 1st). They sent out 5 a circular letter stating that their fees will increase 15-20% during the same period as STRS. This year the increase is .329%, which equates to $74,000 for our district. Medical Premiums: Increased by approximately $980,000 Workers’ Comp.: Increased by $54,000 OPEB Liability: The District took out a bond in 2005 for $150 million. The debt service on the bonds is a general fund obligation. The debt service payment increased by $1.6 million this year. We built our budget based on a target of 19,355 residence FTES. Productivity Level = 17.5 Unrestricted Lottery dollars are the same as prior year. Total Budget is approximately $127 million in the General Fund Unrestricted with an estimated carryover amount of $500,000 to $1 million. Our beginning balance is approximately $14 million. Parcel Tax: In fiscal year 2013-14, we used the parcel tax to restore the 15% reduction from the 2012-13 General Fund. For fiscal year 2014-15, funding was restored 6 5. 2014-15 Integrated Planning Budget Building Calendar 6. Monitor Progress in the Integrated Planning and Budgeting Calendar D.3 Institutional Effectiveness E.1. FTES/FTEF Target E.3 Fiscal Oversight in the General Fund. This year, the parcel tax was used only for 1351 (PT faculty), a couple Classified positions, and the PASS program. New Healthcare Program: The District has to pay $16.50 per employee. Page 19 of the Final Budget: “Applicable International Revenue” should be changed to “Applicable Non-Resident Revenue”. Student Equity Plan: The deadline has been changed because the State has given us more time to complete the college plans. The item will be going to the Board on November 18th for first read and on December 9th for approval. The schedule will be included on a timeline of topics for the committee. Concern was expressed in regards to the process/schedule to review the priority hiring list for Faculty and Classified positions. We need to let HR know by October of this year so that there is adequate time for Fall recruitment for the following year. Per AVC Sanford, it is on the calendar for March 27, 2015. Note: Categorical positions do not need to go through the district-wide shared governance process. It can come to the PBC as an informational 7 item. Faculty Obligation Number (FON): There might be an issue with next year’s FON that may require the hiring of additional faculty (to meet the bare minimum/basic requirement). The percentage calculation method, which allowed the parcel tax to be used to hire additional part-timers and doesn’t count towards the FON, is going away. 6. Committee Resolutions: 5. Evaluate Continuous DFC Improvement CTE of the PBIM Process D.2 Institutional Leadership and Governance D.3 Institutional Effectiveness District Facilities Committee (DFC) memo: The memo was received on September 15th. The DFC recommends that colleges be able to appoint additional members, one Classified representative from each college, to the DFC. While we usually do not make such recommendation until the end of the academic year, however, the DFC cannot wait and this is a way to fast track the change. Request was made to have the data on how many districts operate at the bare base minimum of FON. Per AVC Sanford, the information is posted online and will be circulated to the group. A memo will be sent to the Chancellor for action on adding four classified members to the DFC. Motion to endorse the memo. APPROVED Opposed: 2 8 CTE Subcommittee The deficiency in the PROMT system is the integration between the Payroll and Finance process. It is currently a manual process. There is a lag between when payroll is printed to when it is posted in the finance module. We are waiting for the Finance module to be upgraded. The upgrade is scheduled for this calendar year. We currently don’t have a formal procedure for carryover budgets to be loaded. In the past, Finance loaded partial carryover until the books are closed. We have a fiscal year-end timeline that is not being adhered to. There is a Business Managers’ meeting today to go over the proposed process: once June 30th hits, the Business Managers will need to review their budgets, build their carryovers, and sign off that all bills are paid and payroll is posted. The Business Managers can then upload the carryover budgets. This will be a uniform process across all colleges. VC Rinne will have a written procedure on carryover budgets that will be shared with the DEC, PBC, and the Colleges. She will also work with IT on a timeline for the Finance module upgrade. Payroll budgets cannot be encumbered in PROMT. It is not possible in the current version of PeopleSoft. Timesheets are posted to the budget codes listed, whether the funding is available or not. The last payroll adjustment was completed yesterday. 