12‐Dec‐11 PRELIMINARY RESULTS Less than 10 10‐20

advertisement

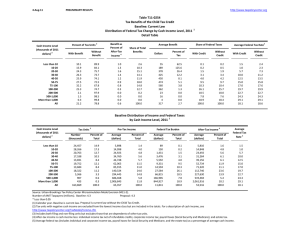

12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T11‐0400 The Gingrich Tax Plan Baseline: Current Policy 1 Distribution of Federal Tax Change by Cash Income Level, 2015 Summary Table Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units with Tax Increase or Cut 3 With Tax Cut Pct of Tax Units 17.0 34.3 61.9 78.6 85.3 91.4 95.6 97.5 99.4 99.7 99.9 70.1 Avg Tax Cut ‐222 ‐247 ‐488 ‐751 ‐985 ‐1,847 ‐3,050 ‐5,799 ‐20,745 ‐76,995 ‐613,689 ‐7,248 With Tax Increase Avg Tax Increase Pct of Tax Units 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0 0 0 0 0 0 0 0 0 0 0 0 Percent Change in After‐Tax Income 4 0.7 0.5 1.2 1.8 2.1 3.1 3.9 5.0 8.9 14.3 28.7 7.9 Share of Total Federal Tax Change 0.1 0.3 0.7 1.2 1.4 4.8 5.1 15.9 16.9 10.6 43.0 100.0 Average Federal Tax Change ($) ‐38 ‐85 ‐302 ‐590 ‐839 ‐1,689 ‐2,915 ‐5,650 ‐20,387 ‐75,939 ‐607,221 ‐5,040 Average Federal Tax Rate 5 Change (% Points) ‐0.6 ‐0.5 ‐1.1 ‐1.6 ‐1.8 ‐2.6 ‐3.1 ‐3.9 ‐6.7 ‐10.5 ‐19.7 ‐6.3 Under the Proposal 2.1 1.3 6.0 9.8 12.7 14.4 15.9 17.9 17.8 16.3 11.9 14.7 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 6.1 Proposal: 0.3 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current policy. Proposal implements the Gingrich tax plan. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐ plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0400 The Gingrich Tax Plan Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 17.0 34.3 61.9 78.6 85.3 91.4 95.6 97.5 99.4 99.7 99.9 70.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 0.7 0.5 1.2 1.8 2.1 3.1 3.9 5.0 8.9 14.3 28.7 7.9 0.1 0.3 0.7 1.2 1.4 4.8 5.1 15.9 16.9 10.6 43.0 100.0 Average Federal Tax Change Dollars Percent ‐38 ‐85 ‐302 ‐590 ‐839 ‐1,689 ‐2,915 ‐5,650 ‐20,387 ‐75,939 ‐607,221 ‐5,040 ‐23.1 ‐28.8 ‐16.1 ‐13.9 ‐12.1 ‐15.2 ‐16.5 ‐17.8 ‐27.3 ‐39.2 ‐62.3 ‐29.9 Share of Federal Taxes Change (% Points) 0.0 0.0 0.3 0.6 0.8 2.0 1.8 4.6 0.7 ‐1.1 ‐9.5 0.0 Under the Proposal 0.1 0.3 1.6 3.0 4.2 11.3 11.0 31.1 19.2 7.0 11.1 100.0 5 Average Federal Tax Rate Change (% Points) ‐0.6 ‐0.5 ‐1.1 ‐1.6 ‐1.8 ‐2.6 ‐3.1 ‐3.9 ‐6.7 ‐10.5 ‐19.7 ‐6.3 Under the Proposal 2.1 1.3 6.0 9.8 12.7 14.4 15.9 17.9 17.8 16.3 11.9 14.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 18,828 26,753 20,164 16,562 13,738 24,031 14,893 23,887 7,059 1,187 603 168,946 Pre‐Tax Income Percent of Total 11.1 15.8 11.9 9.8 8.1 14.2 8.8 14.1 4.2 0.7 0.4 100.0 Average (dollars) 5,900 15,859 26,538 37,305 47,821 65,604 92,846 145,539 305,065 726,148 3,088,329 80,584 Federal Tax Burden Percent of Total 0.8 3.1 3.9 4.5 4.8 11.6 10.2 25.5 15.8 6.3 13.7 100.0 