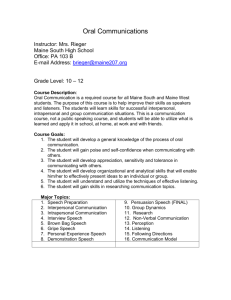

The Current State of Maine’s Pulp & Paper Industry -- A Competitive Assessment

advertisement

The Current State of Maine’s Pulp & Paper Industry -- A Competitive Assessment -PIMA Northeast Division 83rd Annual Meeting Kennebunkport, Maine – September 19, 2003 Jim McNutt Center for Paper Business & Industry Studies -- CPBIS 1 OVERVIEW Maine’s P&P Industry – Where Are We? North America Printing & Writing Paper Market Maine’s Primary Grades Review – Grade-byGrade 9 UCFS 9 SC 9 Directory 9 CGW 9 CFS 2 Where Can We Go? Where are We? In The Mind’s of Many – Maine’s Forest Products Industry Has Entered The Beginning of The End – Much Like Textiles & Steel Yet – Others View Maine’s Forest Products Industry As Being On A Doorstep To Revitalization In Truth – Maine’s Forest Products Industry’s Future Is In The Hands Of Those Who Do . . . Not In The Hands Of Those Who Can’t & Won’t . . . Not In The Hands Of Those Who Only Complain, Point Fingers & Criticize! Yet – The Challenges Are Real, & They Are Major 3 So -- Where are We Now -- Really? Maine’s P&P Industry Is An Industry in Transition . . . Older Infrastructure & Dated Technology Declining Capacity, Jobs, Taxes Paid Older Workforce With Age Structure Imbalance Higher Factors of Production Costs – Especially For: Energy, Fiber, Labor, Maintenance ¾ Taxes, Worker Compensation . . . . ¾ 9 Cost Competitive Pressures Are Severe 9 9 9 9 Markets In Transition & Under Great Pressure . . . 9 Global Competitiveness Has Escalated 9 Demand Growth Is Much More Constrained 9 Customers Are Stressed & More Demanding . . . 4 And – What Are Some Key Realities? Maine Is Not Viewed As A Premium Place For Basic Industry Operations & Investment . . . 9 9 9 Past Political Polarization Tax Structures & Systems State Regulations & Regulatory Processes Site Permitting Requirements ¾ Environmental Arena ¾ Timberlands & Multiple Use Needs Balancing . . . . ¾ Industry Attention Seriously Strained 9 Management Focus On Maine’s Operations 9 Investment History And Patterns 5 Special Interest Groups Public Conflicts . . . . So – Where Do We Start & Look? The Key Today to Maine’s P&P Industry Is Found in the Printing & Writing Paper Grades 9 Uncoated Freesheet -- UCFS 9 SC Grades 9 Directory 9 Coated Groundwood 9 Coated Freesheet – CFS 6 Let’s First Look At Key Printing & Writing Paper Grades For North America As a Whole Grade Outlook – N. Am. P&W Papers Recent Economic Slowdown & Alternative Media Substitution Have Impacted P&W Demand Negatively: Uncompetitive Capacity Being Closed & Modest Demand Increases Will Tend to Reign in Excess Capacity CFS, CGW, UCFS & GW Grades Seemingly Collapsing Into One Relatively Inter-changeable/somewhat Flexible Grade Structure From Consumers’ Perspectives These Changes Brought on by Collapsing Price Structures of the Grades on Top of Each Other Is a Major Sea Change In This Context -- CFS Quickly Becoming Commoditized -Displaced by Improved CGW Grades 7 Grade Outlook – N. Am. P&W Papers In Addition -- High End Uses -- Auto Brochures/annual Reports - Are Being Replaced by Website Versions High Volume UCFS Under Pressure From Overseas Competitors, and Newsprint Producers Are Converting Capacity to UC and CGW Grades Financial Returns & Growth Prospects Are Similar to Industry Average & Room Does Exists for Continued M&A Activity Implications: Implications:This