10‐Jun‐11 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups.

advertisement

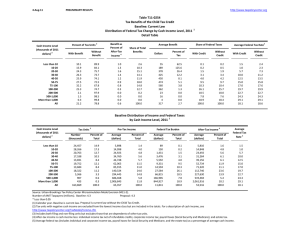

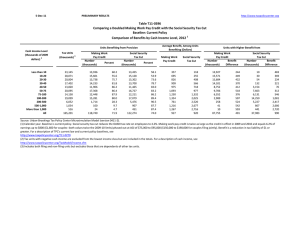

10‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T11‐0168 TPC Interpretation of Governor Tim Pawlenty's Tax Proposal Outline Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2013 1 Summary Table Percent of Tax Units 3 Cash Income Level (thousands of 2011 2 dollars) With Tax Cut Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All 27.9 55.3 83.6 93.9 96.4 98.8 99.6 99.8 99.9 100.0 100.0 80.0 With Tax Increase * 0.1 0.1 0.2 0.2 0.1 * * * 0.0 0.0 0.1 Percent Change in After‐Tax Income 2.5 2.3 3.6 4.1 4.4 5.8 7.0 9.7 13.8 19.4 33.0 11.3 4 Share of Total Federal Tax Change 0.3 0.9 1.6 2.1 2.2 6.5 6.9 20.5 17.1 9.6 32.3 100.0 Average Federal Tax Change ($) ‐139 ‐337 ‐833 ‐1,274 ‐1,686 ‐2,977 ‐4,914 ‐10,236 ‐29,237 ‐94,880 ‐629,326 ‐6,267 Average Federal Tax Rate5 Change (% Points) Under the Proposal ‐2.4 ‐2.2 ‐3.3 ‐3.6 ‐3.7 ‐4.7 ‐5.5 ‐7.3 ‐10.0 ‐13.6 ‐20.8 ‐8.7 2.3 1.7 6.4 10.4 12.7 14.4 16.0 17.3 17.4 16.0 16.3 15.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 0.0 * Less than 0.05 (1) Baseline is current law. Proposal would make 2011 tax law permanent and would also: (a) repeal individual alternative minimum tax; (b) impose rate of 10 percent on first $50,000 of taxable income ($100,000 for married couples filing a joint return) and 25 percent on amounts above that threshold, indexed for inflation after 2011; (c) exclude interest income, dividends, and gains from sales of capital assets from gross income; (d) repeal deduction for investment interest; (e) repeal 3.8 percent additional Medicare tax on investment income; (f) impose an alternative tax rate of 15 percent on sole proprietor, farm, partnership, S corporation, and rental income; (g) repeal the estate tax; and (h) reduce the corporate tax rate to 15 percent. Governor Pawlenty has not specified which corporate tax expenditures he would eliminate; our estimates assume the same base broadeners as in the Bipartisan Policy Center's tax reform proposal (Rivlin/Domenici). Effective date: 01/01/13. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. TPC estimates are based on Governor Pawlenty's description of his tax proposal and subsequent remarks to the New York Times by his spokesperson Alex Conant. Because Governor Pawlenty did not specify which corporate tax expenditures he would eliminate, we provide an illustrative option that broadens the corporate tax base by eliminating the tax expenditures included in the Bipartisan Policy Center's Rivlin‐Domenici plan. Based on remarks by the Governor and Alex Conant, we did not eliminate any individual income tax expenditures. If Governor Pawlenty or his campaign staff provide the Tax Policy Center with additional details on his proposal we will re‐estimate his plan. 10‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0168 TPC Interpretation of Governor Tim Pawlenty's