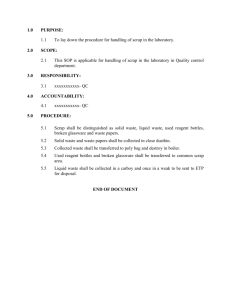

Cost Accounting Procedure for Scrap and Waste: 1.

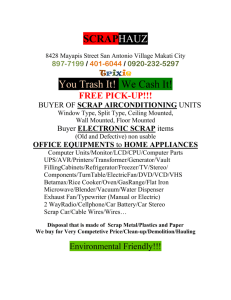

advertisement

Cost Accounting Procedure for Scrap and Waste: In many manufacturing processes, waste and scrap result from: 1. 2. 3. 4. 5. The processing of materials. Defective and broken parts. Absolute stock. Revisions or abandonment of experimental projects. Worn out or absolute machinery. This scrap should be collected and placed in storage for sale to scrap dealers. At the time of sale, the following entry may be made: Cash (or accounts receivable) Scrape sales (or factory overhead control) xxxx Dr. xxxx Cr. The amount realized from the sale of scrap and waste can be treated in two ways with respect to the income statement: 1. The amount accumulated in scrap sales may be closed directly to income summary and shown on the income statement under other income. 2. The amount may be credited to factory overhead control, thus reducing the total factory overhead expense and thereby the cost of goods manufactured. When scrap is collected from a job or department, the amount realized form the sale of scrap is often treated as a reduction in the materials cost charged to the individual job or product. In this case, the entry to record the sale would be: Cash (or accounts receivable) Work in process xxxx Dr. xxxx Cr. When the quantity and value of scrap materials is relatively high, it should be stored in designated place under the supervision of a storekeeper. A scrap report ( as shown below) is generally prepared in duplicate to authorize transfer and receipt of the scrap. Example of Weekly Scrap Report Department: Fabricating Scrap Report For Week Ending: November 10, 20--Part No. Description Units used Scrapped % Scrap 115b Braces 7,200 108 1.50 115e Fines 9,400 305 3.23 Weakly Cost $7.00 $30.50 Reason 115s Guides 15,600 520 115k Supports 8,500 42 Total for week............................................... Scrap cost-Year to date................................ Predetermined Scrap Allowance for Year 3.33 0.50 $41.40 Defective $25.30 Parts $104.20 $4,533.75 $5,000.00 The original is forwarded to the materials ledger clerk, and a copy remains on file in the department in which the scrape originated. The material ledger clerk can follow tow procedures: 1. Open a materials ledger card, filling in the quantity only. The dollar 2. value would not be needed. When the scrap is sold, the entries and treatment of the income item might be handled as discussed previously. Record not only the quantity but also the dollar value of the scrap delivered to the storekeeper. The value would be based on scrap prices quoted on the market on the time of entry. The entry would be: Scrap Materials Scrape Sales (or work in process or overhead control) xxxx Dr. xxxx Cr. When the scrap is sold the entry would be: Cash (or accounts receivable) Scrap Materials xxxx Dr. xxxx Cr. Any difference between the price at the time the inventory is recorded and the price realized at the time of sale would be a plus or minus adjustment in the scrap sales account, the work in process account, or the factory over head control account, consistent with the account credited in the first entry. To reduce accounting for scrap a minimum, often no entry is made until the scrap is actually sold. At that time, cash or accounts receivable is debited while scrap sales is credited. This method is expedient and is justified when a more accurate accounting becomes expensive and burdensome, the scrap value is relatively small, or the price is uncertain. Proceeds from the sale of scrap in reality a reduction in production cost. As long as the amounts are relatively small, the accounting treatment is not a major consideration. What is important is a effective scrap control system based on periodic reporting to responsible supervisory personnel. Timely scrap reports for each producing department call attention to unexpected items and unusual amounts and should induce prompt corrective actions.

![You`re invited to celebrate [child`s name]`s birthday at SCRAP! What](http://s3.studylib.net/store/data/007177272_1-c15601fb9e11b26854f13f1982e634e8-300x300.png)