Michael Cosgrove

advertisement

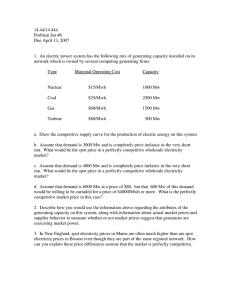

I shall not today attempt further to define the kinds of material I understand to be embraced . . . but I know it when I see it. 1964 – Justice Potter Stewart Interest Rates 1965 - 1980 16.00% 13.35% in 1980 14.00% 12.00% 10.51% in 1974 10.00% Interest rate chart 8.00% 6.00% 4.00% 2.00% Source: (www.federalreserve.gov) 0.00% 2.50 Gasoline Prices 1919 - 2005 2.00 $2.27 in 2005 1.50 Long term gasoline chart $1.38 in 1981 1.00 0.50 0.00 $0.63 in 1978 $0.37 in 1973 Source: (www.eia.doe.gov) Emergency Petroleum Allocation Act of 1973 •Capped Domestic Crude Oil Prices •“New Crude Oil” – No Price Cap •“Stripper Oil” – No Price Cap UN-CONTROLLED OIL CERTIFICATE CONTROLLED OIL CERTIFICATE Price controls rescinded January 1981 long term crude chart Source: (www.eia.doe.gov) • U.K Taxes on North Sea Crude Oil • Japanese trading companies seeking to increase top line revenue • Wall Street begins to arbitrage crude oil National Energy Policy Act - 1992 “you have to understand that market realities have diverged from traditional valuation methodologies” Second Quarter 2000 Top Power Marketers 1. Duke Energy Trading & Marketing, LLC 55,885,662 mwh 2. PG&E Energy Trading Power 51,330,085 mwh 3. Southern Company Energy Marketing LP 42,940,259 mwh 4. Aquila Energy Marketing Corp. 39,964,588 mwh 5. Reliant Energy Services, Inc. 31,288,607 mwh 6. El Paso Merchant Energy 22,339,315 mwh 7. Entergy Power Marketing Corp. 18,201,513 mwh 8. Constellation Power Source 16,466,585 mwh 9. MIECO, Inc. 12,254,449 mwh 10. Sempra Energy Trading 11,269,371 mwh 11. Enron Power Marketing Inc. 9,305,833 mwh 12. Williams Energy Marketing & Trading 7,722,926 mwh 13. TXU Energy Trading 6,838,664 mwh 14. New Energy Ventures, Inc. 6,822,925 mwh 15. HQ Energy Services 6,762,105 mwh 16. LG&E Energy Marketing Inc. 6,505,649 mwh (source – PowerMarketers.com) Cinergy Day Ahead Power 1995 - 1998 2000 1800 1600 1400 1200 1000 800 600 400 200 Source: (www.ferc.gov) Nov-98 Jul-98 Mar-98 Nov-97 Jul-97 Mar-97 Nov-96 Jul-96 Mar-96 Nov-95 0 n98 Ju l-9 8 Ja n99 Ju l-9 9 Ja n00 Ju l-0 0 Ja n01 Ju l-0 1 Ja n02 Ju l-0 2 Ja n03 Ju l-0 3 Ja n04 Ju l-0 4 Ja n05 Ju l-0 5 Ja n06 Ja NASDAQ Adj Close* 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 Source: (www.nasdaq.com) Current market expansion 1. The crude oil trading boom of the late 70’s was based on the gaming of a poorly conceived attempt to legislate energy prices. 2. The crude oil trading boom in the mid 80’s to mid 90’s was based upon a response to evolving tax laws in the U.K., the trading of cargoes of crude oil to bolster top line revenue and by the introduction of the ultimately selfextinguishing practice of arbitrage trading. 3. The boom in power trading in the late 90’s was based upon extraordinary stock market valuations, creating ravenous desire on the part of power marketers to demonstrate superior market share as measured in MWH traded. •Continued deregulation •Changing load shapes •Accurate price reporting •Higher ethical standards •Clearing of OTC energy products •Non-correlated asset •High energy prices •High volatility •Big money •Energy is hot •Balance sheet & order flow •Hedge funds Where do we go from here? 1. Next big thing… 2. Volume growth 3. Sustained volatility 4. Worldwide deregulation 5. Higher allocations to energy 6. Financial institution presence 7. Hedge fund presence 8. Consolidation among utilities 9. Niche players 10.Robust fundamentals We have just begun…