Tax Proposal Outline Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 27.9 55.3 83.6 93.9 96.4 98.8 99.6 99.8 99.9 100.0 100.0 80.0 * 0.1 0.1 0.2 0.2 0.1 * * * 0.0 0.0 0.1 Percent Change in After‐Tax Income 4 2.5 2.3 3.6 4.1 4.4 5.8 7.0 9.7 13.8 19.4 33.0 11.3 Share of Total Federal Tax Change 0.3 0.9 1.6 2.1 2.2 6.5 6.9 20.5 17.1 9.6 32.3 100.0 Average Federal Tax Change Dollars Percent ‐139 ‐337 ‐833 ‐1,274 ‐1,686 ‐2,977 ‐4,914 ‐10,236 ‐29,237 ‐94,880 ‐629,326 ‐6,267 ‐51.0 ‐57.3 ‐33.8 ‐25.6 ‐22.3 ‐24.7 ‐25.7 ‐29.7 ‐36.4 ‐45.9 ‐56.0 ‐36.7 Share of Federal Taxes Change (% Points) ‐0.1 ‐0.2 0.1 0.5 0.8 1.8 1.7 2.8 0.1 ‐1.1 ‐6.5 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) 0.2 0.4 1.9 3.5 4.4 11.5 11.6 28.1 17.3 6.5 14.7 100.0 ‐2.4 ‐2.2 ‐3.3 ‐3.6 ‐3.7 ‐4.7 ‐5.5 ‐7.3 ‐10.0 ‐13.6 ‐20.8 ‐8.7 Under the Proposal 2.3 1.7 6.4 10.4 12.7 14.4 16.0 17.3 17.4 16.0 16.3 15.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 21,065 27,359 20,377 16,959 13,305 22,765 14,636 20,881 6,084 1,051 534 166,272 Percent of Total 12.7 16.5 12.3 10.2 8.0 13.7 8.8 12.6 3.7 0.6 0.3 100.0 Pre‐Tax Income Average (dollars) 5,766 15,205 25,480 35,896 46,141 63,142 89,268 139,817 292,655 696,116 3,032,367 72,381 Percent of Total 1.0 3.5 4.3 5.1 5.1 11.9 10.9 24.3 14.8 6.1 13.5 100.0 Federal Tax Burden Average (dollars) 272 589 2,466 4,988 7,566 12,061 19,150 34,450 80,280 206,532 1,123,826 17,092 Percent of Total 0.2 0.6 1.8 3.0 3.5 9.7 9.9 25.3 17.2 7.6 21.1 100.0 After‐Tax Income 4 Average (dollars) 5,493 14,616 23,015 30,908 38,575 51,081 70,119 105,367 212,376 489,584 1,908,541 55,290 Percent of Total 1.3 4.4 5.1 5.7 5.6 12.7 11.2 23.9 14.1 5.6 11.1 100.0 Average Federal Tax Rate 5 4.7 3.9 9.7 13.9 16.4 19.1 21.5 24.6 27.4 29.7 37.1 23.6 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 0.0 * Less than 0.05 (1) Baseline is current law. Proposal would make 2011 tax law permanent and would also: (a) repeal individual alternative minimum tax; (b) impose rate of 10 percent on first $50,000 of taxable income ($100,000 for married couples filing a joint return) and 25 percent on amounts above that threshold, indexed for inflation after 2011; (c) exclude interest income, dividends, and gains from sales of capital assets from gross income; (d) repeal deduction for investment interest; (e) repeal 3.8 percent additional Medicare tax on investment income; (f) impose an alternative tax rate of 15 percent on sole proprietor, farm, partnership, S corporation, and rental income; (g) repeal the estate tax; and (h) reduce the corporate tax rate to 15 percent. Governor Pawlenty has not specified which corporate tax expenditures he would eliminate; our estimates assume the same base broadeners as in the Bipartisan Policy Center's tax reform proposal (Rivlin/Domenici). Effective date: 01/01/13. