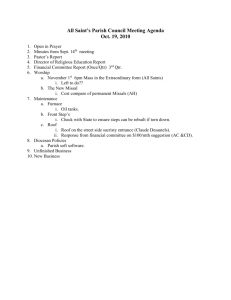

AGENDA THE BOARD OF TRUSTEES MEETING AS A

advertisement