CL53

advertisement

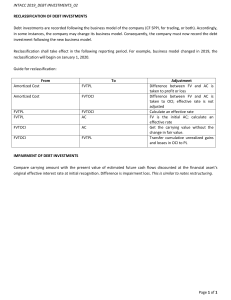

EXPOSURE DRAFT JULY 2009 DRAFT] INTERNATIONAL FINANCIAL REPORTING STANDARD X FINANCIAL INSTRUMENTS: CLASSIFICATION AND MEASUREMENT ED/2009/7 Question 1, 2, 3, 4, 6, 8, 9,10,11,12,13,14,15 No comment Question 5 Do you agree that entities should continue to be permitted to designate any financial asset or financial liability at fair value through profit or loss if such designation eliminates or significantly reduces an accounting mismatch? No, that is unless the ED Fair Value Measurement (ED/2009/5) is also introduced for adoption by the year end 2009, i.e. concurrently with this ED. The G20 leaders have recommended the IASB take action by the end of 2009. This ED/2009/7 proposes a reduction of the number of categories to only “two categories”. Significantly, one of these, ‘Fair Value’, is itself subject to an exposure draft, ED/2005/5, which is not scheduled to be ready by the same date. Were ED/2009/5, Fair Value Measurement, also to be ‘actioned’ by the G20 deadline then the answer to Question 5 would be changed to a Yes. Question 7 Do you agree that reclassification should be prohibited? No. There are circumstances when reclassification will provide understandable and useful information to users of financial statements. Such as; a) when markets dry up and the reported fair values bring uncertainty in the minds of the users of financial statements; whereas using Amortised cost ‘plus’ Impairment would be more appropriate b) when an entity’s management sees that, in hind sight, it inappropriately elected to use Fair Value on certain items in certain, now, illiquid markets (stating its reasons ready to answer questions from users of the financial statements). Amortised cost is the proposed alternative (under this ED/2009/7) and with the proper use of ‘Impairment’ would be an appropriate alternative. With respect to “How would you account for such reclassifications, and why”; the previous accounting entries would be unwound and the accounts would be ‘restated’ using an amortising basis. The particular items would be shown as separate line entries in both the P&L and Balance sheets so that the users of the financial statements can see what were the previous carry amounts and what are the new carrying amounts and be able to reconcile the differences. These ‘movements’ in the values of the particular items would be explained fully and made available by way of a separate note in the accounts. The main benefit is that the users of the financial statements would be able to see very clearly; what’s been changed, why and (importantly) the implications with respect to the performance and management of the entity. Richard Hicks 14th September 2009