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 10‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0168 TPC Interpretation of Governor Tim Pawlenty's Tax Proposal Outline Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table ‐ Single Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 21.7 50.6 80.6 95.2 98.6 99.1 99.3 99.5 99.8 99.8 100.0 67.7 0.1 0.1 0.2 0.3 0.1 * 0.0 0.1 0.1 0.0 0.0 0.1 Percent Change in After‐Tax Income 4 1.7 1.2 2.5 3.7 4.7 7.8 9.9 11.4 20.1 29.6 43.8 9.5 Share of Total Federal Tax Change 0.7 1.4 2.9 4.3 4.4 13.9 9.9 16.4 14.3 7.6 23.9 100.0 Average Federal Tax Change Dollars Percent ‐92 ‐175 ‐556 ‐1,104 ‐1,723 ‐3,739 ‐6,465 ‐11,372 ‐41,890 ‐135,326 ‐756,442 ‐2,889 ‐22.9 ‐17.6 ‐17.4 ‐19.2 ‐18.8 ‐26.4 ‐28.4 ‐30.5 ‐46.3 ‐56.6 ‐61.7 ‐33.5 Share of Federal Taxes Change (% Points) 0.2 0.7 1.4 1.6 1.7 1.9 0.9 0.8 ‐2.0 ‐1.6 ‐5.5 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) 1.1 3.4 7.0 9.2 9.6 19.5 12.6 18.8 8.3 2.9 7.5 100.0 ‐1.6 ‐1.2 ‐2.2 ‐3.1 ‐3.8 ‐6.0 ‐7.3 ‐8.3 ‐14.0 ‐19.4 ‐25.6 ‐7.4 Under the Proposal 5.5 5.4 10.4 13.0 16.2 16.7 18.5 18.9 16.2 14.9 15.9 14.7 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,722 19,121 12,334 9,158 5,981 8,668 3,570 3,358 794 131 74 80,622 Percent of Total 20.7 23.7 15.3 11.4 7.4 10.8 4.4 4.2 1.0 0.2 0.1 100.0 Pre‐Tax Income Average (dollars) 5,678 15,084 25,339 35,802 45,980 62,437 88,424 136,678 298,894 696,170 2,952,272 39,043 Percent of Total 3.0 9.2 9.9 10.4 8.7 17.2 10.0 14.6 7.5 2.9 6.9 100.0 Federal Tax Burden Average (dollars) 402 993 3,188 5,751 9,164 14,174 22,778 37,252 90,423 239,164 1,226,221 8,637 Percent of Total 1.0 2.7 5.7 7.6 7.9 17.6 11.7 18.0 10.3 4.5 13.0 100.0 After‐Tax Income 4 Average (dollars) 5,276 14,090 22,151 30,051 36,816 48,263 65,646 99,426 208,471 457,007 1,726,051 30,407 Percent of Total 3.6 11.0 11.2 11.2 9.0 17.1 9.6 13.6 6.8 2.5 5.2 100.0 Average Federal Tax Rate 5 7.1 6.6 12.6 16.1 19.9 22.7 25.8 27.3 30.3 34.4 41.5 22.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Baseline is current law. Proposal would make 2011 tax law permanent and would also: (a) repeal individual alternative minimum tax; (b) impose rate of 10 percent on first $50,000 of taxable income ($100,000 for married couples filing a joint return) and 25 percent on amounts above that threshold, indexed for inflation after 2011; (c) exclude interest income, dividends, and gains from sales of capital assets from gross income; (d) repeal deduction for investment interest; (e) repeal 3.8 percent additional Medicare tax on investment income; (f) impose an alternative tax rate of 15 percent on sole proprietor, farm, partnership, S corporation, and rental income; (g) repeal the estate tax; and (h) reduce the corporate tax rate to 15 percent. Governor Pawlenty has not specified which corporate tax expenditures he would eliminate; our estimates assume the same base broadeners as in the Bipartisan Policy Center's tax reform proposal (Rivlin/Domenici). Effective date: 01/01/13. