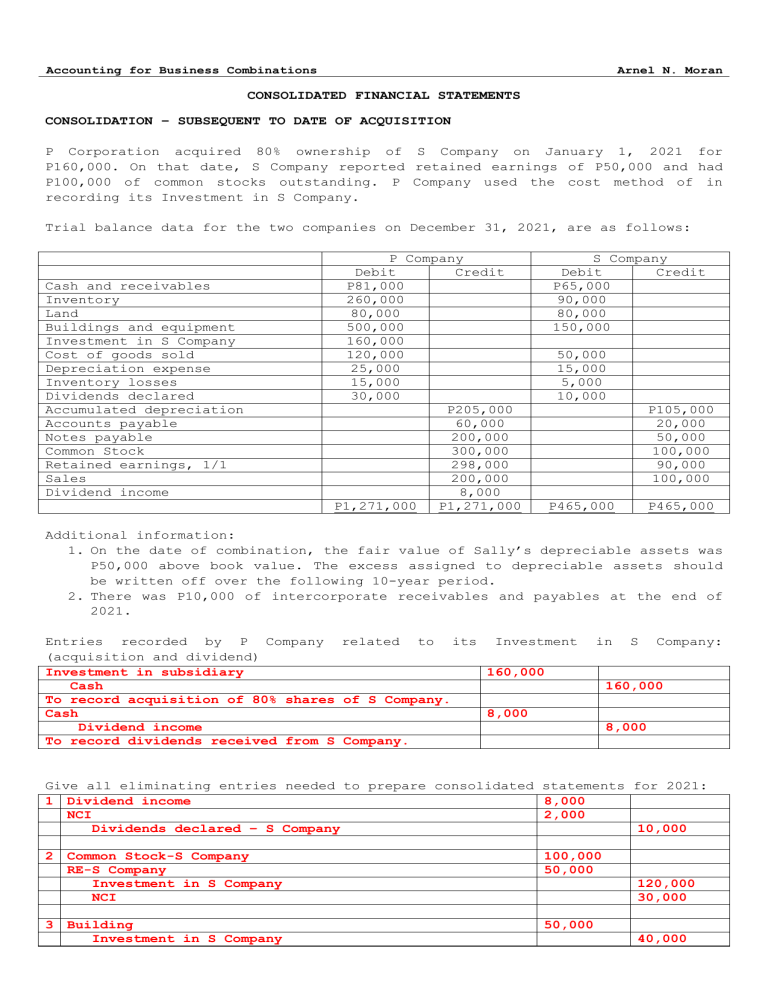

Accounting for Business Combinations Arnel N. Moran CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATION – SUBSEQUENT TO DATE OF ACQUISITION P Corporation acquired 80% ownership of S Company on January 1, 2021 for P160,000. On that date, S Company reported retained earnings of P50,000 and had P100,000 of common stocks outstanding. P Company used the cost method of in recording its Investment in S Company. Trial balance data for the two companies on December 31, 2021, are as follows: Cash and receivables Inventory Land Buildings and equipment Investment in S Company Cost of goods sold Depreciation expense Inventory losses Dividends declared Accumulated depreciation Accounts payable Notes payable Common Stock Retained earnings, 1/1 Sales Dividend income P Company Debit Credit P81,000 260,000 80,000 500,000 160,000 120,000 25,000 15,000 30,000 P205,000 60,000 200,000 300,000 298,000 200,000 8,000 P1,271,000 P1,271,000 S Company Debit Credit P65,000 90,000 80,000 150,000 50,000 15,000 5,000 10,000 P105,000 20,000 50,000 100,000 90,000 100,000 P465,000 P465,000 Additional information: 1. On the date of combination, the fair value of Sally’s depreciable assets was P50,000 above book value. The excess assigned to depreciable assets should be written off over the following 10-year period. 2. There was P10,000 of intercorporate receivables and payables at the end of 2021. Entries recorded by P Company related to its Investment (acquisition and dividend) Investment in subsidiary 160,000 Cash To record acquisition of 80% shares of S Company. Cash 8,000 Dividend income To record dividends received from S Company. in S Company: 160,000 8,000 Give all eliminating entries needed to prepare consolidated statements for 2021: 1 Dividend income 8,000 NCI 2,000 Dividends declared – S Company 10,000 2 Common Stock-S Company RE-S Company Investment in S Company NCI 100,000 50,000 3 Building Investment in S Company 50,000 120,000 30,000 40,000 NCI 10,000 4 Retained earnings (prior year) Depreciation expense Acc. Dep-bldg 5,000 5,000 5 Accounts payable Accounts receivble 10,000 6 NCI-NIS (30,000-5,000)*20% NCI 5,000 7 Retained earnings-S Company[(50,000-90,000)-5,000]*20% NCI 7,000 10,000 10,000 5,000 7,000 Prepare a three-part consolidation working paper as of December 31, 2021: P S Company Company Statement of CI Sales Dividend income Total revenue 200,000 8,000 208,000 100,000 Cost of goods sold Depreciation expense Inventory losses Total cost and expenses Net /consolidated CI 120,000 25,000 15,000 160,000 48,000 50,000 15,000 5,000 70,000 30,000 (1)8,000 Retained earnings statement Retained earnings, 1/1 CI from above Total Dividends declared Retained earnings, 12/31 carried forward Statement of FP Cash and receivables Inventory Land Buildings and equipment Investment in S Company Total Accumulated depreciation Accounts payable Notes payable 170,000 45,000 20,000 235,000 65,000 (4)5,000 (6)5,000 48,000 30,000 298,000 90,000 48,000 346,000 30,000 316,000 30,000 120,000 10,000 110,000 81,000 260,000 80,000 500,000 160,000 65,000 90,000 80,000 150,000 1,081,000 385,000 205,000 105,000 60,000 200,000 20,000 50,000 Consolidated 300,000 300,000 100,000 NCI in CI of subsidiary CI carried forward Adjustments & Eliminations Debit Credit (5,000) 60,000 (2)50,000 (4)5,000 (7)7,000 326,000 (1)10,000 (5)10,000 (3)50,000 (2)120,000 (3)40,000 60,000 386,000 (30,000) 356,000 136,000 350,000 160,000 700,000 - 1,346,000 (4)10,000 (5)10,000 320,000 70,000 250,000 Common stock Retained earnings from above NCI Total 300,000 316,000 100,000 110,000 (2)100,000 (1)2,000 1,081,000 385,000 300,000 356,000 (2)30,000 (3)10,000 (6)5,000 (7)7,000 50,000 1,346,000