– Diminishing PRODUCTS Musharakah – 21 October, 2008

advertisement

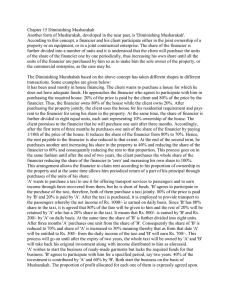

Islamic Modes for Agricultural Financing PRODUCTS – Diminishing Musharakah Lahore 20 – 21 October, 2008 Al – Huda Training Programme Muhammad Khaleequzzaman Head Islamic banking Department Int’l Islamic University Islamabad Islamic Modes – Agricultural Financing Rules of Musharakah • • • • Fulfillment of prerequisites of a contract Rules of contribution of equity Rules of profit and loss sharing Management of Musharakah/Relationship of parties • Termination of musharakah Uses of Musharakah: – Agricultural enterprise financing – Project financing – Working capital financing, etc. Islamic Modes – Agricultural Financing Musharakah • An equity participation contract under which IB and its client contribute jointly to finance an enterprise. • Equity is owned according to each party's share in financing. • Profit is shared in pre-agreed ratio and loss in proportion to the capital contribution. • It is an ideal alternative to the interest-based financing with far reaching effects on both production and distribution. Diminishing Musharakah (DM) Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): A form of Musharakah where the financier and the client participate in a joint commercial enterprise or property. This enterprise is converted into undivided ownership of both the financier and the client. Over certain period the equity of financier, divided into equal value units, is purchased by the client. And ultimately the client becomes the sole owner of the enterprise. Uses of DM – – – Agric. Machinery and implements financing Storage facility construction/sheds Transport vehicles, etc. Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): Procedural details: – Client requests the bank for DM – Appraisal is accorded – Approval is conveyed. – bank releases its share to become partner in the asset. And contract of Musharakah is executed. [buying &selling not stipulated] – This asset becomes undivided ownership of both the bank and the client [Musha] None of the parties can withdraw its equity till DM is terminated – General rules of partnership apply Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): Procedural details: (contd..) – At the same time, uni-lateral promise from client is obtained to purchase the units of bank’s equity. – The price of one unit of bank’s equity is valued – Ijarah Agreement is signed – In case of Ijarah the rent is realized while in case of business or services profit and losses are shared – Expenses connected to asset are borne by the partners proportionately Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): Procedural details: (contd..) – Equity of bank is periodically purchased by the client – Bank’s share in the asset decreases while that of client increases – so happens to the rent or profit – Ultimately the client becomes the sole owner of the asset [Bank’s share reduces to zero] DIMINISHING MUSHARAKAH Share in capital Share in capital 2 Partner Bank 3. Accruing Rentals Pays price of the units of bank’s equity 4 Sell its share in equity Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): Examples – Financing Purchase of Tractor: A client wants to purchase a tractor by sharing of equity of Rs. 40,000 against price of Rs. 400,000. The bank shares rest of the price of tractor ie. Rs. 360,000. How his request can be accommodated by a bank? Bank agrees to finance the purchase of tractor through DM. Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): – 10% of the cost (Rs. 40,000) is paid by the client and 90% of the cost (Rs. 460,000) by the bank. [Musharakah Contract is signed] – The rental of tractor is fixed according to certain reference price [Ijarah for future date is signed] – The client promises (unilateral promise) to the bank to purchase banks equity divided in to equal value units – Say, rent is fixed @ 15% p.a. – The DM terminates after 3 years – Installments can vary [Seasonal, quarterly, monthly] Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): – After acquisition, the client uses tractor and pays rent to bank for using bank’s share in the property – At the same time, purchases unit(s) of equity after expiry of each rental period – The equity of bank diminishes to zero on expiry of three years, the rental as well, client becomes sole owner Islamic Modes – Agricultural Financing Diminishing Musharakah (DM): (Amount in rupees) Total value of Asset: 60000 Share of client 40000 Share of Bank 360000 No. of units 36 Value of one unit 10000 Rent per month 4500 Rent per unit per month 4500 / 35 = 125 End of Month Rent Value unit Total purchased payment Remainin g units Remainin g balance 0 0 0 0 36 460000 1 125 x 36 10000 = 4500 14500 35 450000 2 125 x 35 10000 = 4375 14375 34 440000 3 125 x 34 10000 = 4250 14250 33 430000 35 125 x 2 = 10000 250 10250 1 10000 36 125 x 1 = 10000 125 10125 0 0 Total ?? ?? 460000 Islamic Modes – Agricultural Financing THANKS