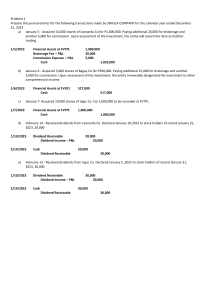

INTACC 2019_DEBT INVESTMENTS_02 RECLASSIFICATION OF DEBT INVESTMENTS Debt investments are recorded following the business model of the company (CF SPPI, for trading, or both). Accordingly, in some instances, the company may change its business model. Consequently, the company must now record the debt investment following the new business model. Reclassification shall take effect in the following reporting period. For example, business model changed in 2019, the reclassification will begin on January 1, 2020. Guide for reclassification: From To Amortized Cost FVTPL Amortized Cost FVTOCI FVTPL FVTPL FVTOCI AC FVTOCI AC FVTOCI FVTPL Adjustment Difference between FV and AC is taken to profit or loss Difference between FV and AC is taken to OCI; effective rate is not adjusted Calculate an effective rate FV is the initial AC; calculate an effective rate Get the carrying value without the change in fair value. Transfer cumulative unrealized gains and losses in OCI to PL IMPAIRMENT OF DEBT INVESTMENTS Compare carrying amount with the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate at initial recognition. Difference is impairment loss. This is similar to notes restructuring. Page 1 of 1