Document 15108289

advertisement

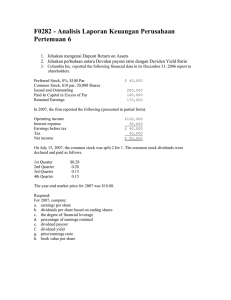

Mata kuliah : F0922 - Pengantar Analisis Pendapatan Tetap Dan Ekuitas Tahun : 2010 ANALISIS EKUITAS: COMPANY ANALYSIS Pertemuan 11 -mupo- ANALISIS EKUITAS: COMPANY ANALYSIS Materi : 1. Review : COMPANY ANALYSIS 2. Kasus : mengenai COMPANY ANALYSIS Bina Nusantara University 3 1. COMPANY ANALYSIS 1.1 Financial Statements 1.1.1 Balance Sheet • Common Sized • Trend or Indexed 1.1.2 Income Statement • Common Sized • Trend or Indexed 1.1.3 Statement of Cash Flows Consolidated Statement of Income for HewlettPackard, 2005 Consolidated Balance Sheet for Hewlett-Packard, 2005 Statement of Cash Flows for Hewlett-Packard, 2005 1.2 Profitability Measures 1.2.1 ROE: measures the profitability for contributors of equity capital 1.2.2 ROA: measures the profitability for all contributors of capital 1.2.3 Leverage has a significant effect on profitability measures Nodett’s Profitability over the Business Cycle Impact of Financial Leverage on ROE Summary of Key Financial Ratios Summary of Key Financial Ratios (cont’) Kasus: Columbia Inc. reported the following financial data in its December 31, 2006 report to shareholders. Preferred Stock, 8%, $100 Par Common Stock, $10 par, 20,000 Shares Issued and Outstanding Paid-In Capital in Excess of Par Retained Earnings $ 40,000 200,000 160,000 170,000 In 2007, the firm reported the following (presented in partial form). Operating income Interest expense Earnings before tax Tax Net income $120,000 30,000 $ 90,000 40,000 $ 50,000 On July 15, 2007, the common stock was split 2 for 1. The common stock dividends were declared and paid as follows. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter $0.28 0.28 0.15 0.15 The year-end market price for 2007 was $18.00. Required: For 2007, compute: a. b. c. d. e. f. g. h. Earnings per share Dividends per share based on ending shares The degree of financial leverage Percentage of earnings retained Dividend payout Dividend yield Price/Earnings ratio Book value per share