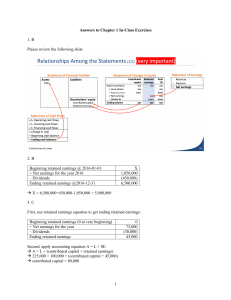

Soal latihan A1034 Akuntansi Menengah Pertemuan 5 & 6

advertisement

Soal latihan A1034 Akuntansi Menengah Pertemuan 5 & 6 Assume the following: Under financial capital maintenance, net income (loss) would be: a. ($180,000) loss b. $180,000 c. $120,000 d. $150,000 Financial capital maintenance concept of income is different form physical capital maintenance: a. only financial capital maintenance relies on current cost. 2. b. only physical capital maintenance relies on current cost. c. only financial capital maintenance excludes owners' transactions. d. only physical capital maintenance excludes owners' transactions. All of the following are elements of income except: a. revenues 3. b. expenses c. retained earnings d. gains Revenue can be recognized: a. only when cash is received. 4. b. only after the service has been performed. c. only during production. d. at the end of productions. An example of systematic and rational allocation of expense recognitions is: a. cost of goods sold. 5. b. managements salary. c. depreciation on property, plant, and equipment. d. utilities. A multi-step income statement is divided into separate sections including all of the following, except: a. income from continuing operations. 6. b. other revenues and gains. c. cost of goods sold. d. retained earnings. The comprehensive income statement is now required by FASB. Which of following transactions would be found on the new statement? 7. a. Discontinued operations. b. Cumulative effect of a change in accounting principle. c. Appropriating retained earnings. Unrealized holding gains and losses on available for sale d. securities. All of the following are included in a statement of stockholders' equity, except: a. prior period adjustments. 8. b. dividends declared. c. net income. d. cumulative effect of a change in accounting principle. Under cash basis accounting, what account most likely would not be needed? a. sales revenue 9. b. wage expense c. rental income d. wages payable Which of the following would normally qualify as an extraordinary item? a. Loss from a strike. 10. b. Loss on sale of equipment. c. Gain on early extinguishments of debt. d. Loss from inventory spoilage.