Average (dollars) 163 293 1,881 4,251 6,923 11,137 17,689 31,708 74,790 193,964 975,058 16,888 Percent of Total 0.1 0.3 1.3 2.5 3.3 9.4 9.2 26.6 18.5 8.1 20.6 100.0 4 After‐Tax Income Average (dollars) 5,737 15,566 24,657 33,053 40,899 54,467 75,157 113,831 230,274 532,183 2,113,271 63,696 Percent of Total 1.0 3.9 4.6 5.1 5.2 12.2 10.4 25.3 15.1 5.9 11.8 100.0 Average Federal Tax 5 Rate 2.8 1.9 7.1 11.4 14.5 17.0 19.1 21.8 24.5 26.7 31.6 21.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 6.1 Proposal: 0.3 * Less than 0.05 (1) Calendar year. Baseline is current policy. Proposal implements the Gingrich tax plan. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0400 The Gingrich Tax Plan Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Single Tax Units Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 15.8 37.9 67.5 83.6 89.5 92.8 95.9 95.5 99.5 99.7 100.0 60.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 0.6 0.6 1.4 2.0 2.1 3.7 5.8 7.0 13.4 20.1 35.7 6.6 0.3 0.9 2.2 3.0 2.7 9.6 8.8 16.5 15.3 9.1 31.6 100.0 Average Federal Tax Change Dollars Percent ‐32 ‐87 ‐333 ‐623 ‐797 ‐1,896 ‐4,097 ‐7,469 ‐31,184 ‐103,740 ‐711,066 ‐2,324 ‐9.2 ‐10.0 ‐11.7 ‐11.7 ‐9.3 ‐13.9 ‐19.2 ‐21.5 ‐39.5 ‐52.1 ‐68.1 ‐26.4 Share of Federal Taxes Change (% Points) 0.2 0.5 1.0 1.3 1.8 3.1 1.2 1.3 ‐1.8 ‐1.6 ‐6.9 0.0 Under the Proposal 0.9 2.8 6.0 8.0 9.6 21.2 13.3 21.5 8.4 3.0 5.3 100.0 5 Average Federal Tax Rate Change (% Points) ‐0.5 ‐0.6 ‐1.3 ‐1.7 ‐1.7 ‐2.9 ‐4.5 ‐5.3 ‐10.0 ‐14.5 ‐23.4 ‐5.3 Under the Proposal 5.4 5.0 9.6 12.6 16.4 18.1 18.9 19.2 15.3 13.4 11.0 14.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 14,874 18,897 12,463 9,026 6,458 9,524 4,046 4,174 926 165 84 81,336 Pre‐Tax Income Percent of Total 18.3 23.2 15.3 11.1 7.9 11.7 5.0 5.1 1.1 0.2 0.1 100.0 Average (dollars) 5,819 15,738 26,424 37,254 47,583 65,053 91,748 142,151 311,980 715,451 3,035,414 44,116 Federal Tax Burden Percent of Total 2.4 8.3 9.2 9.4 8.6 17.3 10.4 16.5 8.1 3.3 7.1 100.0 Average (dollars) 345 872 2,860 5,325 8,617 13,641 21,391 34,691 79,054 199,296 1,044,171 8,815 Percent of Total 0.7 2.3 5.0 6.7 7.8 18.1 12.1 20.2 10.2 4.6 12.2 100.0 4 After‐Tax Income Average (dollars) 5,474 14,866 23,564 31,930 38,966 51,412 70,357 107,459 232,926 516,155 1,991,243 35,301 Percent of Total 2.8 9.8 10.2 10.0 8.8 17.1 9.9 15.6 7.5 3.0 5.8 100.0 Average Federal Tax 5 Rate 5.9 5.5 10.8 14.3 18.1 21.0 23.3 24.4 25.3 27.9 34.4 20.0 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current policy. Proposal implements the Gingrich tax plan. