Chapter Three General Partnerships

advertisement

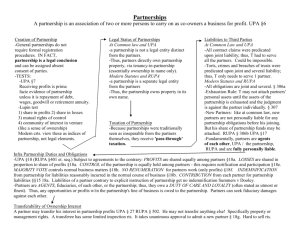

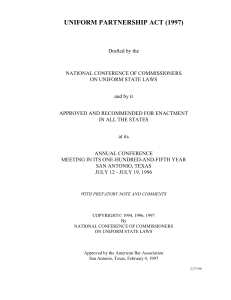

Chapter Three General Partnerships General Partnerships A voluntary association of two or more persons who agree to carry on business together for profit. Unlimited Personal Liability Liability for business debt, which extends beyond what is invested in a business to an individual’s personal assets Law Governing Partnerships UPA: Uniform Partnership Act, model for partnership legislation in about one-fourth of the states RUPA: Revised Uniform Partnership Act, model for partnership legislation in about three-fourths of the states Partnerships by Categories (2008) Arts, Entertainment and Recreation 2% Health Care and Social Assistance 2% Agricultural, Forestry, Fishing, and Hunting 5% Accommodation and Food Services 4% Retail Trade 5% Construction 6% Financing and Insurance 11% Admin/Support/Waste Management/ Remediation Services 2% Professional, Scientific, and Technical Services 6% Real Estate/Rental/Leasing 46% Other 11% Advantages of General Partnerships Ease of formation Flexible management Ease of raising capital Pass-Through Taxation Disadvantages of General Partnerships Unlimited personal liability Lack of continuity Difficulty in transferring partnership interest Partnership Agreement Name of the partnership Names and addresses of the partners Recitals Purpose Address Term Financial provisions Profits and losses Management and control Admission of new partners and withdrawal of partners Dissolution Miscellaneous provisions Signature and dates UPA Approach to Dissolution Under the UPA, dissolution of the partnership triggers a winding up, namely, a wrapping up of the business affairs of a partnership. A variety of events can cause a dissolution, including the following: the ending of the term of a partnership; the withdrawal at will of any partner (if there is no definite term or purpose of the partnership); unanimous agreement of all partners; and the death, expulsion, or bankruptcy of a partner. RUPA Approach To ameliorate the harsh effects of the UPA approach requiring a dissolution and winding up of a partnership every time a partner leaves the enterprise, the RUPA provides that in almost all cases, a partnership may buy out the interest of a partner who leaves the partnership (such departure being referred to as a dissociation), and the partnership will continue its business. Dissociation A withdrawal of a partner from a partnership; does not necessarily cause a dissolution or termination of partnership Wrongful dissociation: a dissociation caused by a breach of partnership agreement Key Features of General Partnerships Partnerships are formed by agreement, either oral or written. All partners share rights to manage the partnership. Partners share profits and losses according to their agreement; if no agreement, profits and losses are shared equally, regardless of capital contribution. Partners have unlimited personal liability for partnership obligations. Liability is joint and several, meaning that each partner is completely liable for any debt. Slide 1 of 2 Key Features of General Partnerships Partnerships are easily and inexpensively formed. Partners owe each other fiduciary duties. Under the UPA, nearly any withdrawal by a partner causes a dissolution of the partnership. Under the RUPA, withdrawal of a partner may not necessarily cause a dissolution and winding up of the partnership; in many instances the dissociating partner is bought out. Partnerships file information tax returns but do not pay federal taxes; all income, whether distributed or not, is passed through to the partners who pay tax at their appropriate individual rates. Slide 2 of 2