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 10‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0168 TPC Interpretation of Governor Tim Pawlenty's Tax Proposal Outline Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 41.8 60.5 79.1 87.3 92.2 98.5 99.8 99.9 99.9 100.0 100.0 93.9 0.0 0.1 0.1 * 0.3 0.2 * * * * * 0.1 Percent Change in After‐Tax Income 4 5.5 4.2 5.8 4.8 3.8 4.3 6.0 9.5 12.8 18.0 31.2 12.7 Share of Total Federal Tax Change 0.1 0.2 0.6 0.8 0.9 3.3 5.6 23.0 19.0 10.8 35.8 100.0 Average Federal Tax Change Dollars Percent ‐272 ‐654 ‐1,388 ‐1,551 ‐1,542 ‐2,316 ‐4,314 ‐10,195 ‐27,306 ‐88,955 ‐594,358 ‐12,644 ‐177.4 ‐304.7 ‐90.1 ‐42.8 ‐28.9 ‐23.0 ‐24.5 ‐30.1 ‐34.7 ‐44.1 ‐54.9 ‐37.9 Share of Federal Taxes Change (% Points) 0.0 ‐0.1 ‐0.2 ‐0.1 0.2 1.3 1.9 3.7 1.1 ‐0.9 ‐6.8 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) 0.0 ‐0.1 0.0 0.6 1.4 6.7 10.5 32.6 21.9 8.3 18.0 100.0 ‐5.3 ‐4.1 ‐5.4 ‐4.3 ‐3.3 ‐3.6 ‐4.8 ‐7.2 ‐9.4 ‐12.8 ‐19.9 ‐9.5 Under the Proposal ‐2.3 ‐2.8 0.6 5.7 8.2 12.1 14.8 16.8 17.6 16.2 16.4 15.6 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,291 2,559 2,875 3,624 4,468 10,281 9,429 16,457 5,091 885 440 57,802 Percent of Total 2.2 4.4 5.0 6.3 7.7 17.8 16.3 28.5 8.8 1.5 0.8 100.0 Pre‐Tax Income Average (dollars) 5,093 15,850 25,634 36,207 46,489 63,998 89,794 140,888 291,809 696,396 2,988,320 132,789 Percent of Total 0.1 0.5 1.0 1.7 2.7 8.6 11.0 30.2 19.4 8.0 17.1 100.0 Federal Tax Burden Average (dollars) 153 215 1,541 3,625 5,342 10,088 17,579 33,901 78,741 201,726 1,083,485 33,360 Percent of Total 0.0 0.0 0.2 0.7 1.2 5.4 8.6 28.9 20.8 9.3 24.7 100.0 After‐Tax Income 4 Average (dollars) 4,940 15,635 24,093 32,582 41,148 53,910 72,215 106,986 213,068 494,671 1,904,836 99,430 Percent of Total 0.1 0.7 1.2 2.1 3.2 9.6 11.9 30.6 18.9 7.6 14.6 100.0 Average Federal Tax Rate 5 3.0 1.4 6.0 10.0 11.5 15.8 19.6 24.1 27.0 29.0 36.3 25.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Baseline is current law. Proposal would make 2011 tax law permanent and would also: (a) repeal individual alternative minimum tax; (b) impose rate of 10 percent on first $50,000 of taxable income ($100,000 for married couples filing a joint return) and 25 percent on amounts above that threshold, indexed for inflation after 2011; (c) exclude interest income, dividends, and gains from sales of capital assets from gross income; (d) repeal deduction for investment interest; (e) repeal 3.8 percent additional Medicare tax on investment income; (f) impose an alternative tax rate of 15 percent on sole proprietor, farm, partnership, S corporation, and rental income; (g) repeal the estate tax; and (h) reduce the corporate tax rate to 15 percent. Governor Pawlenty has not specified which corporate tax expenditures he would eliminate; our estimates assume the same base broadeners as in the Bipartisan Policy Center's tax reform proposal (Rivlin/Domenici). Effective date: 01/01/13. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 10‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0168 TPC Interpretation of Governor Tim Pawlenty's Tax Proposal Outline Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table ‐ Head of Household Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 57.7 67.8 92.8 96.9 98.1 99.3 99.3 99.6 100.0 100.0 100.0 85.9 * * * 0.1 0.0 0.0 * 0.0 0.0 0.0 0.0 * Percent Change in After‐Tax Income 4 5.0 4.7 4.9 4.5 4.7 5.7 7.0 6.7 11.3 16.6 33.8 6.4 Share of Total Federal Tax Change 1.9 7.5 10.7 9.7 8.2 17.3 11.8 11.0 6.5 3.5 11.9 100.0 Average Federal Tax Change Dollars Percent ‐353 ‐761 ‐1,211 ‐1,420 ‐1,802 ‐2,851 ‐4,767 ‐6,641 ‐23,927 ‐80,284 ‐601,275 ‐2,170 81.0 100.2 ‐117.3 ‐34.0 ‐24.3 ‐23.3 ‐23.9 ‐19.9 ‐31.5 ‐41.8 ‐55.7 ‐34.4 Share of Federal Taxes Change (% Points) ‐1.4 ‐5.3 ‐4.0 0.1 1.8 4.3 2.7 4.2 0.3 ‐0.3 ‐2.4 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) Under the Proposal ‐2.2 ‐7.9 ‐0.8 9.9 13.5 29.8 19.6 23.1 7.4 2.5 5.0 100.0 ‐5.4 ‐5.0 ‐4.7 ‐4.0 ‐3.9 ‐4.6 ‐5.4 ‐5.0 ‐8.3 ‐11.9 ‐21.0 ‐5.4 ‐12.0 ‐9.9 ‐0.7 7.7 12.2 15.0 17.2 20.2 18.2 16.5 16.7 10.4 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 2,911 5,398 4,846 3,748 2,505 3,317 1,353 905 149 24 11 25,256 Percent of Total 11.5 21.4 19.2 14.8 9.9 13.1 5.4 3.6 0.6 0.1 0.0 100.0 Pre‐Tax Income Average (dollars) 6,577 15,312 25,728 35,771 45,998 62,381 88,201 132,511 287,163 675,227 2,859,898 39,986 Percent of Total 1.9 8.2 12.4 13.3 11.4 20.5 11.8 11.9 4.3 1.6 3.1 100.0 Federal Tax Burden Average (dollars) ‐436 ‐760 1,032 4,179 7,422 12,232 19,936 33,396 76,042 191,872 1,080,095 6,311 Percent of Total ‐0.8 ‐2.6 3.1 9.8 11.7 25.5 16.9 19.0 7.1 2.9 7.3 100.0 After‐Tax Income 4 Average (dollars) 7,013 16,071 24,696 31,592 38,576 50,149 68,264 99,115 211,121 483,355 1,779,803 33,675 Percent of Total 2.4 10.2 14.1 13.9 11.4 19.6 10.9 10.5 3.7 1.4 2.3 100.0 Average Federal Tax Rate 5 ‐6.6 ‐5.0 4.0 11.7 16.1 19.6 22.6 25.2 26.5 28.4 37.8 15.8 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Baseline is current law. Proposal would make 2011 tax law permanent and would also: (a) repeal individual alternative minimum tax; (b) impose rate of 10 percent on first $50,000 of taxable income ($100,000 for married couples filing a joint return) and 25 percent on amounts above that threshold, indexed for inflation after 2011; (c) exclude interest income, dividends, and gains from sales of capital assets from gross income; (d) repeal deduction for investment interest; (e) repeal 3.8 percent additional Medicare tax on investment income; (f) impose an alternative tax rate of 15 percent on sole proprietor, farm, partnership, S corporation, and rental income; (g) repeal the estate tax; and (h) reduce the corporate tax rate to 15 percent. Governor Pawlenty has not specified which corporate tax expenditures he would eliminate; our estimates assume the same base broadeners as in the Bipartisan Policy Center's tax reform proposal (Rivlin/Domenici). Effective date: 01/01/13. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 10‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0168 TPC Interpretation of Governor Tim Pawlenty's Tax Proposal Outline Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table ‐ Tax Units with Children Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 58.3 79.0 95.6 98.4 98.4 99.6 99.9 99.9 99.9 100.0 100.0 93.8 * * 0.0 0.1 0.1 * * * * 0.0 0.0 * Percent Change in After‐Tax Income 4 6.1 5.9 6.5 6.0 5.7 5.6 6.7 9.4 12.3 18.0 31.6 11.6 Share of Total Federal Tax Change 0.3 1.4 2.2 2.3 2.2 5.2 6.8 22.5 17.6 9.7 29.6 100.0 Average Federal Tax Change Dollars Percent ‐405 ‐1,003 ‐1,644 ‐1,928 ‐2,237 ‐2,879 ‐4,716 ‐9,895 ‐25,919 ‐87,008 ‐582,101 ‐8,205 62.0 70.3 ‐303.0 ‐50.0 ‐32.1 ‐24.4 ‐24.8 ‐28.4 ‐32.4 ‐41.2 ‐52.9 ‐36.8 Share of Federal Taxes Change (% Points) ‐0.3 ‐1.2 ‐1.2 ‐0.4 0.2 1.5 1.9 3.9 1.4 ‐0.6 ‐5.2 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) Under the Proposal ‐0.5 ‐2.0 ‐0.9 1.3 2.7 9.4 12.0 33.0 21.4 8.0 15.4 100.0 ‐6.8 ‐6.5 ‐6.4 ‐5.4 ‐4.9 ‐4.5 ‐5.3 ‐7.0 ‐8.9 ‐12.5 ‐19.8 ‐8.8 ‐17.7 ‐15.7 ‐4.3 5.4 10.3 14.0 16.0 17.7 18.7 17.9 17.6 15.2 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,361 5,658 5,534 4,844 3,945 7,372 5,840 9,226 2,749 450 206 49,418 Percent of Total 6.8 11.5 11.2 9.8 8.0 14.9 11.8 18.7 5.6 0.9 0.4 100.0 Pre‐Tax Income Average (dollars) 5,988 15,525 25,702 35,836 46,072 63,539 89,617 140,522 290,144 695,662 2,943,211 93,026 Percent of Total 0.4 1.9 3.1 3.8 4.0 10.2 11.4 28.2 17.4 6.8 13.2 100.0 Federal Tax Burden Average (dollars) ‐653 ‐1,427 543 3,855 6,969 11,781 19,060 34,805 80,124 211,296 1,101,078 22,303 Percent of Total ‐0.2 ‐0.7 0.3 1.7 2.5 7.9 10.1 29.1 20.0 8.6 20.6 100.0 After‐Tax Income 4 Average (dollars) 6,640 16,953 25,160 31,981 39,103 51,758 70,557 105,716 210,020 484,367 1,842,133 70,722 Percent of Total 0.6 2.7 4.0 4.4 4.4 10.9 11.8 27.9 16.5 6.2 10.9 100.0 Average Federal Tax Rate 5 ‐10.9 ‐9.2 2.1 10.8 15.1 18.5 21.3 24.8 27.6 30.4 37.4 24.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Baseline is current law. Proposal would make 2011 tax law permanent and would also: (a) repeal individual alternative minimum tax; (b) impose rate of 10 percent on first $50,000 of taxable income ($100,000 for married couples filing a joint return) and 25 percent on amounts above that threshold, indexed for inflation after 2011; (c) exclude interest income, dividends, and gains from sales of capital assets from gross income; (d) repeal deduction for investment interest; (e) repeal 3.8 percent additional Medicare tax on investment income; (f) impose an alternative tax rate of 15 percent on sole proprietor, farm, partnership, S corporation, and rental income; (g) repeal the estate tax; and (h) reduce the corporate tax rate to 15 percent. Governor Pawlenty has not specified which corporate tax expenditures he would eliminate; our estimates assume the same base broadeners as in the Bipartisan Policy Center's tax reform proposal (Rivlin/Domenici). Effective date: 01/01/13. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 10‐Jun‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0168 TPC Interpretation of Governor Tim Pawlenty's Tax Proposal Outline Baseline: Current Law 1 Distribution of Federal Tax Change by Cash Income Level, 2013 Detail Table ‐ Elderly Tax Units Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 17.0 26.2 60.5 84.6 89.5 98.0 99.6 99.8 99.9 99.9 100.0 68.0 0.0 * 0.3 0.5 0.5 0.2 0.0 0.0 0.1 0.0 * 0.2 Percent Change in After‐Tax Income 4 0.3 0.3 1.1 2.4 2.9 5.8 8.0 12.5 18.9 26.0 39.5 13.1 Share of Total Federal Tax Change 0.0 0.2 0.5 1.1 1.3 6.1 6.6 19.2 19.3 10.9 34.9 100.0 Average Federal Tax Change Dollars Percent ‐17 ‐48 ‐279 ‐825 ‐1,236 ‐3,208 ‐5,965 ‐13,750 ‐41,456 ‐125,670 ‐744,433 ‐7,465 ‐28.1 ‐32.1 ‐36.6 ‐39.4 ‐37.5 ‐42.5 ‐42.3 ‐46.4 ‐51.9 ‐58.7 ‐62.3 ‐52.3 Share of Federal Taxes Change (% Points) 0.0 0.1 0.2 0.4 0.6 1.5 1.7 2.7 0.2 ‐1.3 ‐6.1 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) 0.1 0.4 1.0 1.9 2.3 9.0 9.9 24.3 19.6 8.4 23.2 100.0 ‐0.3 ‐0.3 ‐1.1 ‐2.3 ‐2.7 ‐5.1 ‐6.7 ‐9.8 ‐13.9 ‐18.0 ‐24.2 ‐10.5 Under the Proposal 0.6 0.7 1.9 3.5 4.4 6.9 9.2 11.4 12.9 12.7 14.6 9.6 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2013 Cash Income Level (thousands of 2011 dollars) 2 Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,030 8,603 4,956 3,838 2,823 5,216 3,053 3,858 1,285 239 130 37,068 Percent of Total 8.2 23.2 13.4 10.4 7.6 14.1 8.2 10.4 3.5 0.7 0.4 100.0 Pre‐Tax Income Average (dollars) 6,762 15,150 25,187 35,853 46,514 63,113 88,974 139,885 298,833 698,342 3,081,067 71,055 Percent of Total 0.8 5.0 4.7 5.2 5.0 12.5 10.3 20.5 14.6 6.4 15.2 100.0 Federal Tax Burden Average (dollars) 60 150 762 2,093 3,301 7,541 14,117 29,636 79,844 213,998 1,195,081 14,265 Percent of Total 0.0 0.2 0.7 1.5 1.8 7.4 8.2 21.6 19.4 9.7 29.3 100.0 After‐Tax Income 4 Average (dollars) 6,702 14,999 24,425 33,760 43,213 55,571 74,857 110,249 218,990 484,344 1,885,985 56,790 Percent of Total 1.0 6.1 5.8 6.2 5.8 13.8 10.9 20.2 13.4 5.5 11.6 100.0 Average Federal Tax Rate 5 0.9 1.0 3.0 5.8 7.1 12.0 15.9 21.2 26.7 30.6 38.8 20.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Baseline is current law. Proposal would make 2011 tax law permanent and would also: (a) repeal individual alternative minimum tax; (b) impose rate of 10 percent on first $50,000 of taxable income ($100,000 for married couples filing a joint return) and 25 percent on amounts above that threshold, indexed for inflation after 2011; (c) exclude interest income, dividends, and gains from sales of capital assets from gross income; (d) repeal deduction for investment interest; (e) repeal 3.8 percent additional Medicare tax on investment income; (f) impose an alternative tax rate of 15 percent on sole proprietor, farm, partnership, S corporation, and rental income; (g) repeal the estate tax; and (h) reduce the corporate tax rate to 15 percent. Governor Pawlenty has not specified which corporate tax expenditures he would eliminate; our estimates assume the same base broadeners as in the Bipartisan Policy Center's tax reform proposal (Rivlin/Domenici). Effective date: 01/01/13. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.