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0400 The Gingrich Tax Plan Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Married Tax Units Filing Jointly Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 29.4 31.0 42.8 66.2 79.6 91.9 95.8 98.0 99.3 99.7 99.9 86.8 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 2.4 0.9 0.9 1.3 1.8 2.7 3.1 4.5 8.0 13.3 27.4 9.0 0.0 0.1 0.1 0.2 0.5 2.6 3.6 15.9 18.0 11.6 47.2 100.0 Average Federal Tax Change Dollars Percent ‐125 ‐150 ‐229 ‐453 ‐773 ‐1,565 ‐2,425 ‐5,223 ‐18,484 ‐71,110 ‐577,164 ‐10,280 951.8 40.7 ‐51.6 ‐19.5 ‐17.5 ‐18.0 ‐15.3 ‐16.9 ‐25.0 ‐36.8 ‐60.9 ‐31.5 Share of Federal Taxes Change (% Points) 0.0 ‐0.1 0.0 0.1 0.2 0.9 1.7 6.3 2.2 ‐0.8 ‐10.5 0.0 Under the Proposal 0.0 ‐0.1 0.1 0.5 1.1 5.5 9.1 35.9 24.8 9.1 13.9 100.0 5 Average Federal Tax Rate Change (% Points) ‐2.4 ‐0.9 ‐0.9 ‐1.2 ‐1.6 ‐2.4 ‐2.6 ‐3.6 ‐6.1 ‐9.8 ‐18.9 ‐7.0 Under the Proposal ‐2.7 ‐3.1 0.8 5.0 7.5 10.8 14.3 17.5 18.3 16.7 12.1 15.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 1,193 2,308 2,817 3,184 4,125 10,125 8,981 18,369 5,889 983 495 58,870 Pre‐Tax Income Percent of Total 2.0 3.9 4.8 5.4 7.0 17.2 15.3 31.2 10.0 1.7 0.8 100.0 Average (dollars) 5,175 16,515 26,670 37,640 48,277 66,252 93,522 146,871 304,115 728,319 3,052,733 146,762 Federal Tax Burden Percent of Total 0.1 0.4 0.9 1.4 2.3 7.8 9.7 31.2 20.7 8.3 17.5 100.0 Average (dollars) ‐13 ‐369 443 2,326 4,415 8,698 15,810 30,971 74,061 193,048 947,306 32,659 Percent of Total 0.0 0.0 0.1 0.4 1.0 4.6 7.4 29.6 22.7 9.9 24.4 100.0 4 After‐Tax Income Average (dollars) 5,189 16,883 26,226 35,314 43,862 57,554 77,711 115,900 230,054 535,271 2,105,428 114,103 Percent of Total 0.1 0.6 1.1 1.7 2.7 8.7 10.4 31.7 20.2 7.8 15.5 100.0 Average Federal Tax 5 Rate ‐0.3 ‐2.2 1.7 6.2 9.1 13.1 16.9 21.1 24.4 26.5 31.0 22.3 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current policy. Proposal implements the Gingrich tax plan. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0400 The Gingrich Tax Plan Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Head of Household Tax Units Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 18.7 21.3 56.3 76.1 83.0 87.2 93.7 97.7 99.3 99.4 100.0 60.2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 0.4 0.2 0.9 1.8 2.5 2.7 3.6 5.5 9.6 12.7 29.6 3.6 0.2 0.6 3.2 6.7 7.7 15.6 11.3 18.2 11.0 4.9 20.4 100.0 Average Federal Tax Change Dollars Percent ‐33 ‐39 ‐251 ‐615 ‐1,023 ‐1,466 ‐2,624 ‐5,790 ‐21,547 ‐66,278 ‐588,431 ‐1,391 4.1 2.5 428.4 ‐19.6 ‐16.1 ‐13.3 ‐14.4 ‐18.1 ‐29.3 ‐35.7 ‐62.0 ‐23.1 Share of Federal Taxes Change (% Points) ‐0.5 ‐1.8 ‐1.0 0.4 1.0 3.4 2.1 1.5 ‐0.7 ‐0.5 ‐3.8 0.0 Under the Proposal ‐1.8 ‐7.1 ‐1.2 8.3 12.1 30.4 20.2 24.7 7.9 2.7 3.7 100.0 5 Average Federal Tax Rate Change (% Points) ‐0.5 ‐0.3 ‐0.9 ‐1.7 ‐2.1 ‐2.3 ‐2.9 ‐4.2 ‐7.2 ‐9.4 ‐20.0 ‐3.1 Under the Proposal ‐12.5 ‐10.1 ‐1.2 6.8 11.2 14.7 17.0 19.0 17.5 16.9 12.3 10.