Document 15121254

advertisement

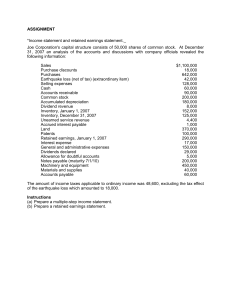

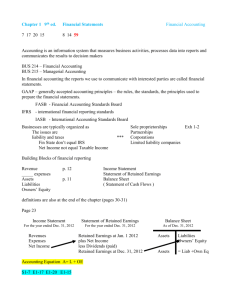

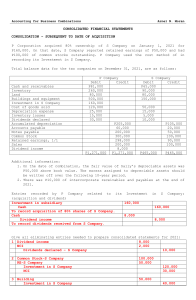

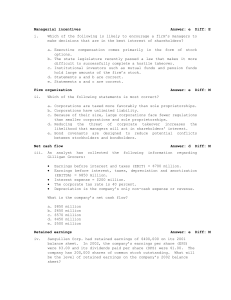

Matakuliah Tahun : V0282 - Manajemen Akuntansi Hotel : 2009 - 2010 PERTEMUAN 5 Chapter 5 The Statement of Cash Flows Allisha McKay has compiled the sources and uses of funds information she needs, she is ready to prepare The Fred Proffet Company’s Statement of Cash Flows for the Year Ended 2012. Help her complete the company’s Statement of Cash Flows by using the information taken from the following Condensed Income Statement and Statement of Retained Earnings for 2012, and 2011 and 2012 Balance Sheets. Answer the question that follow: Bina Nusantara University 3 THE FRED PROFFET COMPANY Condensed Income Statement and Statement of Retained Earnings For the Period: January 1 trough December 31,2012 Income Statement Sales $ 5,200,000 Cost of sales 1,560,000 Gross Profit 3,640,000 Operating Expenses (excluding depreciation) 2,860,000 Depreciation 105,000 Operating Income 675,000 Interest 242,000 Income Before Income Taxes 433,000 Income Taxes (40%) 173,000 Net Income 260,000 Statement of Retained Earnings Retained Earnings, December 31, 2011 1,146,000 Net Income for 2012 260,000 Subtotal 1,406,000 Cash Dividends Pain in 2012 156,000 Retained Earnings, December 31, 2012 1,250,000 THE FRED PROFFET COMPANY Statement of Cash Flows December 31,2012 Net cash Flow from Operating Activities Net Income Adjustments to reconcile net income to net cash flows from operating activities Depreciation Increase in Net Receivables Decrease in Net Inventories Decrease in Account Payable Decrease in Other Current Liabilities Net Cash Flow from Operating Activities Net Cash Flow from Investing Activities Decrease in Marketable Securities Increase in property and Equipment Net Cash Flow from Operating Activities Net Cash flow from Financing Activities Decrease in Notes Payable Increase in Long term Debt Increase in capital Stock ( Common Stock + Paid in Capital) Dividends Paid Net Cash flow from Financing Activities Net Increase in Cash during 2012 Cash at the beginning of 2012 Cash at the end of 2012 Supplementary Disclosure of Cash Flow Information Cash paid during the year for Interest Income Taxes a. Did the change in Cash reflect a Source or a Use of funds? What was the amount of that change? b. Did the change in Net Receivables reflect a Source or a Use of funds? What was the amount of that change? c. Did the change in Notes Payable reflect a Source or a Use of funds? What was the amount of that change? d. Did the change in Retained Earnings reflect a Source or a Use of Funds? What was the amount of that change? e. What was the total amount of Source and uses of Funds?