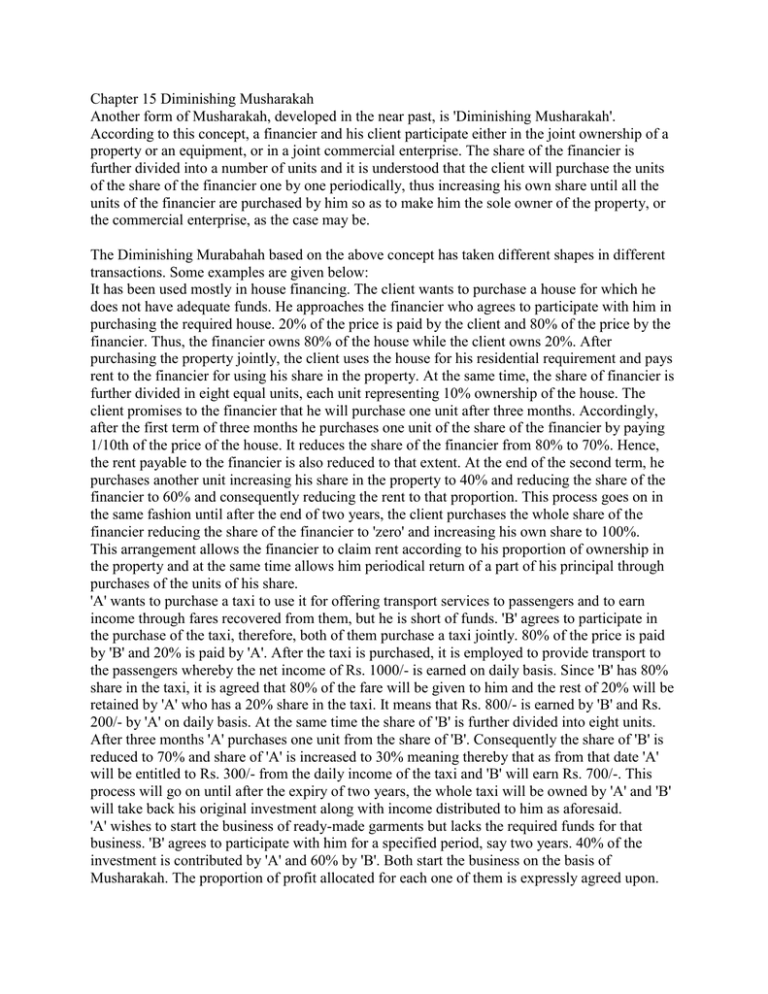

Chapter 15 Diminishing Musharakah

advertisement