This activity takes you into Yahoo Finance, one of the... available for reviewing the financial reports of publicly traded companies.

advertisement

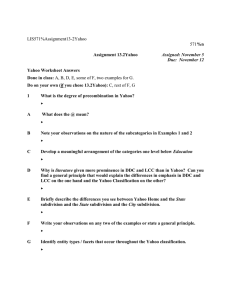

This activity takes you into Yahoo Finance, one of the most user friendly sites available for reviewing the financial reports of publicly traded companies. Google’s finance site also does a great job at displaying useful company performance information, but Yahoo still does better at putting a huge variety of industries in front of us and helping us see just how vast an assortment of business types there are in the economy. What we see as consumers is just barely scratching the surface. I'll lead you to the industry page first. Then I’ll pick an industry, and select a company in that industry. Use this guide to help you do the same thing to find your industry of choice. Ready? 1) Click on this link to go to http://www.yahoo.com/ 2) 3) 4) Explore the current market leaders on this page for a minute. When you are done, find the link on the left side of the screen "Complete Industry List". This may be toward the bottom of your screen. 5) Focus on selecting one industry. Think about what is happening right now that could drive growth and profits in a particular industry. I am going to pick Air Delivery & Freight Services because of the growth in online shopping in recent years, and because of how hard local retailers have been hit by the economy. More people are buying on line, so they have to get their merchandise shipped right? 6) Now we will be able to see the companies that make up this industry. Explore these top performers of the day a bit, then follow the link to get to the next step. We are not concerned with day to day price moves. We are looking for strong, productive companies that we want to own for the long run. 7) This next screen offers a great example of just how many companies exist in each industry. 14 different publicly traded companies is probably 12 more than we are familiar with. Consider that there are many more privately held firms on top of that! Each team needs to select one company per team-member based on a couple of the performance indicators on this screen. To ensure you get to see some contrast try to include: Market Cap: This is one estimate of the price to buy the entire firm. Pick some big, some small, and some medium. P/E: A high number here means that buying the firm is expensive compared to their profits. Find some high, some medium, some low here too. Sometimes you get what you pay for, sometimes you find a bargain. Net Profit Margin: You may find that the big Market Cap firms have low Net Profit Margins. Including at least one smaller firm with high Net Profit Margin just might find you the next rising star.