This grade grade grouping grouping is is in in major major sea sea change change with with grades grades collapsing collapsing on on one one another. another. Significant Significant repositioning repositioning and and redeployment redeployment of of assets assets –– continued continued M&A M&A && financial financial constraints. Certainsegments segmentswill willsuffer suffernet netcapacity capacityreductions. reductions. constraints. Certain 8 Grade Outlook – N. Am. P&W Papers P&W Volume (Short Tons 000s) 43,500 41,000 38,500 36,000 33,500 31,000 28,500 26,000 1990 1992 NA Demand 9 1994 1996 NA Capacity 1998 2000 2002 Total Shipments 2004 2006 N. Am. P&W Demand & Capacity Contracted Between 2000 and 2002 – A Moderate Recovery Has Begun In 2003 Grade Outlook – N. Am. P&W Papers 25% 4,387 4,500 4,187 4,116 4,000 3,500 20% 3,352 2,498 2,258 3,000 2,701 2,732 2,745 11% 10% 2,000 3,294 2,709 3,096 11% 2,427 1,191 10% 8% 1,500 8% 8% 7% 7% 6% 1,000 7% 7% 7% 8% 5% 6% 5% 500 3% 0 0% 1990 1992 1994 1996 Excess Capacity 10 15% 2,004 12% 2,500 2,955 3,059 1998 2000 2002 2004 % Excess Capacity 2006 P&W - % Excess Capacity P&W - Excess Capacity (Short Tons 000s) 5,000 Significant N. Am. P&W Overcapacity Should Dissipate By 2004 Grade Outlook – N. Am. P&W Papers 1,600 Real Prices ($2001 - Short Ton) 1,500 1,400 1,300 1,200 1,100 1,000 900 800 700 600 500 400 1990 1992 1994 1996 CFS No. 3 60lb. UCFS No. 4 Xerocopy 11 1998 2000 2002 UCGW Average CGW No. 4 50lb. 2004 2006 N. Am. P&W Real Pricing Is At Historically Low Levels – Grade Prices Have Converged Grade Outlook – N. Am. P&W Papers 1,300 Nominal Prices ($ per Short Ton) 1,200 1,100 1,000 900 800 700 600 500 400 1990 1992 1994 1996 CFS No. 3 60lb. UCFS No. 4 Xerocopy 12 1998 2000 2002 UCGW Average CGW No. 4 50lb. 2004 2006 N. Am. P&W Nominal Prices Will Likely Improve Some In 2003 & 2004 Now – Let’s Take A Look At Key Grades In Maine All Mill Cost Competitive Data Here Are Provided By Paperloop’s Pulp and Paper Benchmarking Services Group Data are: 9 Fourth Quarter 2002 Basis In 2003 Dollars 9 Mill Level Cash Manufacturing Costs 9 Based on Publicly Available Information & Data 9 Representative of Relative/Typical Operating Configuration Assumptions at Each Mill Assessed 9 Based on Regional Unit Cost Data Inputs 13 Our Competitiveness Assessment Approach First – A Brief Macro Overview of Key Factors of Production For Printing & Writing Paper Grades 9 Focus on Fiber, Energy & Labor 9 And Aggregate Cost Levels Then A Grade-by-Grade With Key Mills Review 9 Uncoated Freesheet 9 SC Grades 9 Directory 9 Coated Groundwood 9 Coated Freesheet 14 Key Competitive Issues – P&W Papers Factors of Production Cost Comparisons For Maine Mills [All Data in USD per Short Ton] Cost Element Industry Average Mill A Mill B Mill C Mill D Mill E Mill F Mill G Mill H Mill I Mill J Mill K Mill L Mill M Mill N Mill O Fiber 156 180 134 101 93 104 150 93 78 78 159 134 70 97 202 384 Power 66 55 44 44 45 62 71 109 75 75 45 100 63 90 129 85 Manpower 71 81 88 125 138 164 114 118 137 137 161 198 178 198 192 139 All Other 123 137 195 218 216 169 168 183 300 241 225 162 299 229 211 206 Total 416 453 461 488 492 499 503 503 521 531 590 594 610 614 734 814 15 Maine’s UCFS Competitiveness Product Quality Is Rated as Competitive Mill Cash Cost Competitiveness = Very High, 4th Quartile Key Cost Issues Are: 9 Labor = High – Unit Costs & Efficiency 9 Energy = Very High 9 Materials & Chemicals = Generally Competitive 9 Fiber = Very Competitive 16 UCFS Cost/Supply Curve 17 UCFS Cost Curve 18 UCFS-Value Added Cost Curve 19 Maine’s SC Competitiveness Product Quality Is Rated as Very Good Mill Cash Cost Competitiveness = 4th Quartile Key Cost Issues Are: 9 Labor = Very High – Unit Costs & Efficiency 9 Chemicals = Relatively High 9 Fiber & Materials = Competitive 9 Energy = Very Competitive 20 SC Cost/Supply Curve 21 SC Cost Curve 22 Maine’s Directory Competitiveness Product Quality Is Rated as Very Good Mill Cash Cost Competitiveness = Very High in The 4th Quartile Key Cost Issues Are: 9 Labor = Very High – Unit Costs & Efficiency 9 Materials = High 9 Fiber & Chemicals = Competitive 9 Energy = Very Competitive 23 Directory Cost/Supply Curve 24 Directory Cost Curve 25 Maine’s CGW Competitiveness Product Quality Is Rated as Good To Very Good Mill Cash Cost Competitiveness = Varied, Ranging Across 1st to 3rd and 4th Quartiles Key Cost Issues Are: 9 Labor = Somewhat High – Unit Costs & Efficiency 9 Materials & Chemicals = Competitive 9 Fiber = Competitive to High 9 Energy = Very Competitive 26 CGW Cost/Supply Curve 27 CGW Cost Curve 28 CGW Cost Curve 29 LWC Cost Curve 30 Maine’s CFS Competitiveness Product Quality Is Rated as Very Good Mill Cash Cost Competitiveness = Good, Mostly in 1st and 2nd Quartiles Key Cost Issues Are: 9 Labor, Energy, Materials, Chemicals, & Fiber = All Competitive 31 CFS Cost/Supply Curve 32 CFS Cost Curve 33 CFS 60# No. 3 & 4 Cost Curve 34 CFS-One Sided Cost Curve 35 CFS-Premium Cost Curve 36 Current -- Typical CFS Commodity $700 $600 $500 Matls/Maint Labor - Sal Labor - Hr Electricity Fuel Chemicals Fiber $400 $300 $200 $100 $0 Asia Europe N. Am. Maine Cost Ranges 405-650 525-850 460-880 485-505 Product 105 gsm 115 gsm 60 lb #3 60 lb #3 37 Data = Q2 2003 & USD/ST Maine not as well positioned 9 Labor – Hourly 9 Materials & Maintenance Maine very well positioned 9 Fiber 9 Energy 9 Fuel 9 Total Cash Cost Note -- Asia/Europe Fiber Costs = Purchased Pulp Driven and Imported Chips for Asia So -- Where Can We Go? Maine Is Blessed With Tremendous Potential . . . 9 Abundant Natural Resources 9 Wonderful Logistics Infrastructure 9 Superb Location To Largest Global Market 9 Very Experienced & Motivated Work Force 9 Substantial Dependency on P&P Industry 9 Renewed Attention of Political, Labor & Industry Leaders 9 Great Need of Local Communities To Rally There Are Great Opportunities To Enhance The Competitive Position of Maine’s Pulp & Paper Mills For The Right Grades However -9 This Will Not Be Easy 9 It Will Require The Combined Attention of Government, Labor & Industry Working Closely Together 9 Many Critical Factors Need Change . . . 38 In Essence Then . . . Maine’s P&P Industry’s Future Has Great Opportunities To Seize -- In Reality -- It Is In The Hands Of Those That Will Do . . . 9 9 9 9 9 39 The Right Things . . . In The Right Way . . . For the Right Products/Grades . . . At The Right Time . . . And That Time Is Now Or Maybe Never. . . Choose Wisely With Sense of Urgency – Your Future is At Stake! And Remember . . . . In Spite Of The Current State of Affairs For Maine’s P&P Industry -- As that Famous Arm Chair Philosopher Ziggy Once Said . . . . “You can Complain Because Roses have Thorns, or you can Rejoice Because Thorns have Roses” Visit The CPBIS Web Site – www.CPBIS.gatech.edu 40