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 2,630 5,290 4,577 3,986 2,750 3,859 1,567 1,144 185 27 13 26,121 Pre‐Tax Income Percent of Total 10.1 20.3 17.5 15.3 10.5 14.8 6.0 4.4 0.7 0.1 0.1 100.0 Average (dollars) 6,699 15,982 26,748 37,118 47,741 65,204 91,930 137,276 297,897 706,379 2,940,222 44,620 Federal Tax Burden Percent of Total 1.5 7.3 10.5 12.7 11.3 21.6 12.4 13.5 4.7 1.6 3.2 100.0 Average (dollars) ‐803 ‐1,580 ‐59 3,135 6,353 11,027 18,283 31,929 73,547 185,747 948,643 6,035 Percent of Total ‐1.3 ‐5.3 ‐0.2 7.9 11.1 27.0 18.2 23.2 8.7 3.2 7.6 100.0 4 After‐Tax Income Average (dollars) 7,502 17,562 26,807 33,983 41,388 54,176 73,647 105,347 224,350 520,631 1,991,579 38,585 Percent of Total 2.0 9.2 12.2 13.4 11.3 20.7 11.5 12.0 4.1 1.4 2.5 100.0 Average Federal Tax 5 Rate ‐12.0 ‐9.9 ‐0.2 8.4 13.3 16.9 19.9 23.3 24.7 26.3 32.3 13.5 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 (1) Calendar year. Baseline is current policy. Proposal implements the Gingrich tax plan. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0400 The Gingrich Tax Plan Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Tax Units with Children Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 16.2 25.1 50.3 75.0 85.1 90.9 95.4 98.2 99.6 100.0 100.0 75.6 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 0.6 0.4 0.8 1.7 2.5 3.3 3.7 4.4 7.7 12.1 27.6 7.5 0.0 0.1 0.4 0.9 1.4 4.5 5.2 17.0 18.1 10.1 41.9 100.0 Average Federal Tax Change Dollars Percent ‐43 ‐71 ‐232 ‐592 ‐1,063 ‐1,823 ‐2,797 ‐5,052 ‐17,386 ‐63,511 ‐570,983 ‐6,095 4.0 2.8 22.9 ‐25.2 ‐19.4 ‐17.8 ‐16.7 ‐16.1 ‐23.1 ‐31.5 ‐58.2 ‐28.6 Share of Federal Taxes Change (% Points) ‐0.1 ‐0.6 ‐0.4 0.1 0.3 1.1 1.5 5.3 1.8 ‐0.4 ‐8.5 0.0 Under the Proposal ‐0.4 ‐1.8 ‐0.9 1.1 2.4 8.2 10.5 35.6 24.2 8.8 12.1 100.0 5 Average Federal Tax Rate Change (% Points) ‐0.7 ‐0.4 ‐0.9 ‐1.6 ‐2.2 ‐2.8 ‐3.0 ‐3.5 ‐5.8 ‐8.7 ‐18.7 ‐6.0 Under the Proposal ‐18.0 ‐16.0 ‐4.7 4.7 9.2 12.7 15.0 18.0 19.2 19.0 13.5 14.8 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 3,055 5,354 5,205 4,865 4,063 7,481 5,727 10,299 3,188 488 225 50,185 Pre‐Tax Income Percent of Total 6.1 10.7 10.4 9.7 8.1 14.9 11.4 20.5 6.4 1.0 0.5 100.0 Average (dollars) 6,104 16,179 26,687 37,231 47,981 66,213 93,379 146,387 301,180 726,899 3,052,860 102,460 Federal Tax Burden Percent of Total 0.4 1.7 2.7 3.5 3.8 9.6 10.4 29.3 18.7 6.9 13.3 100.0 Average (dollars) ‐1,055 ‐2,517 ‐1,013 2,347 5,488 10,222 16,793 31,435 75,347 201,581 981,898 21,289 Percent of Total ‐0.3 ‐1.3 ‐0.5 1.1 2.1 7.2 9.0 30.3 22.5 9.2 20.6 100.0 4 After‐Tax Income Average (dollars) 7,159 18,695 27,699 34,883 42,493 55,990 76,586 114,951 225,833 525,318 2,070,962 81,172 Percent of Total 0.5 2.5 3.5 4.2 4.2 10.3 10.8 29.1 17.7 6.3 11.4 100.0 Average Federal Tax 5 Rate ‐17.3 ‐15.6 ‐3.8 6.3 11.4 15.4 18.0 21.5 25.0 27.7 32.2 20.8 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current policy. Proposal implements the Gingrich tax plan. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 12‐Dec‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0400 The Gingrich Tax Plan Baseline: Current Policy Distribution of Federal Tax Change by Cash Income Level, 2015 1 Detail Table ‐ Elderly Tax Units Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 18.9 25.2 57.5 78.2 84.2 93.6 97.1 98.0 99.5 99.8 99.9 66.3 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After‐Tax 4 Income Share of Total Federal Tax Change 0.4 0.4 1.2 2.0 2.2 3.6 4.9 8.0 13.6 20.8 33.4 10.6 0.0 0.2 0.6 1.1 1.0 4.4 4.7 15.6 18.4 12.4 41.5 100.0 Average Federal Tax Change Dollars Percent ‐29 ‐62 ‐300 ‐719 ‐973 ‐2,102 ‐3,946 ‐9,567 ‐33,294 ‐112,159 ‐701,191 ‐6,872 ‐44.9 ‐47.9 ‐44.5 ‐40.9 ‐32.9 ‐33.8 ‐32.1 ‐37.5 ‐47.5 ‐59.0 ‐70.0 ‐51.0 Share of Federal Taxes Change (% Points) 0.0 0.0 0.1 0.3 0.6 2.4 2.9 5.9 1.4 ‐1.8 ‐11.7 0.0 Under the Proposal 0.0 0.2 0.8 1.6 2.2 9.0 10.2 27.2 21.2 9.0 18.5 100.0 5 Average Federal Tax Rate Change (% Points) ‐0.4 ‐0.4 ‐1.1 ‐1.9 ‐2.0 ‐3.2 ‐4.3 ‐6.6 ‐10.6 ‐15.4 ‐22.6 ‐8.8 Under the Proposal 0.5 0.4 1.4 2.8 4.2 6.3 9.0 11.0 11.7 10.7 9.7 8.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2015 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 2,834 8,975 5,212 3,903 2,851 5,623 3,151 4,366 1,477 296 158 38,882 Pre‐Tax Income Percent of Total 7.3 23.1 13.4 10.0 7.3 14.5 8.1 11.2 3.8 0.8 0.4 100.0 Average (dollars) 6,863 15,942 26,318 37,346 47,663 65,129 92,429 145,274 315,054 730,232 3,102,318 78,233 Federal Tax Burden Percent of Total 0.6 4.7 4.5 4.8 4.5 12.0 9.6 20.9 15.3 7.1 16.1 100.0 Average (dollars) 64 129 672 1,756 2,955 6,223 12,283 25,541 70,060 190,096 1,002,137 13,472 Percent of Total 0.0 0.2 0.7 1.3 1.6 6.7 7.4 21.3 19.8 10.7 30.2 100.0 4 After‐Tax Income Average (dollars) 6,799 15,813 25,646 35,590 44,708 58,906 80,146 119,732 244,994 540,137 2,100,181 64,761 Percent of Total 0.8 5.6 5.3 5.5 5.1 13.2 10.0 20.8 14.4 6.4 13.2 100.0 Average Federal Tax 5 Rate 0.9 0.8 2.6 4.7 6.2 9.6 13.3 17.6 22.2 26.0 32.3 17.2 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current policy. Proposal implements the Gingrich tax plan. For a detailed description of TPC's interpretation of the plan, see http://taxpolicycenter.org/taxtopics/Gingrich‐plan.cfm. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11‐0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.