9 7. Board Policies and Administrative Procedures 3. Review and Recommend BPs and APs D.2 Institutional Leadership and Governance There will be a workshop scheduled to help people understand more clearly what is required for us to close the books and why we need to adhere to the fiscal year-end cutoffs. A number of years ago, we received an accreditation recommendation that we failed to keep our Board Policies (BPs) and Administrative Procedures (APs) up-to-date. To continue to address the ACCJC recommendation, Peralta must show regular and ongoing review of our BPs and APs. Tom Henry was here to help us on Finance issues. He recommended hiring Jim Grivich is assist in responding to the ACCJC recommendation. Mr. Grivich recommended that we move our policies and procedures to the Community College League of California’s (CCLC) process for updating BPs and APs. BP 5020 Nonresident Tuition The language was taken from the CCLC due to new regulations. BP 5030 Student Fees This BP was reviewed with the AVC of Student Services. Section III. B. should read “The Chancellor is authorized to implement a Capital Outlay fee of $6 per unit, not to exceed $144 in an academic year.” 10 BP 6200 Budget Preparation Remove the statement “Unrestricted general reserves shall be no less than 5%.” The statement is inserted into BP 6250 Budget Management. BP 6250 Budget Management New policy and follows the CCLC template. AP 3560 Alcoholic Beverages It would be legal to have alcoholic beverages as an option when renting out facilities and to increase the rental income. The rental agreement must be approved by the College President or the Chancellor. Per General Counsel Nguyen, you’ll still need a liquor license or permit but no insurance required. AP 6700 Civic Center and Other Facilities Use It was noted that we need to hold the Business Managers accountable for staffing hours and to adhere to this BP and AP. It is contractual to have advance notice. There is a dollar sign missing under the second asterisk on the bottom of page 3 of 4. It should read “Additional tennis courts are $15 per hour”. 11 Motion to approve the Board Policies and Administrative Procedures as amended. APPROVED Abstain: 4 8. BAM Updates Discussion: RES FTES vs. Total FTES Fixed Costs 1. Update the BAM to operationalize full implementation of the model. E.2 Budget to Improve Student Success E.3 Fiscal Oversight E.4 Support Quality Instruction Discussion on moving toward full implementation of the BAM by looking at how we calculate the base allocation from resident FTES to total FTES. The front of the first page shows the changes, which now includes both resident and non-resident FTES based on a three year rolling average. This will also change the Full-time Equivalent Faculty (FTEF) allocation to the colleges. The FTEF will increase by the same ratio. A master list will be created with all the problems related to the BAM that have been brought up, such as the cost of CTE and faculty with more years of service. The back of page first page shows the current BAM that was part of the Final Actual Adopted Budget. language change on For example: the proposed Under the new method, BCC’s amendment revenue allocation is $17,974,747. to the BAM Under the old method, BCC’s revenue will be allocation is $17,962,939. brought back to the PBC. The current budget is based on the targeted FTES. We then distribute the number of positions needed in order to support the FTES number. Part-time faculty funding is based on your FTEF number. 12 Recommended revision: To include a line (as a deduction) for fixed costs (with an asterisk) under Revenue Allocation by College. 9. Accreditation Update 10. Schedule Workshops 11. Adjournment 7. Receive from the colleges monthly reports….. 4. Provide Workshops on the BAM D.3 Institutional Effectiveness PCCD Integrated Accreditation and Planning Timeline for 2014-15 is the District’s guide for the year. The shaded areas are completed. The Colleges were asked to update their strategic plans and to be used as an update for accreditation. It is due to the Board of Trustees on December 9, 2014. D.1 Service Leadership Accreditation site visits are scheduled for March 9th – 12th, 2015. A VC Sanford met with college teams the past two weeks. The Colleges are working on their first draft. The next meeting is on September 30th from 35pm and will schedule additional meetings if needed. Set aside a 30 minute block of time to To setup go over, in depth, the understanding of CCCConfer the BAM. Time: 11:48 PM Minutes taken by: Sui Song Attachments: All documents and/or handouts for this meeting can be found at: http://web.peralta.edu/pbi/planning-and-budgeting-council/pbcdocuments/ 13